Thailand Clears Bitcoin for Regulated Derivatives — What Institutional Investors Need to Know

Summary

Overview — why this matters for APAC institutional markets

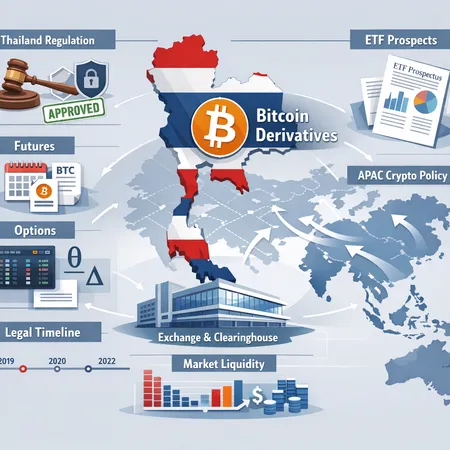

Thailand’s recent decision to allow Bitcoin to be used as an underlying asset in regulated derivatives marks a meaningful step in regional crypto policy. For institutional investors, fund managers and Asia-focused traders, the change signals that a major APAC jurisdiction is ready to bring crypto instruments into the formal derivatives ecosystem rather than leave them to unregulated venues. Expect this to accelerate conversations about spot products, custody standards and cross-border liquidity aggregation.

For many traders, Bitcoin remains the primary market bellwether; giving exchanges the green light to offer BTC futures and options under a regulated roof can reduce counterparty risk and attract institutional order flow previously hesitant to trade on offshore platforms.

What changed: the legal update in Thailand

Thailand’s executive branch and financial regulators have moved to permit Bitcoin as a legitimate underlying asset for futures and options contracts within regulated markets. The update stems from a Derivatives Act revision and related SEC rulemaking to set out how crypto‑linked products can be listed, cleared and traded.

Local reporting indicates the Cabinet approved the policy direction and Thailand’s SEC will draft implementing rules covering product specs, listing criteria and licensing. Early coverage summarized the Cabinet decision and the follow-up SEC drafting process, helping market participants anticipate the regulatory arc (Coinpedia and Invezz provide contemporaneous reporting on these developments).

Key legal elements to expect

- Clear definition of permitted underlying: BTC (the spot reference and settlement mechanics will be specified).

- Licensing and venue rules: only licensed derivatives exchanges and clearinghouses can list these products.

- Custody and settlement frameworks: approved custodians, segregation requirements and proof-of-reserves standards.

- Market‑conduct and disclosure rules: pre‑trade and post‑trade transparency, position limits and surveillance obligations.

What kinds of futures and options will be enabled

The framework paves the way for several derivatives types commonly used by institutions and market makers:

- Cash‑settled Bitcoin futures: contracts settled against a published BTC reference price (suitable for institutions concerned about custody of spot BTC).

- Physically‑settled futures: where settlement requires delivery of BTC into approved custody, useful for ETFs and funds that want to acquire spot exposure via derivatives.

- Listed options: calls and puts on BTC futures or an indexed BTC reference, enabling hedging of directional exposure and volatility strategies.

- Structured derivatives: exchange‑listed products with caps, collars or spreads that are tailored for client needs, subject to stricter approval.

Regulators are likely to prefer cash‑settled offerings initially because they simplify custody and AML/KYC oversight; however, the door is left open for physically settled contracts once robust custody and settlement rails are proven.

How this could accelerate spot ETF and institutional product development

A regulated derivatives market creates infrastructure and precedents that make spot ETFs and institutional products more viable:

- Price discovery and benchmarks: liquid, regulated futures can produce reliable reference prices used by spot ETF issuers and NAV calculations. This is a common path global markets have followed.

- Custody ecosystem maturation: custody requirements for derivatives counterparties force standards that spot issuers can reuse for ETFs and custody‑backed funds.

- Clearing and margin practice: standardized margining and clearing reduce counterparty credit risk, making institutional counterparties more comfortable supporting ETF flows or seed investments.

If Thai exchanges demonstrate orderly markets and effective surveillance, asset managers could file for local ETF vehicles or cross‑list APAC‑facing products. Invezz’s reporting highlights how Thailand’s Derivatives Act update and subsequent SEC drafting are viewed as steps that open the door to futures — and, by implication, make ETF prospects more realistic as the market develops.

Liquidity implications and market structure expectations

Liquidity will not be instant. Expect a phased progression:

- Initial period: activity concentrated among domestic brokers, regional market makers and a handful of offshore liquidity providers testing admission rules and margin regimes.

- Mid-term: growing participation from institutional desks that prefer regulated venues, especially if clearing costs and settlement risk are competitive.

- Longer term: deeper two‑way markets, narrower spreads and higher notional sizes as ETFs, custodial programs and derivatives desks scale up.

Several factors will influence liquidity buildup: the cost and accessibility of approved custody, cross‑border capital flow rules, stamp taxes or transaction levies, and the appetite of global market‑making firms to integrate Thai listings into their inventory.

Regulatory guardrails — what institutions should expect

Thailand’s approach is likely to be conservative and compliance‑heavy at first, reflecting a desire to balance innovation with investor protection. Expect the following guardrails:

- Stringent licensing for exchanges, clearinghouses and custodians.

- Enhanced KYC/AML and sanctions screening for crypto counterparty relationships.

- Position limits to curb concentration and reduce market manipulation risk.

- Stress‑testing, initial and variation margin models designed for BTC’s known volatility.

- Transparency rules requiring publication of reporting metrics for market surveillance.

Institutional participants should prepare internal policies to meet these requirements, update client disclosures, and be ready for increased operational reviews from regulators or exchanges.

Cross‑border and APAC policy ripple effects

Thailand’s move will be watched closely across APAC. When a substantive market like Thailand formalizes derivatives pathways, nearby regulators often reassess their frameworks — both to encourage domestic financial activity and to manage spillovers.

Possible regional effects:

- Faster policy convergence on custody standards and market surveillance among Southeast Asian regulators.

- Increased dialogue between APAC clearing houses about cross‑margining and interoperability.

- Competitive product launches: exchanges in Singapore, Japan and Australia may accelerate their own rule‑making to retain market share.

For fund managers operating across APAC, this presents both opportunity and complexity: easier market access in more jurisdictions, but a patchwork of slightly different compliance regimes to navigate.

Practical checklist for institutional investors and fund managers

- Custody: vet local approved custodians and confirm segregation, insurance and proof‑of‑reserves practices.

- Legal & tax: reassess fund documents and tax models for derivatives exposure and potential delivery of BTC (ticker: BTC).

- Risk models: incorporate BTC volatility into margining, liquidity stress tests and counterparty credit assessment.

- Market access: establish relationships with licensed Thai brokers and clearing members; evaluate cross‑listing and prime‑broker options.

- Product strategy: weigh cash‑settled vs physically‑settled instruments; consider overlay strategies using options to manage downside risk.

Operational readiness and a proactive compliance posture will shorten time‑to‑market for institutions seeking to trade or launch products in Thailand.

How to monitor the rollout

Track three signals closely:

- Final SEC rule texts and guidance that detail listing standards, custody requirements and margin models. 2. Exchange rulebooks and any pilot programs or sandbox listings. 3. Market‑making participation and early order‑book metrics (spreads, depth, open interest).

Early reporting from news outlets like Coinpedia and Invezz have already signaled the Cabinet decision and the SEC’s drafting work; those stories are useful immediate references while waiting for formal rules to be published.

Conclusion — a calibrated opportunity for APAC institutions

Thailand’s choice to permit Bitcoin as an underlying for regulated futures and options is a pragmatic, incremental step toward integrating crypto into mainstream institutional markets. It creates a pathway for spot ETFs and broader product innovation, but it will be disciplined, compliance‑driven and phased. Institutional participants that prepare custody, risk and compliance frameworks in advance will be best positioned to benefit as liquidity and product variety expand across APAC.

Bitlet.app users and institutional readers should watch the SEC’s rule releases closely and align operational readiness with the emerging Thai market structure.

Sources

- Coinpedia: Thailand approves Bitcoin for derivatives market and suggests ETF follow‑ups — https://coinpedia.org/news/thailand-approves-bitcoin-for-derivatives-market-crypto-etfs-could-follow/

- Invezz: Thailand clears crypto for derivatives trading, opens door to Bitcoin futures — https://invezz.com/news/2026/02/12/thailand-clears-crypto-for-derivatives-trading-opens-door-to-bitcoin-futures/?utm_source=snapi