Solana Sell-Off and the Forward Industries Shock: What $1B+ Corporate SOL Exposure Reveals

Summary

Executive summary

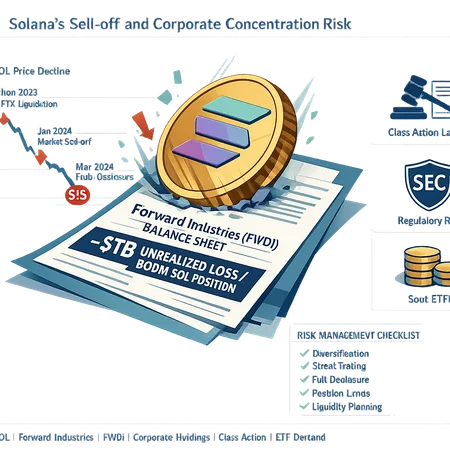

Solana’s recent sell-off is more than a price blip: it exposed how concentrated corporate balance-sheet positions can amplify volatility and create legal and systemic risk. A class-action lawsuit and headlines about Forward Industries’ roughly $1 billion unrealized SOL loss — even as it reportedly maintains a ~600M SOL position — force a rethink about market dynamics. This article walks through the timeline, the FWDI facts, the broader implications for corporate holdings, and whether spot-ETF demand can still act as a stabilizing force. It ends with practical risk-management steps for both institutional and retail holders.

Timeline of the sell-off and the class-action context

Solana’s price decline unfolded over weeks rather than a single event, but several catalyzing headlines concentrated attention. Early weakness followed broader crypto volatility; then a wave of negative coverage and a class-action suit alleging misleading statements and failures in governance intensified selling pressure. The class-action has been cited widely in market commentary as adding legal and reputational overhang to SOL, creating uncertainty that can dissuade marginal buyers and encourage holders to de-risk.

A clear, sourced overview of the price dive and how the lawsuit fits into the narrative is summarized in recent market coverage: the legal claim added a new dimension to investors' calculus and coincided with concentrated losses among corporate holders. The combination of regulatory/legal risk and concentrated balance-sheet exposures is what drove attention from risk managers and institutional desks.

Forward Industries (FWDI): the facts and why they matter

Multiple reports indicate Forward Industries (ticker FWDI) is carrying a very large unrealized loss in SOL. Some outlets estimate the figure at roughly $1 billion of unrealized loss while noting the company continues to hold a very large SOL position. For example, reporting has highlighted both the scale of the unrealized loss and that Forward Industries still appears to maintain a roughly 600 million SOL position despite that loss. These points are covered in reporting from CoinPaper, Coincu and Blockonomi, which together paint a consistent picture of significant paper losses coexisting with continued exposure (CoinPaper, Coincu, Blockonomi).

Why is that important? Two reasons:

- Size effects: a single corporate actor sitting on hundreds of millions of tokens can sway perceived market depth. Large paper losses raise the odds of eventual selling should liquidity or funding conditions tighten. That creates a second-order liquidity premium: other holders demand compensation for potential forced liquidation risk.

- Signaling effects: when a public company discloses large losses or becomes the subject of litigation tied to a token, that may trigger covenant tests, margin calls, or broader investor flight in correlated assets.

The coverage also notes Forward’s strategic optionality — the firm can choose to hold through volatility or monetize holdings incrementally — and that optionality changes how counterparties and the market should forecast future flows.

How concentrated corporate token holdings create systemic vulnerabilities

Concentrated balance-sheet exposures in volatile tokens create several channels of systemic risk:

- Liquidity shock transmission: If a large holder needs to reduce exposure quickly, selling into thin markets can cascade price declines, hitting other leveraged participants and liquidity providers.

- Counterparty and credit risk: Banks, custodians, and counterparties that accepted SOL as collateral or are exposed to FWDI on derivative positions may face losses or unexpected capital strain.

- Governance and market-confidence effects: High-profile legal actions and disclosure of large unrealized losses can erode confidence and reduce natural liquidity — market-makers step back, spreads widen, and even routine rebalancing becomes costly.

These channels are not hypothetical. The market has already seen widening spreads and episodic liquidity vacuums around SOL during the sell-off, and headlines around Forward Industries amplified concerns about how a corporate-level forced sale would propagate through the market.

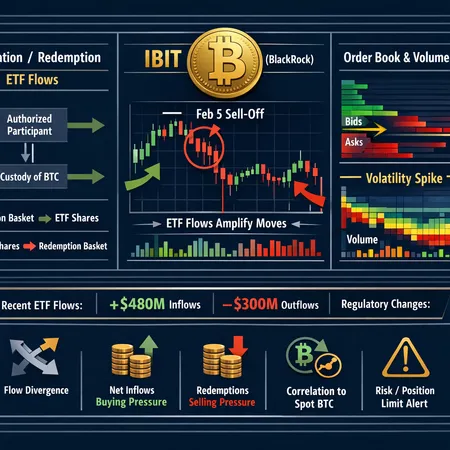

Can spot-ETF demand still provide a structural bid for SOL?

Several commentators have argued that the emergence of spot-ETF demand can create a durable structural buyer for major tokens, including SOL. Optimists point to the potential for steady inflows from institutional allocators and ETFs to compress volatility and provide a predictable buyer of last resort. A counterpoint, however, is that ETF flows are not guaranteed and may underdeliver if legal uncertainty or concentrated corporate selling coincides with redemption pressure.

A balanced read: ETF demand can help, but it is not a panacea. Recent coverage argues that ETF money could still come into SOL despite recent price action, which would help create a floor when flows and liquidity normalize (AMBCrypto). Yet the structural bid from ETFs depends on timing, regulatory clarity, and whether large corporate sellers (or forced liquidations) overwhelm inflows during dislocations.

Importantly, ETFs are relatively slow-moving compared with flash sales from a distressed corporate holder. An ETF can smooth flows over weeks or months; it cannot necessarily absorb overnight dumps worth hundreds of millions without substantial price impact. So while ETF demand is a constructive long-term narrative for SOL, it does not eliminate short-term liquidity and contagion risk driven by concentrated exposures.

Legal and regulatory risk: why the class-action matters now

The class-action suit adds friction for potential institutional buyers and public-market intermediaries. Even without an adverse judgment, litigation creates disclosure obligations, management distraction, and potential restrictions on how a public company can monetize digital assets. Coverage of the class-action served as a catalyst because it reframed some of the sell-off as not only market-driven but also legally consequential.

Moreover, litigation can interact with regulatory haircuts (how much value regulators or counterparties assign to crypto on balance sheets), which affects capital ratios and margin requirements. That interaction is what amplifies concerns about forced selling: if regulators or lenders revalue SOL holdings downward, firms with concentrated SOL exposure could face margin pressure or capital shortfalls.

For these reasons the combination of the lawsuit and large corporate exposures matters now: both increase tail risk for SOL and related markets just as headlines concentrate investor attention.

Practical risk-management takeaways

Below are concrete steps for different market participants to manage the risks exposed by this episode.

For institutional holders and risk managers

- Stress-test concentrated exposures: Run tail scenarios that include sharp price drops (30–70%+), legal/regulatory shocks, and forced-sale timelines. Model how collateral and covenant triggers behave under those scenarios.

- Diversify custody and counterparty exposure: Avoid single-custodian concentration and review bilateral exposures to any counterparty with large SOL positions on their books.

- Implement pre-defined exit ladders and time-based execution plans: Instead of attempting to sell large blocks into thin markets, use algorithmic execution with participation caps and explicit slippage budgets.

- Reconsider accounting and disclosure policies: Clearer disclosures reduce surprise risk; consider marking policies that balance transparency and operational flexibility.

- Liquidity buffers and contingency funding: Maintain non-correlated liquidity and lines of credit to avoid fire sales if assets are repriced suddenly.

For retail and non-professional holders

- Size positions relative to personal drawdown tolerance: Holding a single-asset concentrated position in SOL exposes retail investors to both price and idiosyncratic corporate/legal risk.

- Use staggered rebalancing: Dollar-cost averaging when buying and selling helps avoid being fully exposed at a local peak or trapped during sudden volatility.

- Beware of headline-driven decisions: News about lawsuits or corporate losses can be noisy; treat them as inputs to a broader plan rather than immediate buy/sell triggers.

- Custody hygiene: Use reputable custodians or hardware wallets, and avoid lending or staking large positions to counterparties unless you understand counterparty risk.

Market-monitoring checklist (quick reference)

- Track large on-chain transfers and whale wallets for SOL concentration.

- Monitor corporate filings and earnings calls of any public companies holding significant SOL (ticker FWDI in this episode).

- Watch spreads and depth on major venues — widening spreads and thinning order books are early warning signs of stress.

- Follow regulatory bulletins on crypto asset haircuts and capital treatment.

Where this leaves investors

The FWDI headlines crystallized an underappreciated risk: corporate balance sheets concentrated in volatile tokens can create outsized market impact and legal/regulatory spillovers. The presence of potential spot-ETF demand is a constructive long-term force for SOL, but ETFs cannot fully immunize markets against sudden liquidity-driven sales or legal shocks.

For intermediate to advanced investors and crypto risk managers, the practical takeaway is simple: assume concentration risk, model for severe tail scenarios, and prepare execution and funding playbooks. Platforms that help with execution, custody, and liquidity sourcing — including services mentioned across industry commentary and marketplaces like Bitlet.app — are part of the toolkit, but they do not substitute for stress testing and disciplined risk limits.

Conclusion

Solana’s price episode was not just about token fundamentals; it revealed structural vulnerabilities that arise when corporations hold large, volatile crypto positions. Forward Industries’ reported ~$1B unrealized loss and continued 600M SOL position are a reminder that balance-sheet concentration can amplify volatility, trigger legal and regulatory friction, and stress liquidity—especially in the short term. Spot-ETF demand remains a credible positive for SOL’s longer-term market structure, but it should be viewed as complementary to — not a replacement for — robust risk management.

Sources

- What’s next for Solana: 20, 120 or 250? — The Motley Fool (coverage of price dive and class-action context)

- Solana giant FWDI sits on $1B paper loss — Coincu

- Forward Industries faces $1B unrealized SOL loss — CoinPaper

- Forward Industries maintains 600M SOL position despite $1B unrealized loss — Blockonomi

- Why ETF money is still coming despite SOL’s price action — AMBCrypto

For readers tracking protocol-level narratives, remember to cross-check on-chain concentration metrics with exchange and custody flow data, and keep an eye on adjacent markets such as DeFi and Solana ecosystem developments for early signals.