Why Hyperliquid's Surge Matters: The Rise of Decentralized Perpetuals and the Risks Behind the Numbers

Summary

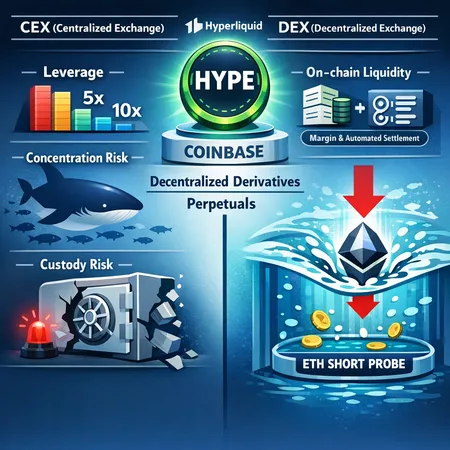

A new milestone: decentralized perpetuals hit the main stage

In early coverage, industry outlets reported that Hyperliquid — a native decentralized perpetuals venue — overtook Coinbase in notional perp trading volume, a moment many assumed would take longer to arrive. That metric is more than a vanity stat: it signals that decentralized derivatives can attract large, institutional‑sized flow when the engineering, incentives, and market structure align. The move wasn’t accidental; it was the result of on‑chain liquidity design choices that lower frictions for certain strategies while introducing their own set of tradeoffs. For many traders, Bitcoin and other spot bellwethers still matter, but perpetual flow is increasingly routing on‑chain.

How decentralized perpetuals moved the needle

Decentralized perpetuals like Hyperliquid benefit from three structural advantages that made volume growth possible: native on‑chain margin, tokenized incentives (HYPE), and lower custody friction via smart contracts and composability.

On‑chain margining and transparent liquidity

On‑chain margin models place collateral, PNL, and margin calls inside transparent smart contracts rather than off‑chain ledgers. That transparency reduces counterparty ambiguity — liquidity providers can see open interest and depth without relying on exchange reporting — and enables new liquidity primitives such as automated funding flips and AMM‑style perpetual pools. The result is on‑chain liquidity that can be directly composed into lending, staking, or hedging strategies.

Native tokens and incentive layering: the role of HYPE

Native protocol tokens like HYPE serve multiple functions: they bootstrap liquidity, subsidize fees, and create yield channels for market makers. Token incentives can attract LPs to provide deep books and can also be staked to back solver or auction mechanisms. That said, tokenized incentives can concentrate economic exposure: if LP rewards rely heavily on HYPE, a price move in the token interacts with leverage and collateral economics in complex ways.

Reduced custody friction and composability

By keeping collateral on‑chain, DEX perpetual platforms remove custodial gatekeepers and shorten the path for capital to move between protocols. Traders can leverage assets already deployed in DeFi — for example, using collateral from a lending pool to short ETH on a perp DEX — without the delay and KYC friction of CEX on‑ and off‑ramps. This composability accelerates flow, which helps explain how Hyperliquid captured significant volume quickly. It’s also why many protocols mention integration with broader DeFi stacks as a growth vector.

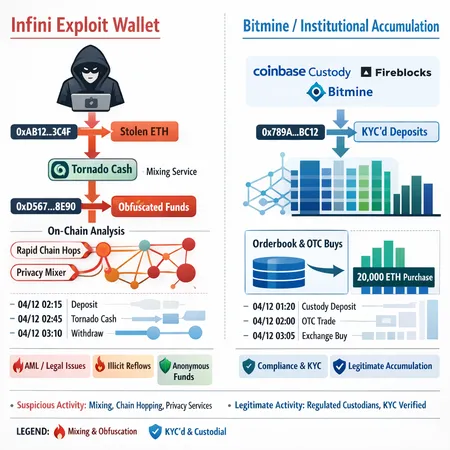

Systemic risks laid bare: the Hyperliquid ETH short probe

Success attracts scrutiny. Recent reporting probed a large ETH short position on Hyperliquid and raised questions about positioning risk and custody of collateral. The coverage suggests a real‑world case where the new mechanics collide with old‑fashioned leverage dangers.

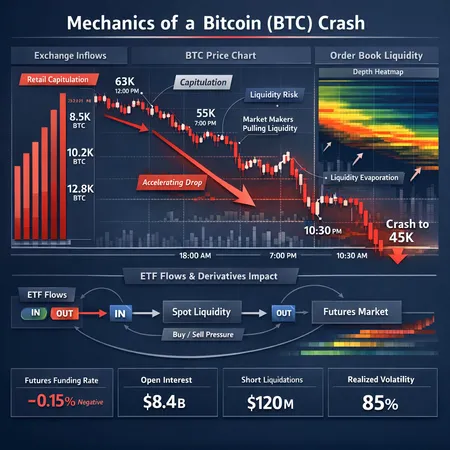

Concentration and large unhedged shorts

Large concentrated positions on any market create fragility. According to reporting that examined Hyperliquid’s notional volumes, the platform’s growth coincided with outsized ETH positions that were sizeable relative to available on‑chain liquidity pools. When that happens, the market faces a classic risk: liquidations or aggressive squeeze dynamics can cascade, especially if counterparties aren’t diversified. The CoinCu piece probing the ETH short frames this as a positioning risk — not merely theoretical but observable on the ledger when you can inspect open interest on‑chain (CoinCu coverage).

Custody of collateral and liquidation mechanics

On‑chain custody solves many trust problems but creates others. Smart contracts hold collateral, and liquidation engines may rely on auctions, on‑chain market makers, or external solvers. If collateral is concentrated in a few contracts or LP positions (for instance, LP tokens or wrapped derivatives), the ability to seize, reprice, or unwind that collateral during stress becomes brittle. The DailyCoin report that Hyperliquid overtook Coinbase highlights scale, but scale without robust liquidation and oracle resilience magnifies custody risk when markets move fast (DailyCoin report).

Token dynamics and incentive misalignments

When protocol tokens like HYPE subsidize market making, rewards can mask true risk. Liquidity can look deep while a significant portion of posted collateral is effectively backstopped by token emissions or reward expectations. If the market re‑prices HYPE or rewards taper, apparent depth can evaporate, exposing leveraged shorts or longs that counted on token inflows to remain solvent.

Lessons from the probe: what protocol designers must fix

The Hyperliquid ETH short episode is instructive: transparency exposes positions faster, but transparency alone is not a panacea. Protocol designers should prioritize three areas.

1) Robust liquidation and multi‑venue unwinds

Design liquidation rails that can fall back to cross‑venue execution or incentivized solver auctions. Ensure oracles and fallback pricing paths are battle‑tested; slow or faulty price feeds are the weakest link during squeezes.

2) Collateral composition and enforceable custody

Discourage brittle collateral types (highly tokenized or illiquid LP tokens) as sole margin. Implement haircut schedules, stress tests, and on‑chain insolvency bridges so collateral can be realized without depending on a single solver or AMM pool.

3) Token economics aligned with solvency

Align HYPE (or any native token) incentives with solvency guarantees: vesting, dynamic reward tapering under stress, and secondary insurance funds can reduce moral hazard where token subsidies mask naked exposure.

What this means for derivatives liquidity: DEXs vs CEXs

The rise of decentralized perpetuals is not a zero‑sum displacement of centralized venues, but a fast‑evolving reallocation of specific perp flow types.

- DEXs win on composability and custody minimization — attractive to on‑chain market makers, algos, and DeFi native capital that values speed and permissionless access. That’s how Hyperliquid scaled volume rapidly.

- CEXs retain advantages in concentrated professional order flow, deep cross‑margining, fiat rails, and operational risk controls that institutional clients expect. Centralized orderbooks still excel at complex block trades and off‑chain credit arrangements.

For derivatives traders and protocol designers, the practical takeaway is to match venue to strategy. If you need rapid composability and prefer on‑chain collateral flows, decentralized perpetuals offer attractive liquidity and lower custody friction — but accept the need for stronger oracle, liquidation, and incentive engineering. If you require bilateral credit, discreet execution, or complex block trading, CEXs remain more appropriate.

Conclusion: a balanced road ahead

Hyperliquid overtaking Coinbase in notional perp volume is a milestone that proves decentralized derivatives can scale fast. But growth without hardened operational primitives invites systemic risk: position concentration, fragile collateral, and incentive misalignment can convert scale into vulnerability. The ETH short probe shows these vulnerabilities in real time. Protocols that stitch together resilient liquidation rails, conservative collateral policies, and solvent token economics will convert volume into durable liquidity.

Traders should treat DEX perpetuals as a complementary venue — powerful for certain strategies, risky in others. Protocol teams and market makers must work together to close the gaps. Bitlet.app and others in the ecosystem will watch these design battles closely: the winners will be those who preserve the composability of on‑chain liquidity while repairing the custody and leverage fractures that can turn a success story into a cautionary tale.

Sources

- DailyCoin — Decentralized milestone: Hyperliquid overtakes Coinbase in perp trading: https://dailycoin.com/decentralized-milestone-hyperliquid-overtakes-coinbase-in-perp-trading/

- CoinCu — Ethereum sees positioning risk as Hyperliquid short probed: https://coincu.com/news/ethereum-sees-positioning-risk-as-hyperliquid-short-probed/?utm_source=snapi