Optimism Superchain Buybacks: Mechanics, Tokenomics, and What Governance Choices Mean for OP

Summary

Executive summary

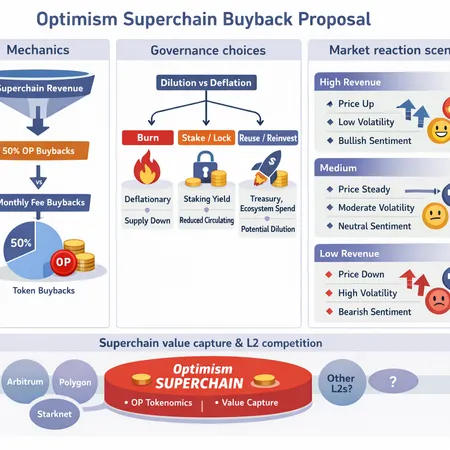

Optimism’s community is weighing a proposal to redirect Superchain fees into OP token buybacks. At face value it’s straightforward: capture value generated by an L2 product and return some of it to token holders. But the difference between allocating 50% of Superchain revenue into buybacks versus adopting a monthly fee-based buyback cadence matters a great deal for signaling, predictability, and market microstructure. Equally important is the follow-up governance decision: what happens to tokens after the protocol repurchases them—burn, stake (lock), or reuse for incentives? Each path produces different dilution/deflationary dynamics and trade-offs for long-term value capture.

This article breaks down the mechanics of both buyback regimes, explains downstream governance options and their tokenomics implications, sketches plausible market-reaction scenarios under varying revenue outcomes, and situates the proposal within L2 competition and broader industry precedents. It’s written for governance participants and investors modeling OP’s long-term value.

How the proposed mechanics work: 50% of Superchain revenue vs monthly fee-based buybacks

50%-of-revenue model — rules-based allocation

Under the 50% model the protocol would commit a fixed share of Superchain revenue (half) to repurchasing OP on market or via on-chain mechanisms as revenue is realized. The core features:

- Pro rata, continuous capture: As fees accrue to the Superchain, half immediately becomes earmarked for buybacks. This makes the mechanism proportional to actual economic activity on the Superchain.

- Predictability in policy, variability in volume: The policy is predictable (50%), but executed buyback volumes fluctuate with revenue, so markets will see variable weekly/daily buys depending on usage and gas revenue.

- Strong signal: A fixed fraction signals a durable commitment to return value to OP holders—an important governance cue.

The proposal itself — framed as using a share of Superchain revenue — is described in the Optimism community discussion; coverage of the specifics appears in reporting such as Optimism proposes using 50% of Superchain revenue for OP buybacks.

Monthly fee-pool buybacks — cadence and discretion

The alternative highlighted in reporting is a model where a fee pool accumulates Superchain fees and the protocol performs monthly buybacks from that pool. Key contrasts:

- Lump-sum vs continuous: Monthly buys tend to be larger, discrete market events, which can produce larger episodic price impact and clearer reporting moments for the treasury.

- Smoothing and discretion: Governance can smooth buys within the month, or decide thresholds (e.g., only buy back if pool > X). A monthly cadence can reduce overhead and make financial planning simpler. Coverage of this variant is summarized in related commentary like the Invezz note on monthly OP buybacks from Superchain fees (see: Optimism proposes monthly OP buybacks using Superchain fees).

- Signaling differences: Monthly buys are less automatic than a fixed percentage rule and give governance more de facto discretion, which can be desirable or risky depending on participants’ trust in treasury stewards.

Practical differences that matter to markets

- Volatility & order flow: Continuous proportional buys tend to create steady buying pressure and dampen volatility; lump-sum monthly buys concentrate order flow and may spike short-term realized volatility.

- Transparency & expectations: A 50% rule is easier for models—analysts can forecast expected buyback volumes from revenue estimates. Monthly buys introduce more governance timing risk and forecasting uncertainty.

- Execution risk: Bigger monthly buys require careful execution to avoid price slippage. Continuous small buys can be algorithmically executed with less slippage but more on-chain gas overhead.

Post-buyback governance choices: burn vs stake vs reuse (and tokenomics consequences)

What governance does with repurchased OP is arguably more important than the buyback cadence. There are three dominant paths:

1) Burn (permanent supply sink)

- Mechanics: Tokens purchased are sent to a burn address or otherwise made irretrievable.

- Tokenomics effect: Reduces total and circulating supply; all else equal, this should be deflationary and increase scarcity. The magnitude depends on revenue scale and buyback share.

- Pros: Clear, credible way to return economic value to holders; simple, reduces governance overhead. Historically, burns (and protocol-level burns like EIP‑1559 for ETH) create a persistent narrative of supply tightening.

- Cons: Irreversible — permanently limits future strategic flexibility (e.g., you can’t reuse those tokens to bootstrap new products or reward contributors).

2) Stake / lock (time-locked value capture)

- Mechanics: Bought tokens are locked in staking, vesting contracts, or governance escrows that remove them from liquid circulation for a defined period.

- Tokenomics effect: Temporarily reduces liquid supply; depending on lock duration, may look deflationary in the short term but could reintroduce supply later. Staking can also create yield streams or governance power concentration.

- Pros: Preserves optionality — tokens can be reactivated for future incentives; shows long-term commitment to network security or voter alignment. It can also create on-chain yields that attract long-term holders.

- Cons: Re-locking schedules and concentrated stakes risk centralization. Returns to stakers change economic incentives for trading vs voting.

3) Reuse for treasury incentives (recycle)

- Mechanics: Treasury retains repurchased tokens to deploy as future incentives, partnerships, grants, or developer rewards.

- Tokenomics effect: Neutral or inflationary relative to burning, because tokens eventually re-enter circulation as incentives—though if deployed to productive growth that raises revenue, net value to holders could still be positive.

- Pros: Tactical flexibility to grow the ecosystem; aligns with startup-style runway thinking.

- Cons: Creates perceived dilution risk for current holders and can undermine the price-support narrative of buybacks if tokens are recycled aggressively.

Hybrid approaches and governance levers

Governance can combine these: e.g., burn 25% of buybacks, stake 50% for 3 years, and keep 25% in treasury. Or set thresholds: burn if revenue < X; stake if revenue between X–Y; reuse if revenue > Y and new product ROI is projected high. These levers let governance trade off short-term scarcity against long-term optionality.

Dilution and deflation math — an illustrative example

Walkthrough (simplified): assume Superchain revenue is $100M/year and OP market cap is $2B with 2B supply.

- 50% of revenue => $50M/year for buybacks. At an average OP price of $1.00, that’s 50M OP removed or acquired.

- If those 50M are burned, supply falls from 2,000M to 1,950M — a 2.5% permanent cut. In simple market-cap terms, if demand stays constant this could be price-accretive.

- If instead those 50M are staked/locked for 3 years, circulating supply declines but total supply remains; long-term inflationary risk returns when locks expire.

- If reused as incentives, circulating supply might increase later depending on deployment velocity.

Two important caveats:

- Markets price in expectations—if buybacks are already priced, outsized new revenue will matter more than the mere existence of a policy.

- Elastic response—if buybacks materially increase demand for OP (via narrative or utility), the net effect could be larger than supply math alone implies.

Precedents and likely market reaction scenarios

Precedents to consider

- Exchange buybacks: Centralized exchanges (Binance, FTX historically) executed buyback-and-burn programs to signal value capture. Those programs were often well-received because of transparency and scale.

- Protocol-level burns: Ethereum’s EIP‑1559 created a protocol-level burn of base fees and materially changed ETH’s supply dynamics. That set a precedent that on-chain fee-burning or fee-driven value capture can reshape token economics.

- Treasury buybacks: Some DAOs retain buyback flexibility and then use treasury tokens for ecosystem spending; the market reaction depends on transparency and demonstrated ROI.

Scenario analysis for OP under different revenue outcomes

- Low revenue (Superchain still nascent): Buybacks are small and likely symbolic. Markets will treat the policy as positive governance but not materially change price models. Governance will face pressure to prioritize growth over burning.

- Medium revenue (steady growth): Consistent monthly or proportional buybacks create steady buy-side demand and may compress float, gradually supporting price. Burn-heavy outcomes increase scarcity signaling; stake- or reuse-heavy choices may trade price support for growth.

- High revenue (Superchain sees mass adoption): Buybacks become a major flow. If burned, OP could be materially deflationary and reprice significantly; if staked or reused, the treasury will have powerful optionality to fund growth or secure the network. Markets will watch governance for discipline—aggressive recycling without clear ROI could undercut long-term price gains.

Behavioral reaction matters: human actors front-run known scheduled buys (monthly events), while continuous buys are harder to game. So the execution cadence influences not just immediate price but tactical trading behavior.

Where this fits into Superchain value capture and L2 competition

Value capture is the difficult question for L2s: who benefits when rollups or Superchains capture fees? Optimism’s proposal is an explicit attempt to monetize that value into OP-holder utility. Compared to other L2s that may funnel fees into operator revenue, token incentives, or developer grants, a committed buyback fraction gives OP holders a more direct claim on economic activity.

Strategically, this matters in two ways:

- Differentiation: Protocols that demonstrate robust on-chain mechanisms to convert product revenue into token value can attract investors seeking yield or scarcity narratives. That’s a competitive edge versus L2s without explicit value-capture rules.

- Capital for growth: If governance retains some buybacks in treasury, the Superchain has runway for incentives, partnerships, or originator payouts—helpful in bootstrapping network effects against rivals.

This calculus must be balanced with ecosystem health. Overly aggressive burning might starve developer incentives; overuse of tokens for incentives can look inflationary. The governance challenge is choosing the mix that maximizes long-term TVL, fee revenue, and token holder value.

Governance design recommendations for voters and delegates

- Insist on transparent reporting: revenue streams, buyback execution metrics, and post-buyback disposition should be auditable.

- Favor hybrid, conditional policies: a single always-on 50% rule is simple, but combining it with governance thresholds (e.g., minimum revenue buffers, strategic reinvestment tranches) preserves optionality.

- Define execution mechanics: algorithmic on-chain buybacks vs off-chain market buys each have pros/cons; prefer low-slippage on-chain mechanisms where feasible with clear routing.

- Time-lock a portion for community-aligned purposes: a modest fraction of buybacks could be staked to align long-term holders while the remainder is burned for immediate scarcity signal.

- Build contingency clauses: allow governance to divert a tranche to treasury if exceptional opportunities (M&A, cross-chain partnerships) arise, but require supermajority oversight.

What investors should model

- Create revenue scenarios (low/medium/high) and map them to buyback volumes under a 50% rule vs a monthly cadence. Model three post-buyback dispositions (burn/stake/reuse) and factor in reintroduction rates for locked tokens.

- Consider execution slippage for monthly lump-sum buys and discount expected effective treasury buy price accordingly.

- Price in governance risk: the market will heavily discount perceived ability of governance to stick to the announced plan.

- Use narrative optionality: if the Superchain becomes a dominant L2 hub, buybacks could extract sustained and growing revenue streams that materially change OP’s long-term supply trajectory.

For crypto investors using platforms such as Bitlet.app to manage positions, these scenarios matter for both allocation sizing and time horizons.

Conclusion

Optimism’s buyback proposal is a watershed moment in L2 tokenomics: it shifts Superchain fees from a passive accounting line into an explicit lever for OP value capture. The choice between a rules-based 50% allocation and a monthly-fee cadence boils down to trade-offs between predictability, market execution, and governance discretion. Even more consequential is what governance does with repurchased OP — burning increases scarcity, staking locks value but retains optionality, and reuse preserves firepower for growth at the cost of dilution narratives.

Voters should demand clear mechanics, transparent reporting, and conditional frameworks that balance scarcity with growth. Investors should model multiple revenue scenarios and explicitly account for execution and governance risk. If Optimism gets the design and communication right, Superchain-driven buybacks could become a durable template for how L2s translate product success into token holder value.

Sources

- Optimism proposes using 50% of Superchain revenue for OP buybacks

- Optimism proposes monthly OP buybacks using Superchain fees

For complementary context on how layer-1 and layer-2 token economics evolve, see discussions in broader ecosystems such as DeFi and how macro narratives sometimes shift interest between assets like Bitcoin.