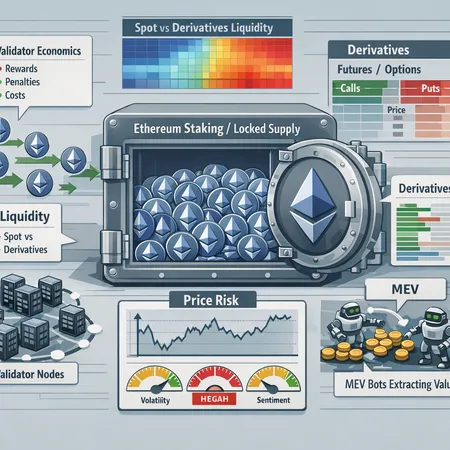

Ethereum's Locked Staking Supply in 2026: Liquidity, Derivatives, and Price Discovery

Summary

Executive summary

By mid‑2026 the Ethereum staking contract holds a material portion of ETH supply—roughly 77.85M ETH, or about 46% of total issuance according to recent on‑chain tallies. That scale of locked supply changes the plumbing of liquidity: smaller spot float, heavier reliance on liquid staking derivatives (LSTs) and perpetual swaps for leverage and hedging, and a different set of stress points when markets move fast. Institutional traders and protocol economists face new tradeoffs between durable structural support from stakers and fragile liquidity in market microstructure.

This note walks through: the scale and mechanics of the locked supply; how it interacts with spot and derivatives liquidity; why professional traders may remain cautious even into a rally; MEV and validator economics implications; and two practical scenarios for a liquidity‑driven pullback versus structural support — plus monitoring signals and risk management pointers.

The scale of Ethereum's locked staking supply and what it means

The headline: the staking contract now exceeds ~77.85M ETH locked, representing close to half of the network's effective supply. That figure is meaningful not because staking coins disappear — they still exist as protocol security — but because availability for trading or immediate settlement is materially reduced. Less tradable float amplifies the price impact of flows that require prompt liquidity (large exchange withdrawals, margin calls, liquidations).

Two consequences follow quickly.

1) Lower on‑chain float increases market impact for large spot orders

A concentrated pool of tradable ETH means a given buy or sell order sweeps deeper into the book, widening realized slippage. For market participants executing institutional sized trades, slippage and market impact become primary cost components, not just fees. That drives more activity into derivatives where execution can be more capital efficient — but derivatives introduce their own fragilities.

2) Greater reliance on liquid staking derivatives and swaps

With native ETH less available for immediate transfer, market participants increasingly use LSTs and perpetual futures for exposure. Liquid staking solutions abstract validator deposits into transferable tokens, but they also layer in counterparty risk, rebase mechanics, and peg dynamics that can disconnect derivative pricing from native ETH in times of stress.

For many participants, Ethereum exposure now comes as a combo of native ETH plus LSTs and derivatives, not one clean instrument — and that complicates price discovery.

How locked supply interacts with spot and derivatives liquidity

The derivatives complex (perpetuals, futures, options) absorbs a lot of the demand that would otherwise go to spot. Two structural effects matter for price discovery and liquidity:

Basis and term structure: With a constrained spot float, calendar spreads and basis can widen because the cost to borrow/settle physical ETH increases. Funding rates and basis become information signals about marginal liquidity stress rather than pure funding costs.

Concentration of liquidity in perpetuals: Perpetuals provide synthetic leverage without moving spot balances, so they concentrate leverage and unwind risk there. In a squeeze, deleveraging pressure may cascade into spot as basis converges, causing outsized price moves.

Derivatives liquidity depth is not a perfect substitute for spot: large liquidations on perp books still demand either synthetic rebalancing or spot conversion. If spot cannot absorb the flow without severe price moves, a derivative‑led unwind forces funding and basis dislocations that feed back into on‑chain market makers.

Why professional traders remain cautious despite price strength

Recent price rallies can look bullish on the surface, but institutional desks and pro traders often remain measured. Cointelegraph noted that even as ETH hit ~$3.4k, professional traders were not fully bullish — a behavior pattern worth unpacking.

Positioning, convexity, and liquidity risk

Net positioning and crowded longs: Pro desks watch aggregated positioning across perp funding, options skews, and futures OI. A sharp long bias increases the risk of violent de‑risking if a liquidity trigger appears. Crowded longs are a classic asymmetric risk even amid steady price appreciation.

Convexity exposure: Options markets can position desks with non‑linear exposures. Vega and gamma risk become expensive to hedge when liquidity is limited; delta‑hedging large options positions in a shallow spot book amplifies directional moves.

Unwind paths: Professional traders plan exit routes. When a meaningful share of ETH is locked, the path from synthetic longs to neutral requires unwinding basis trades or liquidating LST positions — both can be slow or painful.

Macro and funding considerations

High ETH prices don't erase funding fragility. If funding rates for perps spike, long leverage can be forcibly reduced via liquidations. Additionally, institutional players consider macro correlations, capital constraints, and regulatory risk before upping net exposure — so bullish price action alone does not guarantee aggressive placement of new risk.

MEV, validator economics, and how rewards change the math

Locked ETH secures Ethereum but validator returns are not just the beacon chain yield; MEV (Miner/Maximal Extractable Value) revenue materially augments effective staking income. For protocol economists and traders, the MEV component matters in three ways:

Supplemental yield smooths staking returns: MEV can raise validator gross returns, making staking more attractive and reducing the incentive to exit even in adverse price environments. That strengthens the structural argument for support.

Concentration and centralization risk: High MEV capture tends to cluster around well‑resourced validators and MEV‑aware builders. If MEV flows concentrate, validator economics diverge across operators and LST providers, creating heterogenous staking returns and counterparty premium/discount dynamics.

Behavioral effects on proposer choices: MEV incentives can alter proposer behavior, influence block inclusion timing, and—depending on PBS or MEV‑relay architecture—produce short‑term revenue swings that affect staking liquidity indirectly.

Validator economics are also shaped by the cost structure (hardware, uptime penalties, slashing risk) and by LST tokenomics. LST issuers who promissory‑label staking yield introduce basis and liquidity risk: in a sell‑off, LSTs can trade at a discount if unstaking liquidity is impaired or if counterparty trust frays.

Liquidity‑driven pullback versus structural support: scenarios and triggers

Institutions need scenario planning. Below are two archetypal paths and the signals that differentiate them.

Scenario A — Liquidity‑driven pullback (fast, technical)

Trigger: sudden macro shock or large forced liquidation that overwhelms perp depth.

Mechanics:

- Perps experience rapid funding spikes and liquidations.

- Basis narrows quickly as futures converge to spot, creating selling pressure on any available spot float.

- LSTs and LST marketplaces widen discounts as arbitrageurs struggle to source native ETH for settlement.

- MEV revenue may drop amid volatile blocks, reducing validator supplementary yield and prompting short‑term selling from yield hunters.

Signal set to watch: rapidly widening perp funding, spike in futures OI reductions, LST discounts increasing, on‑exchange ETH balances rising, and option implied vol spiking. This path is mostly technical and can produce a deep but potentially short correction.

Scenario B — Structural support (durable, sentiment backed)

Trigger: improving fundamentals (strong on‑chain activity, MEV tailwinds, institutional buy‑and‑hold), plus sticky staking economics.

Mechanics:

- Stakers remain locked; LST supply tightens and arbitrage keeps LSTs close to peg.

- Derivatives markets price in lower expected volatility and tighter basis as liquidity normalizes.

- MEV revenue remains a stable supplement, making validator returns attractive relative to riskless alternatives.

Signal set to watch: persistent outflows to staking, narrowing LST spreads, steady/low funding rates, moderate options skews, and low exchange inflows. This path underpins a more durable, less fragile price foundation.

Monitoring and risk management for institutional desks and protocol economists

Practical indicators to watch in real time:

- Futures basis and funding behavior: Term structure inversion or extreme funding rates precede mechanical squeezes.

- LST basis and redemption throughput: Discounts/premiums on LSTs are early warnings of settlement stress.

- Exchange balances: Net deposits of ETH to exchanges signal potential selling pressure; withdrawals are supportive but can also be staking inflows.

- MEV flow and block‑by‑block revenue: Sudden MEV drops reduce validator yield and can weaken staking stickiness.

- Validator concentration metrics: High concentration increases systemic counterparty risk if a large operator is compromised or changes policy.

Risk mitigants and hedges:

- Use calendar spreads and options to hedge basis and convexity rather than relying solely on spot sells. Calendar hedges guard against forced cash settlement squeezes.

- Stress test exposure to LST de‑peg events; treat LSTs as correlated but not identical to native ETH in scenario models. Collateral haircuts matter.

- Maintain liquidity buffers to handle slippage when converting derivatives exposure to spot.

- For protocol economists: consider tokenomic tweaks that improve exit liquidity resilience, such as smoother unstake windows or better LST redemption rails.

Practical takeaways: positioning for asymmetric outcomes

- Locked staking materially reduces immediate spot float and elevates the importance of derivatives in price discovery. That increases the potential amplitude of short squeezes and fast corrections.

- Professional traders' caution in rallies is rational: positioning, basis mechanics, and LST complexity create asymmetric downside risk even as headlines tout price strength. See analysis of trader positioning amid rallies for context. Cointelegraph analysis.

- MEV and validator economics can both support staking stickiness and introduce divergence across operators; this nuance matters for LST pricing and counterparty selection.

- Track the right market signals: funding, basis, LST spreads, exchange balances, and MEV flows. These will help you distinguish a technical liquidity unwind from a structural re‑pricing.

Institutional trading desks and protocol teams should incorporate these dynamics into execution algorithms, capital allocation, and stress scenarios. Tools like liquid staking and derivatives are powerful, but they reframe — rather than remove — price and liquidity risk.

Bitlet.app users and institutional desks will benefit from treating LSTs and perp exposure as correlated but operationally distinct instruments when modeling risk.