Custody

Fidelity CEO Abigail Johnson argues Bitcoin is shifting from speculative trade to household savings. This article evaluates the evidence, product and policy changes, practical allocation frameworks, custody options, and what advisers should do over the next 12–36 months.

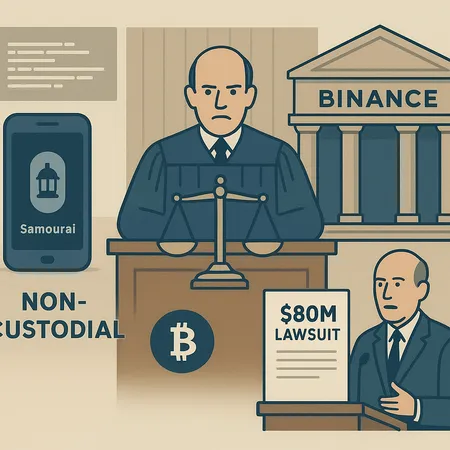

Recent legal moves — from calls to criminalize non‑custodial code to a reopened $80M Binance suit and regulators distinguishing BTC — are reshaping custody models and developer liability. This article maps the risk landscape and practical steps for compliance officers and legal teams.

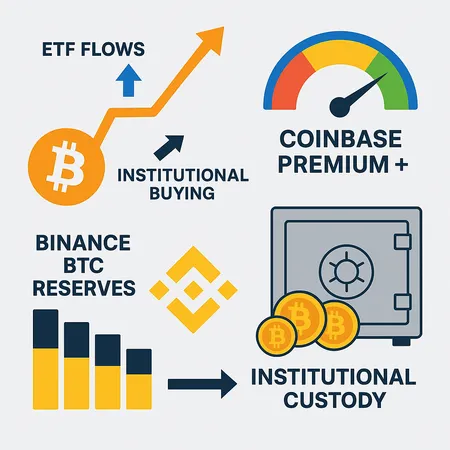

A synthesis of Coinbase premium, on‑exchange reserves, and corporate custody moves suggests the market may be shifting from short squeezes to structural accumulation — but confirmation needs multiple on‑chain and market indicators. This article outlines what to watch and practical thresholds for traders and analysts.

Tokenized gold’s $3 billion milestone signals a maturing market for digital commodities. This primer breaks down product types (PAXG, XAUT), institutional drivers, custody and legal risks, and practical due diligence for integrating tokenized metals into portfolios.

The tokenized real‑world asset (RWA) market could top $16 trillion — but institutional adoption hinges on ironclad custody and security. This guide unpacks practical custody models, compliance guardrails, and tactical steps for projects, exchanges, and regulators to prevent systemic risk.

Recent high-profile prosecutions — notably Do Kwon’s sentencing and a UK Bitcoin seizure tied to Zhimin Qian — are reshaping legal risk, custody practices and market sentiment. This article explains why these actions matter and offers a concise due-diligence playbook for institutions.

A data-first look at massive recent Bitcoin on-chain flows — 580k BTC withdrawn from exchanges, SpaceX’s $105M wallet moves, Coinbase custody migrations and a $100B market inflow — and how to convert those signals into practical trading rules.

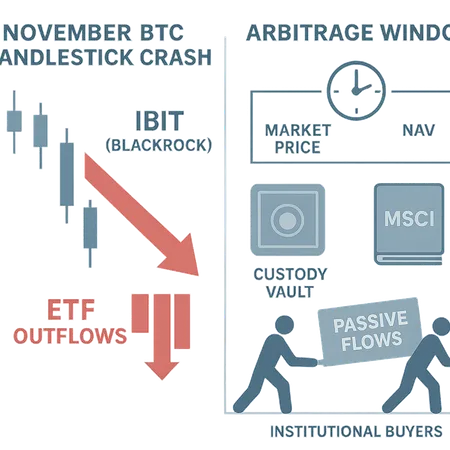

November’s BTC rout was intensified by record US spot Bitcoin ETF outflows, frictions in ETF arbitrage mechanics and shifting institutional flows. This investigation explains arbitrage windows, custody constraints, MSCI-driven allocation risk and scenarios where ETFs can amplify price moves.

The OCC’s update permitting banks to hold crypto for network fees alters custody operations and treasury playbooks. This article unpacks the guidance, practical gas-management designs, counterparty considerations, and what SharpLink’s ETH move to Galaxy Digital signals for firms holding native reserves.

New Hampshire's $100M Bitcoin-backed municipal bond is a watershed test of how BTC reserves can be integrated into public finance. This deep-dive examines structure, custody, regulatory risk, market potential in the $140T debt universe, and how OCC guidance could enable broader bank participation.