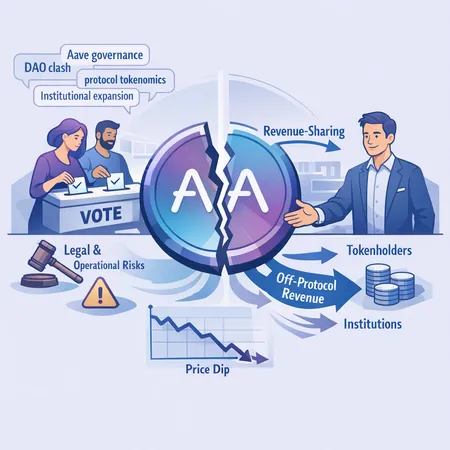

Dissecting the Aave Governance Clash and the Founder’s Revenue-Sharing Proposal

Summary

Quick recap: what ignited the DAO clash

In late-stage governance discussions, Aave’s founder proposed an IP-transfer alongside plans for off‑protocol commercial activity. The intent was to capture and monetize intellectual property and channel some of that revenue back to the ecosystem. The Aave DAO voted — and the transfer of IP to the proposed entity was rejected, sparking a public debate about governance scope, treasury stewardship, and how a decentralized protocol should commercialize emergent assets.

The contest set up two competing narratives. On one side, proponents argued that an operational vehicle could accelerate institutional expansion and capture fees that the on‑chain protocol cannot. On the other, many voters saw the IP-transfer as ceding core communal assets to an entity that might prioritize centralized control or future extraction.

Governance timeline: the key milestones

- Proposal introduced and discussed in governance forums; details on the IP-transfer and the rationale for a commercial arm were circulated.

- The DAO executed a vote and rejected the IP-transfer. Reporting on this sequence and the founder’s follow-up strategy is summarized in recent coverage by CryptoNews and CoinPedia.

Those sources trace how the rejection forced a pivot: instead of transferring ownership, the founder publicly outlined a plan to share off‑protocol revenue with AAVE holders as a way to return value without moving IP. See the reporting that covers the founder’s post‑vote strategy for specifics (for example, CryptoNews and CoinPedia).

Why the DAO rejected the IP-transfer

The rejection boiled down to three practical concerns. First, ownership and control: moving IP to a distinct legal or commercial vehicle can concentrate decision rights and reduce the DAO’s direct control. Voters worried this could undermine long‑term decentralization. Second, transparency and alignment: the proposed transfer left open how commercial decisions would be made and how proceeds would be allocated. Third, regulatory and liability exposure: ceding IP to an operational arm can create corporate footprints and compliance obligations that contagiously affect tokenholders and the on‑chain protocol.

Put differently, many DAO voters treated the IP as a communal, public good. Transferring that good to an entity with possibly narrower incentives looked like a slippery slope. Rejecting the transfer was a conservative defense of communal ownership rather than an outright rejection of monetization ideas.

The founder’s revenue‑sharing proposal: mechanics and intent

After the vote, the founder and Aave Labs framed an alternate approach: capture off‑protocol revenue without transferring IP, then distribute a portion of those proceeds to AAVE holders. Blockonomi covered these revenue‑sharing announcements and the accompanying vision for institutional expansion by Aave Labs, which positions the commercial activity as complementary rather than replacing the on‑chain market (Blockonomi).

Mechanically, the proposal as explained publicly would typically include:

- A commercial arm (or partnerships) conducting services or products off‑chain—think custody, white‑label lending, or regulated solutions aimed at institutions.

- An income stream from those activities routed into a program that allocates a defined percentage to tokenholders, possibly via staking rewards, buybacks, or distributions to a treasury that DAO voters can route.

- Governance hooks that let the DAO adjust parameters, approve distributions, or mandate auditing and transparency requirements.

The nuance: the revenue-sharing is off‑protocol—it does not change smart‑contract economics directly (no change to interest rates or liquidity mining by itself). Instead, it creates a promised cashflow that augments tokenholder value through external sources.

Market reaction: price moves and sentiment

The immediate market reaction was mixed and muted rather than explosive. News of the governance clash and the rejected IP-transfer created short‑term uncertainty, and AAVE traded with elevated volatility around the vote. Coverage and commentary noted dips and recoveries as investors digested the implications; the founder’s pivot to revenue-sharing calmed some concerns but raised new questions about execution and legal exposure.

For traders and token investors, the episode highlighted how governance risk translates into price risk. Even a well‑intentioned commercial strategy can compress token returns if the community perceives the proposal as a governance overreach or a regulatory liability. Conversely, a credible revenue stream that is transparently governed can increase AAVE’s expected cashflow and therefore its risk‑adjusted valuation over time.

How revenue‑sharing changes incentives and tokenomics

Adding off‑protocol revenue to the token value proposition shifts incentives along several vectors:

- Tokenholder alignment: If revenue is shared directly with AAVE holders, passive holders gain a clearer cashflow return, which can reduce purely speculative trading and increase long‑term staking incentives.

- Voter behavior: When token votes carry the power to approve distributions or commercial terms, voters gain more reason to engage on operational details. That can be good for accountability, but it can also encourage short‑term rent‑seeking if distributions are sizable and frequent.

- Protocol vs. product priorities: AAVE’s core on‑chain lending market has to compete for attention and resources with off‑chain products. Resource allocation debates are inevitable: should DAO capital and reputational capital be used to chase institutional clients or to optimize the protocol?

In short, revenue‑sharing introduces a quasi‑dividend feature to the token, pushing AAVE away from a pure governance / utility token model and toward an asset-like instrument that embodies claims on commercial income. That change has second‑order effects on tokenomics such as circulating supply velocity, staking behavior, and the marginal buyer profile.

Regulatory, legal, and operational pitfalls

Revenue‑sharing sounds attractive, but it raises thorny issues:

- Securities risk: Regular distributions tied to commercial revenue may look like dividends to regulators. If AAVE holders receive predictable cashflows, arguments that the token constitutes a security become stronger in some jurisdictions.

- Liability and corporate structure: Running off‑chain institutional products typically requires legal entities, licenses, KYC/AML programs, and insurance. Those obligations can create counterparty and reputational risk that ricochet back to the DAO.

- Enforcement and transparency: Off‑protocol revenue is harder for the community to independently verify. Without robust auditing and reporting, disputes over amounts and allocations can proliferate.

- Governance capture: Commercial partnerships and institutional deals create new stakeholders (investors, employees, service providers) who may have incentives misaligned with the DAO.

Addressing these pitfalls requires careful design: explicit guardrails in governance proposals, tranche‑based rollouts, independent audits, and legal wrappers that limit contagion to tokenholders. The alternative is exposing the community to regulatory or financial downsides that might outweigh revenue upside.

What other DeFi projects should watch

Aave’s debate will be a live case study for other protocols considering monetization or institutional channels. Key lessons to observe:

- Transparency matters: If you plan to capture off‑chain revenue, build auditability and disclosure into the model from day one.

- Preserve on‑chain sovereignty: Proposals that simply move communal assets off‑chain without clear DAO control are likely to face resistance.

- Design for optionality: Revenue‑sharing mechanisms that are adjustable, time‑limited, or contingent on milestones reduce political blowback.

- Think about signaling: Institutional ambitions change a protocol’s community profile. Some users welcome it; others may exit if they perceive mission drift away from open permissionless finance.

For DAO voters and builders, the practical takeaway is to codify both the economic terms and the accountability structures. That means on‑chain proposals that include reporting cadence, dispute resolution, and sunset clauses for revenue programs.

Conclusion: pivot or evolution?

Aave’s founder pressing a revenue‑sharing route after the IP-transfer rejection is less a hostile pivot and more a pragmatic attempt to reconcile commercial ambitions with DAO sensibilities. The model reframes tokenomics: AAVE could carry both utility value inside the protocol and claims on external cashflows. Whether this becomes a durable pattern depends on execution — legal structuring, governance transparency, and how well the DAO maintains control while enabling growth.

Other protocols will watch closely. If Aave demonstrates a safe, auditable path to institutional expansion that benefits tokenholders without jeopardizing decentralization, revenue‑sharing could become a repeatable monetization template. If not, the episode will stand as a cautionary tale about the limits of blending on‑chain public goods with off‑chain commercial ventures.

For builders and voters designing proposals, ask concrete questions early: who audits the revenue, how will distributions be governed, what legal protections exist, and how will on‑chain consent be preserved? Those are the kinds of conditions that will determine whether revenue‑sharing strengthens protocol economics or becomes a governance liability.

Bitlet.app users and other market participants will want to watch subsequent proposals and implementation details closely — the mechanics matter as much as the headline.

Sources

- Aave founder proposes revenue-sharing with AAVE token holders after DAO clash — CoinPedia

- Aave founder lays out strategy after governance vote rejects IP transfer — CryptoNews

- Aave Labs announces revenue-sharing plans as protocol targets 500 trillion asset base — Blockonomi

For more background on market mechanics and governance design see discussions on DeFi and community threads around Aave.