Why Token Unlock Schedules Keep Breaking Markets: Lessons from BGB, LayerZero and Pi

Summary

Token unlocks: why a calendar can become a systemic hazard

Token unlocks are simply scheduled transfers from vesting contracts into wallets or exchange listings, but when those transfers amount to hundreds of millions in value the effect on market liquidity can be dramatic. Investors and risk teams often treat unlocks as “known unknowns”: the timing is visible, yet the size and speed of subsequent selling are hard to forecast. That disconnect — between predictable supply changes and unpredictable market reaction — is what creates recurring systemic risk.

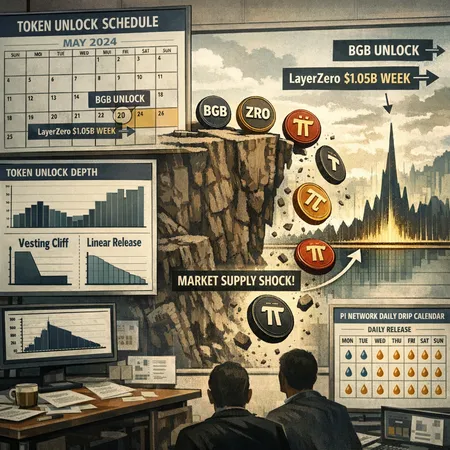

For market participants in DeFi and broader crypto, unlocks are not niche events. They interact with exchange depth, OTC capacity, derivatives positioning, and trader expectations to either be absorbed smoothly or catalyze abrupt downdrafts. A well-publicized example is the week when Bitget’s BGB and LayerZero-related schedules combined into more than $1.05 billion of token releases, sparking concerns across desks and liquidity providers (report).

Mechanics: cliff releases vs linear vesting

Understanding the design of a vesting schedule is the first step toward modeling its market impact. Two common mechanics dominate:

Cliff vesting: a tranche is locked until a set date, then becomes available (often immediately or in large increments). The effect is a concentrated supply pulse — a cliff — that can overwhelm market depth.

Linear (or graded) vesting: tokens are released continuously or in small periodic tranches across a window. This smooths the theoretical rate of new supply entering markets.

Both have pros and cons. Cliffs are administratively simple and can align incentives (e.g., hitting milestones before reward), but they concentrate risk. Linear releases reduce daily shock but can produce long-lived selling pressure that depresses price through gradual absorption.

There are also hybrids: stepwise cliffs, graded cliffs, and time-locked release with transfer restrictions. Each design shifts where and how liquidity pressure appears.

Why the market cares about the shape

Markets price expected future supply into today’s levels. If traders see a cliff for 200 million tokens in 30 days, they may sell ahead of the event or bid prices down preemptively. With linear vesting, the expected additional daily supply is lower, so the immediate price impact is smaller — but expectations about sustained selling can still suppress forward returns.

The key behavioral driver is timing uncertainty and coordination failure: even if a project intends to hold a large unlocked allocation, investors may not trust that promise and will hedge by selling earlier. That anticipatory selling becomes a self-fulfilling liquidation of value.

Case study: BGB, LayerZero and a $1.05B unlock week

In one recent sequence, industry reporting showed Bitget’s BGB token schedules and LayerZero-related releases combining into more than $1.05 billion in token unlocks over a single week (Cryptopolitan report). That concentration of newly liquid supply created alarm for market-makers and funds that typically provide depth in these markets.

A concentrated unlock of that scale stresses order books in several ways: bid-side depth can dry up quickly, spreads widen, and slippage for large sell orders spikes. Even programs intending to drip-sell via VWAP or OTC desks run into liquidity ceilings — leading to longer execution windows or higher realized losses.

This episode is illustrative because it combined multiple projects’ schedules. Systemic risk here is not just the per-project design but correlation: many unlock schedules across the ecosystem coinciding (or perceived to coincide) compress market capacity to absorb supply.

Case study: Pi Network’s daily cliff releases and price pressure

Contrast the above with the Pi Network story, where heavy daily unlocks created persistent selling pressure. Coverage of Pi’s unlock pattern highlighted how routine, sizeable daily cliffs — rather than a single climactic cliff — sustained downward price pressure and magnified volatility (Crypto.News coverage).

The Pi example shows a different path to damage: instead of one big shock, a steady drumbeat of cliff unlocks overwhelms liquidity providers’ capacity to re-provision bids, and market sentiment turns negative as holders anticipate continual supply. Even modest daily volumes, when repeated over weeks, can depress price materially.

Tickers matter: while BGB and ZRO were focal points in the concentrated-week example, PI’s path demonstrates how repeated cliffs can be just as corrosive as one large event.

How markets attempt to price expected supply

Pricing expected supply is both an art and a quantitative exercise. Market participants use several inputs:

- Public vesting schedules and on-chain vesting contract inspections.

- Exchange and OTC order book depth, including price impact models (e.g., slippage per $1M sold).

- Open interest in derivatives and liquidations risk (leveraged sellers amplify moves).

- Narrative and communication from projects: clarity reduces the risk premium.

A practical model: compute the incremental daily supply under each release scenario, map that to expected absorbed volume given historical liquidity, and stress the model for adverse timings (e.g., low-volume weekends, macro risk events). Traders will typically price a discount to forward value proportional to the ratio between unlocked supply and typical 24-hour traded volume — when unlocked supply equals a large multiple of daily volume, price risk spikes.

How projects can mitigate sell pressure (practical designs)

Projects are not helpless. Thoughtful tokenomics and execution choices materially reduce market impact.

Smoother vesting: prefer continuous or finer-grained releases over large cliffs. Stepwise reductions combined with transfer restrictions can smooth supply shock.

Clawbacks / lockups for insiders: conditional vesting that ties releases to on-chain milestones or KPIs reduces opportunistic selling.

Market-making and liquidity commitments: fronting capacity near unlock windows helps absorb supply (but beware moral hazard if commitments are temporary).

Buyback programs and revenue sinks: converting protocol revenue into buybacks creates endogenous demand; permanent burns reduce net supply pressure.

OTC and strategic distribution: instead of dumping on public venues, executing large sells OTC to long-term counterparties reduces visible pressure and limits slippage.

Escrowed escrow-with-delay: even after unlock, apply short transfer restrictions (e.g., minimum holding windows) so tokens don’t immediately flood exchanges.

Transparent, staged communications: honesty about amounts and intentions can reduce pre-emptive selling; opacity tends to increase risk premia.

No single measure eliminates risk. Combinations — for example, smoothing vesting plus an executed buyback during unlock windows — are more credible.

Guidance for traders, venture teams and risk officers

For token investors, venture teams, and backers building stress tests, adopt a disciplined checklist:

- Map the full vesting schedule and identify concentrated cliffs or correlated unlock clusters across portfolio tokens.

- Compute unlocked supply as a multiple of average daily traded volume and simulate price impact using historical slippage curves. Model scenarios: baseline, low-liquidity day, and correlation shock (multiple tokens unlocking same week).

- For traders: stagger sell execution, prefer OTC/desk liquidity for large blocks, use limit orders to control slippage, and hedge directional exposure when unlock risk is imminent (options, inverse products, or short futures when available).

- For venture/backers: consider committing to slow-sale agreements, coordinate with exchanges about listing and liquidity provisioning, and fund buybacks or market-making budgets around critical windows.

- Monitor on-chain movement post-unlock: immediate transfers to centralized exchanges are a strong signal of selling intent and should trigger defensive execution adjustments.

Mentioning tools: vesting explorers, token lists, and on-chain analytics should be part of regular risk dashboards. For teams executing client-friendly cash flows or installment products, platforms like Bitlet.app are increasingly used to manage payouts and customer exposure in environments with complex token schedules.

Modeling tips and stress testing

A robust stress test has at least three components:

- Supply shock layer: model cliffs as instantaneous increases in circulating supply and linear vesting as a time-series inflow. Apply conservative absorption rates.

- Liquidity buffer layer: use historical top-of-book and aggregated order book depths to estimate slippage at various execution sizes.

- Behavioral layer: overlay probability of correlated selling — insiders, exchanges listing behavior, and secondary effects from liquidation cascades.

Run red-team scenarios: what happens if a major market maker withdraws, or if a macro event reduces baseline liquidity by 50%? Those tail cases are where systemic risk becomes real.

Conclusion: predictable events, avoidable damage

Token unlocks are one of the few major market events that are predictably scheduled yet frequently mishandled. The difference between a routine unlock and a price collapse lies in design choices (cliff vs linear), execution planning (OTC, market-making, buybacks), and transparent communication. The BGB / LayerZero concentrated-week example and Pi Network’s persistent daily releases show two distinct paths to damage — correlation of large unlocks, and repeated cliff-induced grinding — both of which can be anticipated and mitigated.

For investors and risk officers this means building vesting-aware models into every valuation and risk process. For projects and backers, it means designing schedules that align long-term incentives with market resilience. Those are not cosmetic choices: they determine whether a token’s liquidity arrives as a trickle or a flood.

Sources