Vesting

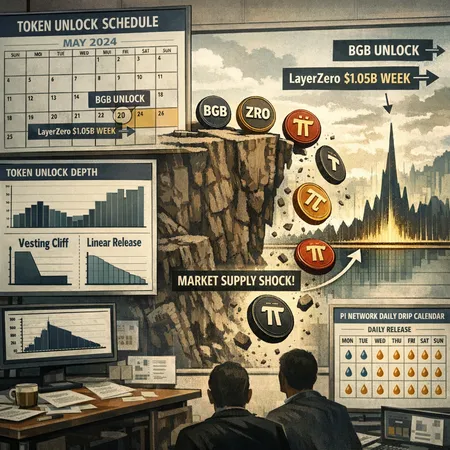

Why Token Unlock Schedules Keep Breaking Markets: Lessons from BGB, LayerZero and Pi

Large simultaneous token unlocks are a recurring systemic risk that can trigger sharp sell-offs and liquidity stress; understanding cliffs vs linear releases, pricing of expected supply, and mitigation strategies is essential for investors and venture teams. This investigation uses the BGB/LayerZero $1.05B unlock week and Pi Network’s daily cliffs as case studies.

Published at 2026-01-19 16:07:08

Why Worldcoin’s 44M WLD Transfer Sparked Market Panic — A Guide for Investors

When the Worldcoin team moved 44 million WLD (about $25.6M) the market reacted violently — a useful case study in why team-controlled supply matters. This guide explains the mechanics of such panics, regulatory implications, and a practical checklist for assessing projects with large team reserves.

Published at 2025-12-07 12:46:29