Arbitrage

US spot Bitcoin ETFs recorded roughly $561–562M of inflows despite renewed BTC volatility. This article explains which issuers led flows, how creation/redemption and arbitrage work under stress, and practical trading responses.

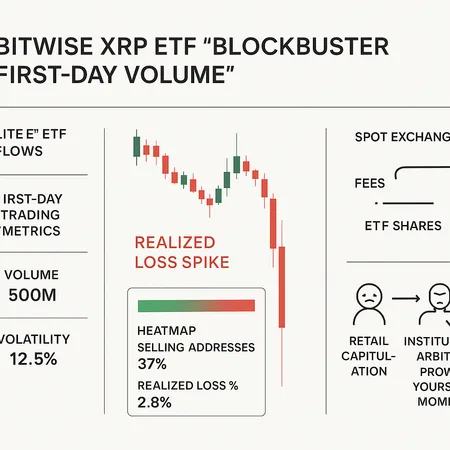

Bitwise’s XRP ETF posted a >$100M first‑day trading blaze while on‑chain metrics showed a wave of realized losses and retail capitulation. This explainer reconciles ETF flow mechanics, arbitrage paths, seller profiles, and practical risk management for active traders.

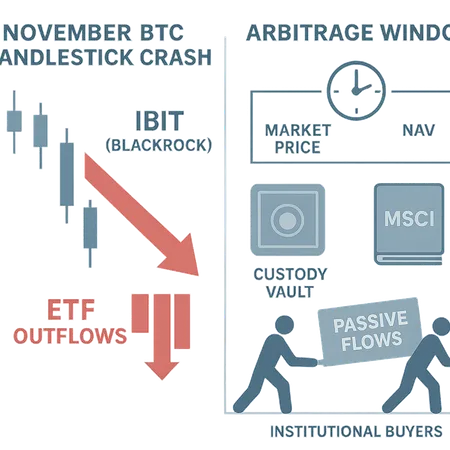

November’s BTC rout was intensified by record US spot Bitcoin ETF outflows, frictions in ETF arbitrage mechanics and shifting institutional flows. This investigation explains arbitrage windows, custody constraints, MSCI-driven allocation risk and scenarios where ETFs can amplify price moves.