How a Solana Fee Spike Triggered a Cross‑Market Leveraged Shakeout — A Playbook for Thin Markets

Summary

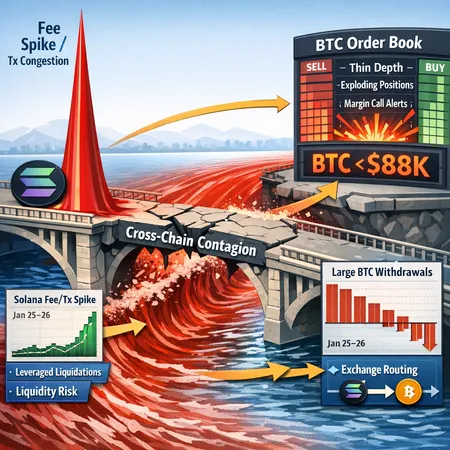

Overview: why a fee spike on one chain can topple positions elsewhere

On Jan 25–26 the crypto market saw a textbook example of cross‑chain contagion: a severe fee and transaction spike on Solana coincided with concentrated BTC withdrawals to exchanges and a wave of leveraged liquidations that pushed Bitcoin under $88K. The incident is not just a curiosity; it reveals how liquidity risk, exchange routing and operational decisions interact when markets are thin.

For derivatives traders and exchange ops, the lesson is simple but uncomfortable: chains are not isolated — congestion on a fast, cheap network can force actors to rebalance on other venues, producing outsized moves. Many readers will know Bitcoin remains the market bellwether, but the route between on‑chain stress and BTC price action runs through liquidity, execution and margin mechanics.

On‑chain evidence and the timeline of events

Public reporting and block data showed a distinct Solana fee and transaction spike on Jan 25 that preceded acute exchange flows and price pressure in BTC. Crypto.News documented how a Solana fee spike helped fuel leveraged liquidations that pressured Bitcoin prices; that article is useful for reconstructing the correlation between the Solana congestion and the subsequent shakeout (Crypto.News).

At the same time, market coverage noted that BTC was dumped below $88K and highlighted two warning signs traders missed: concentrated withdrawals and on‑chain stress in alternative chains like Solana (CryptoPotato). Complementary reporting showed SOL slid roughly 16% amid elevated staking and on‑chain pressure on the same dates, underscoring how market participants were active on Solana while the network experienced friction (AMBCrypto).

Piecing these sources together with exchange flow windows yields a plausible sequence:

- Solana experiences a sudden rise in transaction volume and fee levels, raising the cost and latency of on‑chain settlement.

- Some whales and large liquidity providers attempting to rebalance positions or move collateral across chains either delay or pay elevated fees; a subset opts to cash out or withdraw to centralized exchanges to ensure timely margin management.

- These concentrated exchange inflows, combined with thin liquidity and algorithmic deleveraging logic, trigger forced liquidations on derivatives venues, amplifying downward pressure on BTC.

The causality is not purely on‑chain → price; it’s mediated by liquidity providers, routing choices, and the mechanics of cross‑exchange margin systems. But the temporal alignment of Solana stress and BTC withdrawals is a red flag that decentralised congestion can transmit risk into centralized markets.

Mechanics: how elevated fees and congestion cause cross‑market rebalances

The mechanics are straightforward but often underappreciated:

Elevated fees increase execution friction. When a chain like Solana spikes in fees or latency, moving tokens between on‑chain venues (DEXes, liquidity pools, custodial bridges) becomes costlier and slower. For actors managing large collateral portfolios, that friction is functionally equivalent to a sudden haircut.

Whales and liquidity providers rebalance to avoid being unable to meet margin or to lock in exposure. If on‑chain settlement cannot be relied upon within the required margin window, actors prefer the certainty of centralized exchange withdrawals or OTC trades — even at a premium.

Centralized exchange inflows concentrate supply. Large, near‑simultaneous deposits to a set of exchanges increase sell‑side pressure on order books. If these inflows collide with thin bids, market impact is magnified.

Algorithms and margin logic produce a feedback loop. Perpetual and margin systems execute auto‑deleverage, cross‑margin reductions, or uncapped liquidations based on mark prices and margin ratios. When multiple positions are under stress, forced sells depress market prices, which in turn triggers more liquidations — a classic deleveraging spiral.

Routing fragility and liquidity fragmentation amplify slippage. Traders who would usually spread flow across venues are constrained by latency, KYC limits or single‑exchange exposure. That concentration raises the likelihood that a localized flow will tip global prices.

In short: congestion raises execution risk; execution risk leads to concentrated flows to exchanges; concentrated flows against thin liquidity cause price moves that force automated deleveraging elsewhere.

Jan 25–26 case study: what happened and what the on‑chain signals said

The Jan 25–26 episode is useful because it combines observable on‑chain signals (fee/tx spikes on Solana) with exchange behavior (large BTC withdrawals and sudden selling pressure) and price outcomes (BTC dipping under $88K).

Solana: Block and fee telemetry showed a short‑duration spike in transactions and fees. That coincided with reports of users and validators grappling with queueing and elevated signer costs, which made time‑sensitive moves more expensive. Coverage of SOL’s drop (~16%) and record staking suggests heavy on‑chain activity and composition changes during the same window (AMBCrypto).

Exchange flows: Public flow trackers and exchange reporting noted sizeable inbound BTC transactions around the same time. Analysts covering the move flagged two warning signs traders missed: the chain stress and concentrated exchange inflows preceding the dump (CryptoPotato).

Liquidations: As liquidity providers and leveraged traders attempted to rebalance, elevated slippage and widened spreads made it harder to unwind positions smoothly. Reports tied the Solana fee event to leveraged liquidations that contributed to the BTC drop under $88K (Crypto.News).

Taken together, the case study shows correlation across on‑chain congestion, exchange flow concentration and derivatives liquidations. While causality is multifactorial, this alignment reveals predictable failure modes when networks — even ones not directly hosting BTC trading — become compromised.

Playbook: risk controls for market makers and liquidity providers

Market makers and LPs operate at the intersection of execution risk and inventory risk. During thin markets they should prioritize survival over micro‑P&L. Recommended controls:

Fee‑sensing routing: Implement fee and latency thresholds for on‑chain routing. If fees on a primary settlement chain exceed a preconfigured threshold, automatically re‑route or widen quoted spreads. This avoids getting filled at prices that don’t account for execution cost.

Dynamic skew and inventory caps: Reduce position limits and increase skewed quoting (wider bid/ask when holding large directional exposure) as cross‑chain congestion metrics tick upward. Hard caps on exposure limit the chance of being forced to unwind into an empty book.

Hedging backstop liquidity: Predefine OTC counterparties and bilateral swap lines to move inventory off exchange books without market impact. Establish standing instructions for instant OTC execution when on‑chain settlement is unreliable.

Margin and collateral diversification: Avoid concentration of collateral on a single chain or bridge. Spread collateral and maintain warm wallets and preapproved withdrawal rails across at least two settlement layers.

Real‑time monitoring: Incorporate chain health dashboards (fees, mempool growth, confirmation times) into automated risk triggers that widen spreads or enter temporary passive mode.

These measures cut slippage risk and reduce the probability that a single congested chain will force rapid, disorderly liquidations.

Playbook: controls for exchanges and derivatives desks

Exchanges are the plumbing. Small changes to operational logic can materially reduce contagion:

Circuit breakers and delayed settlement windows: Implement micro‑circuit breakers that pause large auto‑liquidations for a short window if external chain health indicators spike. A brief delay gives counterparties time to re‑route or coordinate instead of instantly sweeping markets.

Smarter liquidation engines: Incorporate cross‑venue liquidity depth into liquidation sizing and routing. Liquidation engines that take into account available depth across multiple CLOBs and pools can execute less aggressively.

Fee‑aware margin calls: Notify counterparties with fee and latency intelligence — if the chain used for collateral transfers is congested, adjust required notice or provide alternatives (instant off‑chain settlement via custodial transfers) before forcing on‑chain moves.

Withdrawal and inflow throttles: Temporary rate limits on large withdrawals can prevent a flood of sell‑side liquidity from arriving in a narrow timeframe. Throttles should be calibrated and transparently communicated to avoid panic.

Cross‑margin and portfolio offsets: Where possible, enable cross‑margin that can absorb stress from one asset without instantly forcing liquidation of another unrelated position, reducing unnecessary forced sales.

Post‑event reconciliation and transparency: Publish reconciliations of how liquidations were priced and executed during the event to give clients confidence and to expose operational friction points.

These controls require trade‑offs: delaying liquidations raises counterparty credit exposure, while throttles risk leaving distressed users unable to move collateral. The point is to build calibrated, conditional responses rather than brittle, all‑or‑nothing automation.

Operational playbook for exchange routing and custody

Infrastructure and ops teams should treat chain health as an input to custody and routing logic. Practical steps:

Maintain diversified settlement rails: Keep hot paths across at least two high‑throughput chains and two custodial rails to avoid single‑chain bottlenecks.

Pre‑funding and staged withdrawals: For known large clients, support scheduled staged withdrawals or pre‑funded custodial allocations that can be transferred off‑exchange without on‑demand on‑chain settlement.

Bridge and multi‑sig staging: Avoid concentration of custodial multisigs on a single bridge or operator. Keep fallbacks and manual overrides that can be invoked when automated bridges are congested.

Alerting and playbooks: Tie on‑chain alerts (rapid fee increase, mempool backlog) into ops playbooks that include communicating with top counterparties, temporarily widening spreads, and engaging OTC desks.

Stress testing and tabletop exercises: Simulate chain congestion and multi‑venue withdrawal waves. These exercises surface timing issues, coordination gaps and automated logic that would otherwise only be evident in a real event.

Bitlet.app users and other market participants benefit from platforms that bake these considerations into product design, but the operational steps above are broadly applicable across custodians and exchanges.

Conclusion: rethink contagion as liquidity routing risk

The Jan 25–26 episode shows that on‑chain congestion is not an isolated technical nuisance — it is a liquidity and routing problem with real market consequences. Solana’s fee spike created execution friction that encouraged concentrated exchange flows and catalyzed leveraged liquidations, dragging BTC below $88K.

Derivative traders, market makers and exchange ops should treat chain health metrics as first‑class risk signals. The mitigation playbook is practical: fee‑sensing routing, diversified rails, dynamic inventory controls, smarter liquidation engines, and operational playbooks that include throttles and OTC fallbacks. Together these controls reduce the probability that a single congested chain becomes a systemic trigger during thin markets.

For teams building resilience, start with monitoring and simulated drills — then iterate on automated triggers that adjust quotes, routing and liquidation behavior based on real‑time chain telemetry.