How Institutional Deleveraging Amplified the ETH Crash: A Forensic Case Study

Summary

Executive summary

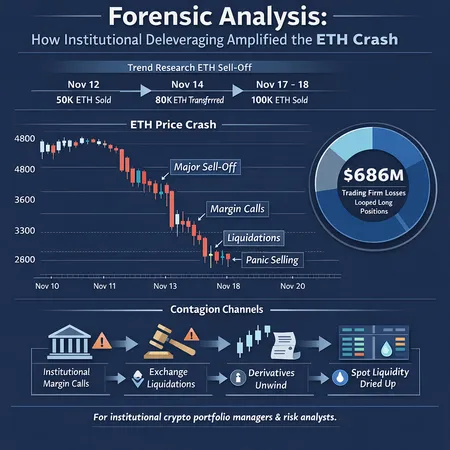

This forensic report explains how concentrated institutional selling and complex leveraged structures turned a market shock in ETH into a cascading liquidation event. Reports indicate that Trend Research slashed its ETH holdings to repay loans, realizing a large loss, while a separate trading desk suffered roughly $686 million of mark-to-market damage from looped long positions that fed back into spot markets. The interaction of margin calls, automated liquidations, thin spot liquidity, and rehypothecation created a self-reinforcing deleveraging spiral. This analysis is aimed at institutional crypto portfolio managers and risk analysts who must guard against similar contagion channels.

Timeline and scale: reconstructing Trend Research’s ETH sell-off

What was reported

In early February 2026, several investigative pieces and market reports revealed an active institutional unwind of ETH positions. Public reporting shows Trend Research sold major ETH holdings to repay loans and reduce exposure; subsequent analysis estimated the firm realized a roughly $747 million loss on its full ETH exit. Those sales coincided with intense pressure across spot and derivatives venues and preceded a larger mark-to-market hole in another trading firm’s book valued at $686 million.

How the sell-off unfolded (sequence and market impact)

- According to contemporaneous reporting, Trend Research began slashing ETH positions as prices were falling, electing to liquidate to meet lender requirements and cut exposure rather than add margin. CryptoNews reported the sell-off as a loan-repaying deleveraging action.

- Coinpaper tracked the final exit and quantified realized losses near $747 million after selling ETH into a falling market. Selling into a thin book amplified slippage and pushed ETH lower, increasing stressed margin requirements for other leveraged players.

- Within 24–72 hours of those sales, price moves triggered margin calls and automatic liquidations on futures and perpetual markets, accelerating downward pressure.

Taken together, the timing mattered: a large, concentrated spot sell program into already deteriorating liquidity expanded the initial shock, leaving little time for other institutions to absorb flow without closing or cutting positions.

The $686M looped-long collapse: anatomy of a trading-firm failure

What “looped long” means here

A looped long typically describes situations where a trading firm’s exposures and collateral are circularly linked: asset A is used as collateral to borrow USD (or stablecoins), those proceeds buy more of asset A or a derivative that synthetically increases A exposure, and the same collateral is rehypothecated across desks or counterparties. This magnifies net exposure while superficially appearing collateralized.

How the loop blew up

- CoinDesk’s investigation reconstructed a firm whose balance sheet relied on ETH-linked collateral and derivative positions in a way that created concentrated directional exposure to ETH moves. When ETH dropped below critical levels, margin requirements across venues rose simultaneously. CoinDesk reported a roughly $686 million gaping hole in the firm’s book linked to looped long positions.

- Because the firm’s collateral was re-used and its exposures overlapped across counterparties, forced (and often automatic) liquidations in futures desks and margin engines created sell pressure that landed back on the spot order books. The firm’s attempts to deleverage by selling produced further price declines, which in turn triggered more margin calls — a classic positive feedback loop.

- Automatic close-out mechanics on centralized exchanges (CEXs) and algorithmic deleveraging models generally prioritize speed over price. In conditions of low liquidity, large automatic liquidations tend to trade against top-of-book bids, widening spreads and causing outsized realized losses relative to mark-to-market numbers.

The mechanics that turned losses into contagion

Several operational features compounded the problem:

- Rehypothecation: collateral used in multiple places meant one counterparty’s call could force several simultaneous sell events.

- Cross-exchange margining asymmetries: margin increases on one platform weren’t always recognized as liquidity needs on another, preventing coordinated, orderly deleveraging.

- Funding rate and basis shocks: as spot fell, perpetual funding rates diverged, creating liquidity drains for long holders and incentivizing short squeezes that sold into spot.

Contagion channels: from institutional margin calls to spot and derivatives

Primary propagation paths

- Institutional spot selling — Large holders liquidate spot holdings to meet lender calls. Spot sales immediately depress the reference price and thin out order books.

- Derivatives automatic liquidations — Futures/perpetual engines auto-liquidate undercollateralized positions by trading on the exchange, often crossing into spot liquidity pockets.

- Intermediary deleveraging — Prime brokers and OTC desks recall funding or enforce haircuts, forcing clients to sell underlying assets.

- Cross-market feedback — Price declines widen futures basis, prompting arbitrageurs to unwind hedges and sell spot to cover, which further lowers the spot price.

Each path amplifies the others. Importantly, the dominance of algorithmic liquidation systems means that what starts as a bilateral margin issue can become a market-wide liquidity event in minutes.

Liquidity microstructure factors

- Order-book depth: during stressed moves, the realized liquidity (how much you can sell without moving price) is far lower than normal book size. Large institutional sell programs that ignore realized liquidity suffer extreme slippage.

- Fragmentation across venues: liquidity sits in pockets — some venues become illiquid first, concentrating liquidation costs on the remaining venues.

- Funding and settlement mismatch: margin calls denominated in USD stablecoins vs collateral in ETH create forced conversions and trade pressure in both spot and stablecoin markets.

Why institutional selling looks different from retail or HFT flows

Institutions bring size, correlated exposures, and contractual constraints. They may be constrained by mandates, regulatory reporting, or loan covenants that require fast action. Unlike retail traders, institutions often deleverage by selling large blocks, which cannot be easily absorbed by liquidity providers without price concession. Also, institutions tend to have concentrated positions and similar risk frameworks, increasing the chance of simultaneous deleveraging across entities.

For many traders, Ethereum remains the most liquid alt asset — until it isn’t. During stress, that liquidity evaporates fast, and rehypothecation chains become the critical fault lines.

Lessons for asset managers, risk teams, and regulated counterparties

Governance and portfolio limits

- Enforce concentration limits on single-asset exposures and counterparty rehypothecation. No one institution should rely on being able to liquidate a concentrated position without market impact.

- Maintain clear, pre-approved deleveraging playbooks: tiered actions, timelines, and decision authorities reduce panic selling.

Counterparty and settlement practices

- Limit rehypothecation and require clearer disclosure of reuse of collateral across entities. If collateral is used more than once, treat the notional exposure with multiples in stress tests.

- Negotiate close-out netting and porting clauses that allow orderly transfer of positions in default scenarios to minimize fire sales.

Stress testing and scenario design

- Run joint spot-derivative stress tests with severe slippage assumptions (e.g., 20–50% realized price impact for large blocks within 24–48 hours), not just mark-to-market shocks.

- Include funding-rate shocks, cross-margin calls, and haircuts under correlated moves in scenario matrices: margin requirements can jump non-linearly in cascades.

- Simulate rehypothecation chains and bilateral haircut contagion — track notional reuse and treat that as leverage.

Operational risk controls

- Pre-funded liquidity buffers in stablecoins or short-duration liquid assets that can be quickly mobilized without selling the primary asset at market.

- Automated kill-switches or staggered execution protocols to avoid single-bucket block sales into thin liquidity.

- Real-time monitoring of funding rates, open interest, and basis across major venues to detect early signs of forced deleveraging.

Counterparty due diligence

- Ask counterparties for transparency on exposures and collateral reuse; counterparties that rehypothecate aggressively increase systemic risk.

- Prefer counterparties with robust stress-tested liquidation protocols and well-documented insurance or recovery mechanisms.

Practical checklist for managing liquidation risk (for portfolio managers)

- Limit single-asset concentration; run daily realized-liquidity calculations for block-sell scenarios.

- Maintain a liquidity buffer that covers the first wave of margin calls (24–72 hours), denominated in non-stressed instruments.

- Require counterparties to provide counterparty stress test results and rehypothecation transparency.

- Adopt staged execution: break large sells into time-sliced, venue-diversified orders rather than one-time blocks.

- Coordinate with prime brokers and OTC desks to arrange pre-negotiated, time-bound liquidity lines rather than reactive requests.

Final thoughts: balancing return and systemic resilience

The recent ETH episode shows that institutional selling plus opaque leverage structures can convert a price correction into a systemic liquidity event. The combination of rehypothecation, tightly coupled collateral, and automated liquidation systems means that margin calls are no longer private — they broadcast into public markets in seconds. Institutions and regulated counterparties must assume that the market will not behave like a perfectly deep pool during stress.

Risk teams should treat realized liquidity, counterparty reuse, and cross-market margin shocks as first-class risks. Practical changes — clearer collateral rules, better stress scenarios, and operational buffers — will raise costs in calm markets but materially reduce the probability of catastrophic, reputation-destroying defaults.

Bitlet.app and other institutional platforms that aggregate liquidity should continue to invest in tooling that measures realized liquidity and tracks rehypothecation chains in real time.

Sources

- Trend Research sold large ETH holdings to repay loans (reporting): https://cryptonews.com/news/trend-research-slashes-ether-holdings-after-market-crash-to-repay-loans/

- Analysis of Trend Research's ETH exit and reported $747M realized loss: https://coinpaper.com/14374/they-bought-eth-high-sold-low-747-m-loss-after-full-eth-exit?utm_source=snapi

- CoinDesk investigation into a trading firm’s $686M loss tied to looped long positions: https://www.coindesk.com/markets/2026/02/07/ether-s-recent-crash-below-usd2-000-leaves-usd686-million-gaping-hole-in-trading-firm-s-book