Ethereum's Next Narrative: Liquidity Stress vs. On‑Chain AI (ERC‑8004’s Role)

Summary

Overview

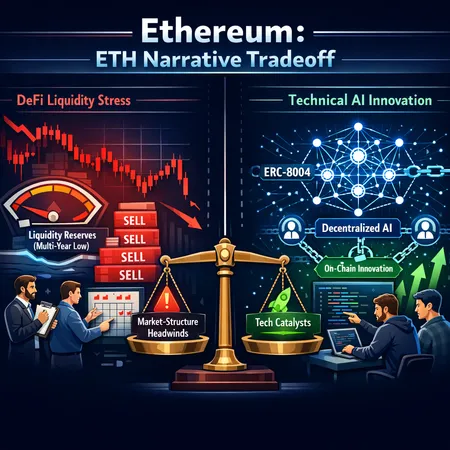

Ethereum sits at a crossroads. On one side is a market‑structure story: shrinking liquidity reserves across exchanges and DeFi pools that make ETH price action more volatile and sensitive to large flows. On the other side is a technology story: new standards like ERC‑8004 aiming to enable decentralized AI agent interactions and unlock fresh on‑chain utility. For developers, protocol investors, and institutional researchers, the key question is whether short‑term liquidity stress will swamp longer‑term technical moats.

This article examines three linked threads: signs of liquidity landscape shifts, the recent ETH sell‑off and analyst perspectives on when selling might abate, and the potential long‑run impact of on‑chain decentralized AI standards. I also sketch scenarios investors should consider depending on liquidity normalization and ERC‑8004 adoption.

Liquidity landscape: what the data is telling us

Over the last year, several indicators have pointed toward lighter liquidity on Ethereum. Exchange and protocol reserves — the aggregate pools of ETH readily available for market making and large trades — have declined toward multi‑year lows, a trend that worsens slippage for large orders and increases realized volatility for all market participants. Reporting and analysis of this shifting landscape highlight that fewer on‑chain reserves mean the order book is thinner, so outsized flows produce outsized price moves. For a succinct analysis, see the AmbCrypto breakdown on reserves hitting multi‑year lows and the resulting liquidity implications (AmbCrypto analysis).

Why does this matter technically? Lower reserves change how automated market makers (AMMs), centralized exchanges, and OTC desks interact:

- AMM depth for major ETH pairs tightens, increasing impermanent loss risk and making large on‑chain swaps more costly.

- Centralized exchange order books with thinner top‑of‑book liquidity are prone to laddered sells and cascading stops.

- OTC and institutional liquidity providers demand higher spreads or reduced exposure when funding and inventory become costly.

For protocol developers, these dynamics influence design choices for liquidity incentives, fee structures, and oracle assumptions. And for institutional allocators, they mean reassessing execution risk and potential market impact.

ETH price weakness and where selling might stabilize

ETH’s recent price weakness has been a mixture of macro headwinds, liquidation cascades, and active selling. Market commentary and on‑chain analytics indicate episodic pressure rather than a single, persistent trend. Several analysts argue that the sell‑off won’t continue indefinitely; sell pressure tends to concentrate around specific catalyst windows (on‑chain flows, macro events, or concentrated derivatives positioning). A view laying out why the decline should not be perpetual and when stabilization could occur is discussed in this NewsBTC piece with analyst perspectives (NewsBTC analysis).

Key signals to watch for stabilization:

- Flow normalization: a recovery or re‑accumulation of exchange/protocol reserves, easing immediate market impact costs.

- Funding and derivatives balance: when perpetual funding flips and open interest cools, leverage‑driven forced selling declines.

- Liquidity provider re‑entry: renewed AMM deposits or market‑maker inventory returning as spreads compress.

Because the liquidity picture and the selling pressure are intertwined, monitoring reserve metrics alongside derivatives positioning provides the clearest near‑term read for when selling may abate.

ERC‑8004 and decentralized AI: a technical catalyst

On the technical innovation front, ERC‑8004 represents a class of standards designed to let decentralized agents interact, transact, and establish reputation on chain. Cryptobriefing’s coverage outlines how the standard enables trustless commerce and paves the way for agent‑to‑agent ecosystems (Cryptobriefing coverage).

Why might ERC‑8004 matter economically for Ethereum?

- New persistent demand: decentralized AI applications could generate steady transaction volume for coordination, reputation updates, micropayments, and oracle calls.

- Developer moat: standards reduce friction for building inter‑operable agent ecosystems, attracting developer mindshare and composability between protocols.

- Fee and MEV dynamics: agent interactions create predictable transaction patterns (bids, settlements, attestations) that may be monetizable by validators and builders.

For protocol engineers, ERC‑8004 is interesting because it moves beyond purely tokenized or financial primitives into programmable, autonomous economic agents. That broadens the addressable market on Ethereum and could make ETH usage more diverse — not just trading and DeFi, but marketplace coordination, automated procurement, and machine‑to‑machine commerce.

There are caveats. On‑chain AI today still wrestles with complexity: off‑chain model computation, gas costs for state updates, and incentive design for honest behavior. ERC‑8004 does not, on its own, solve off‑chain compute or model verification — but it offers a lingua franca for agent identities, negotiation, and reputation, which reduces integration costs and fosters network effects.

How ERC‑8004 interacts with the liquidity story

These two narratives — liquidity stress and on‑chain AI adoption — interact in asymmetric ways:

- Positive feedback: successful onboarding of decentralized AI apps could increase recurring transaction volume, attracting liquidity providers back to ETH markets and reducing slippage. More predictable fees could support higher validator yields and greater protocol economic activity.

- Timing mismatch: technological adoption tends to be gradual; liquidity normalization can be faster (or faster to reverse). If reserves continue to thin before AI use cases scale, price outcomes may remain dominated by market‑structure noise regardless of future utility.

- Structural change: if agent ecosystems create new high‑frequency, low‑latency on‑chain interactions, they could alter MEV patterns and require new tooling — beneficial for builders but potentially disruptive for existing liquidity providers.

Understanding these interactions is vital for both builders (who need to design gas‑efficient, user‑friendly agent flows) and investors (who must weight adoption timelines against current liquidity risk).

Scenarios for ETH investors

Below are three pragmatic scenarios that blend adoption dynamics for ERC‑8004 with liquidity normalization timelines. These are not predictions but frameworks to guide allocation and risk management.

Scenario A — Liquidity Normalizes, AI Adoption Accelerates (Bullish)

- Exchange/protocol reserves recover within 6–12 months as risk sentiment improves and LPs re‑enter.

- ERC‑8004 sees rapid adoption for marketplaces and agent coordination, producing recurring transaction volume and new fee sinks.

- Outcome: ETH benefits from both improved market depth and higher real on‑chain demand, supporting a structural re‑rating and lower realized volatility. Developers and indexers focused on agent infrastructure capture outsized value.

Scenario B — Liquidity Remains Tight, Slow AI Adoption (Base / Risk‑On-Off)

- Reserves stay constrained for several quarters; sales continue to produce high slippage on large orders.

- ERC‑8004 adoption is steady but narrow, constrained by off‑chain compute and UX friction.

- Outcome: ETH price remains rangebound with episodic drawdowns; long‑term utility improves but not fast enough to offset market‑structure risks. Tactical execution strategies and execution‑cost hedges matter most for institutional investors.

Scenario C — Liquidity Worsens, AI Adoption Fails to Materialize (Bearish)

- Market makers and LPs pull back further; liquidity dries up in stressed macro conditions.

- ERC‑8004 projects fail to scale due to cost, competition from layer‑2 alternatives, or lack of viable business models.

- Outcome: ETH faces prolonged volatility and re‑pricing risks. Opportunistic builders and deep‑pocketed institutional buyers can accumulate at dislocations, but passive holders suffer from elevated drawdown risk.

Practical takeaways for each audience

- Developers: Prioritize gas efficiency, modular identity/reputation primitives, and designs that minimize off‑chain dependency friction. Early integration with emerging standards such as ERC‑8004 could pay off, but focus on composability and UX.

- Protocol investors: Balance conviction in long‑term ETH utility with short‑term execution risk. Use layered entry, consider execution cost overlays, and monitor reserve and derivatives metrics weekly.

- Institutional researchers: Incorporate reserve and funding data into stress tests and scenario modeling. Evaluate agent‑driven use cases not just on developer interest, but on sustainable fee generation and measurable demand curves.

A practical resource for practitioners: platforms like Bitlet.app are starting to reflect how installment and P2P models interact with on‑chain demand patterns, a reminder that real‑world flows influence on‑chain economics.

Final thoughts

Ethereum’s immediate narrative is dominated by liquidity stress — thinner reserves make price moves more volatile and execution risk higher. At the same time, standards like ERC‑8004 open a genuine technical path toward new on‑chain applications centered on decentralized AI agents. The ultimate investment outcome depends on timing: if liquidity normalizes before or as AI standards drive recurring fee demand, ETH’s economic moat could widen substantially. If liquidity stress persists and technical adoption lags, prices will remain hostage to market structure rather than fundamentals.

For developers and protocol investors, the prudent approach is dual: build and experiment with ERC‑8004 and related primitives now (to capture first‑mover advantages), while actively hedging or mitigating execution and liquidity risk in capital allocations. For researchers, the near term will be a live experiment in how technology adoption interacts with market microstructure — a case study worth watching closely.

Sources

- AmbCrypto — Assessing Ethereum’s liquidity landscape shift as reserves hit multi‑year lows: https://ambcrypto.com/assessing-ethereums-liquidity-landscape-shift-as-reserves-hit-multi-year-lows/

- NewsBTC — Ethereum price is not going to keep falling forever, analyst says: https://www.newsbtc.com/altcoin/ethereum-price-is-not-going-to-keep-falling-forever-analyst-says/

- Cryptobriefing — ERC‑8004 enables decentralized AI agent interactions: https://cryptobriefing.com/davide-crapis-erc-8004-enables-decentralized-ai-agent-interactions-establishes-trustless-commerce-and-enhances-reputation-systems-on-ethereum-unchained/

For additional reading on protocol and token dynamics, explore resources on Ethereum and broader DeFi.