Are Institutional Flows and Exchange Dynamics Signaling a Renewed Bitcoin Rally?

Summary

Overview: why on‑exchange dynamics matter

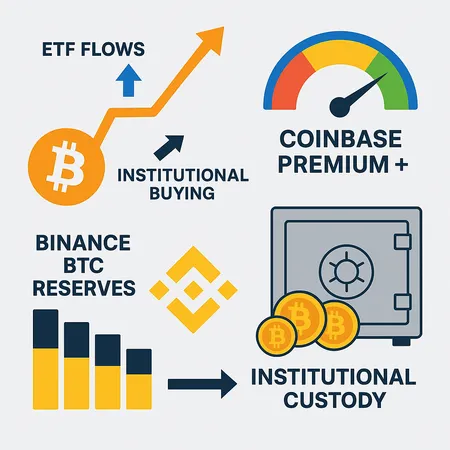

Short-term price swings in BTC often look frenetic, but the background of where supply sits and who is buying determines whether moves are fleeting or the start of a durable leg up. For many traders, Bitcoin remains the primary market bellwether: when large buyers accumulate off‑exchange or move coins into custody, exchange liquidity thins and price becomes more sensitive to demand. In 2025, three signals have dominated desk conversations: the Coinbase premium flipping positive, measurable BTC leaving Binance, and visible institutional/trust positioning such as ABTC.

These signals are complementary — the premium tells you who is paying a premium for spot in a major US venue, exchange balances tell you where liquidity is concentrated (or absent), and custody/trust disclosures reveal which legal vehicles are soaking up supply.

Coinbase premium: what a positive premium implies about US buyer demand

A positive Coinbase premium — when BTC trades at a higher price on Coinbase Pro/Advanced relative to aggregated global spot — has historically acted as a proxy for US buyer demand, particularly from institutional-sized orders. CryptoPotato recently noted how the Coinbase premium flipping from negative to positive has in prior cycles signaled big money returning to Bitcoin (analysis).

Why does this matter? US institutions and wealth managers operating through onshore venues often use Coinbase for execution or as a liquidity hub. When they re‑enter the market, they create a persistent bid that shows up as a premium versus venues more populated by international retail or arbitrage desks.

Key nuance: a short-lived positive premium can be caused by orderbook fragmentation, routing issues, or a temporary influx of buy orders. The premium is a directional clue — powerful when sustained for days to weeks and when corroborated by other flow metrics (ETF flows, custody inflows, exchange outflows).

Limitations and false positives

A stubborn positive premium without net exchange outflows could simply reflect local market microstructure rather than structural demand. Also, ETF or trust creations/redemptions and big OTC fills can distort the premium. Treat it as a necessary but not sufficient condition for a durable rally.

On‑chain evidence: BTC leaving Binance and supply tightness

One of the louder on‑chain narratives recently is shrinking BTC balances on Binance. Reporting shows Binance’s Bitcoin stockpile has declined even while prices rose, which is a classic sign of supply tightening on exchange orderbooks and reduced ability for sellers to dump into liquid pools (Bitcoinist).

When exchange reserves fall, two things tend to happen: the bid-ask spread widens, and any incremental demand causes larger price moves. That dynamic converts moderate buying pressure into outsized percentage gains. Complementary market commentary has flagged broader seller exhaustion and the prospect of a relief rally as selling pressure wanes (CryptoNews).

But again: look for persistence. Short bursts of outflows followed by inflows (or exchanges moving BTC to cold wallets and then back) are noise. Persistent net outflows over weeks, especially from major liquidity pools like Binance, are a stronger signal.

Institutional custody and proxy plays: ABTC and corporate treasuries

Institutional appetite often shows up not directly in spot orderbooks but via custody products and trust vehicles. TheBlock’s disclosure on American Bitcoin (ABTC) and its sizable BTC holdings underscores how corporate/trust balance sheets can soak up large chunks of available supply and alter market psychology (TheBlock).

Products like ABTC or other institutional trusts act as proxy spot demand: investors buy shares of a vehicle rather than moving coins on‑chain themselves. That creates a mechanical demand loop where the trustee or custodian must acquire or custody BTC to back the product, tightening spot supply the same way direct buys do — but with different on‑chain signatures.

Important distinctions:

- Custodial inflows to regulated trusts are durable; these assets typically remain locked with custodians, reducing circulating float.

- Proxy flows can be monetized (created/redemptions) and are susceptible to product design and fee arbitrage.

- Publicized corporate buys (or large trust disclosures) shift market expectations, influencing speculative positioning even before flow is complete.

These corporate/trust positions matter to traders because they can sustain asymmetric risk-reward: with a meaningful portion of sell-side removed, a gradual rebuild in bids can catalyze a steeper climb once leverage unwinds.

Putting the pieces together: what confirms a sustainable bull leg?

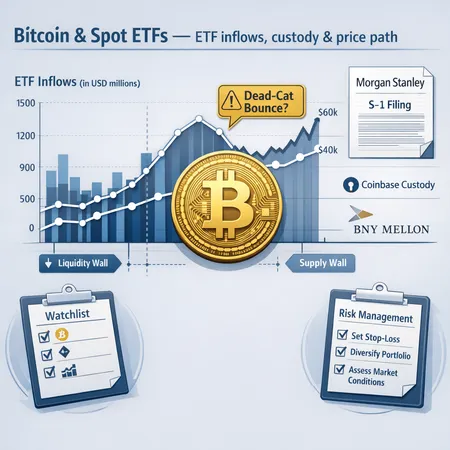

The three threads — Coinbase premium, exchange outflows (Binance reserves), and institutional custody — are necessary ingredients for a durable rally, but not sufficient alone. Traders and analysts should wait for multi‑signal confirmation. Below are practical indicators and how to read them:

- Sustained Coinbase premium: positive for 7+ trading days and expanding dollar spread, not just tick-level blips.

- Net exchange outflows: multi-week declines in total exchange BTC balances, led by major venues (Binance, Coinbase). A single day of outflows is noise; progressive weekly reductions are meaningful.

- Large custody inflows / trust allocations: verified filings or disclosure changes for ABTC/other trusts, or known OTC fills routed to custody addresses.

- Futures basis and options skew: positive futures basis (contango) with benign funding rates indicates organized spot buying; exploding negative basis or sharply negative funding suggests short squeezes rather than genuine demand.

- Open interest behavior: declining OI amid price strength can signal short covering; rising OI with price increases suggests fresh leveraged long positioning — more durable but riskier.

- Seller exhaustion signals: lower realized selling from short-term holders, fewer coins moving to exchanges, and indicators like SOPR (Spent Output Profit Ratio) rolling toward 1 or lower can imply exhaustion.

- Macro/ETF flows: confirmed large creations/redemptions in spot ETFs or institutional vehicles that persist across settlement windows.

No single metric should be used in isolation. For example, a positive Coinbase premium plus Binance outflows is persuasive, but if futures funding spikes wildly positive and OI rockets, you might be looking at a leveraged blow-off rather than structural accumulation.

Trade setups and risk management

For active traders and desks:

- Require at least two confirming signals (e.g., positive Coinbase premium + multi‑week net exchange outflows) before committing significant capital.

- Scale into positions: enter a base size on initial confirmation, add on follow‑through (daily close above key resistance) and trim into spikes.

- Use volatility-aware sizing when funding rates or options vols are elevated. High implied vol can flip a rational buy into a leveraged squeeze.

- Monitor custody and trust disclosures in real time; a large institutional buy announced after your entry justifies adding, while a sudden redemption event may warrant tightening stops.

Platforms such as Bitlet.app can help traders layer execution and custody signals into a unified workflow, but don’t substitute real‑time flow analysis and on‑chain verification.

Conclusion: likely start — but wait for confirmation

The convergence of a sustained positive Coinbase premium, shrinking Binance BTC balances, and visible institutional custody flows (including trust allocations like ABTC) increases the odds that the market is transitioning from short-term rallies to a more durable accumulation phase. However, traders should insist on corroboration across multiple metrics — exchange outflows, futures basis, options skew, and custody disclosures — before labeling the move a new bull leg.

Markets can remain irrational longer than expected; a checklist approach reduces the chance of mistaking squeeze dynamics for structural rotation. If several of the indicators above align and persist for multiple weeks, the probability of a sustained rally materially improves.