Solana DeFi Contagion: A Post‑Mortem of Jupiter Lend’s Vault Design and Risk Messaging

Summary

Executive summary

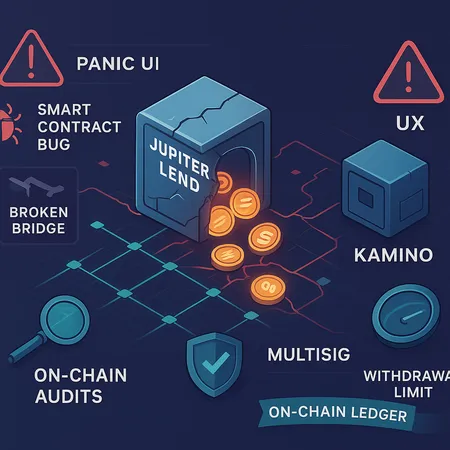

Jupiter Lend’s recent disclosures about risk and a follow-up clarification sparked a notable DeFi contagion scare on Solana. What began as technical caveats and an assertion about limited contagion became a community backlash after the vault architecture and messaging didn’t line up with user expectations. The episode highlights how isolated vaults can still threaten the broader ecosystem through composability, liquidity overlap, and UX-driven runs.

This post-mortem is written for DeFi-savvy product managers and risk-focused traders. It explains what Jupiter disclosed, how the community and competitors reacted, why vault isolation is often illusory on Solana, how UX and messaging can escalate panic, and — most importantly — concrete mitigation steps for users and builders.

What Jupiter Lend disclosed and the immediate reaction

In short: Jupiter Lend published risk disclosures that attempted to categorize threat vectors and reassure users that contagion would be limited; after a painful backlash, an executive admitted the original “zero contagion” implication was overstated. Early coverage of the risk disclosure framed it as an attempt to be transparent about vault exposures and counterparty assumptions, but community and competitor scrutiny focused on the vault design and withdrawal mechanics. Reporting at the time captured both the initial disclosure and later pushback: AmbCrypto flagged the initial risk framing and contagion fears, and follow-up coverage documented a Jupiter executive acknowledging the statement was not 100% correct after criticism about vault design and guarantees. See detailed reporting from AmbCrypto and The Block for the chronology and quotes: AmbCrypto coverage and The Block follow-up.

Why the disclosures mattered

Risk disclosures are a double-edged sword. On the one hand, they help users calibrate exposure. On the other, when language is imprecise — e.g., implying “limited” or “zero” contagion without fully enumerating shared dependencies — they can create complacency that explodes into panic when edge cases appear. In Jupiter’s case, the messaging gap between engineering nuance and product assurances was the spark.

How an “isolated” vault still spreads risk on Solana

Many read “isolated vaults” as meaning operationally and financially siloed. On Solana, that assumption is fragile. There are several technical and economic channels that turn a single-vault issue into ecosystem-level stress:

Composability and cross-program invocations: Solana programs call one another, reuse token accounts, and rely on shared program IDs. A vault that executes a complex cross-program withdrawal can trigger failures in downstream programs or revert sequences that cause cascading liquidations.

Shared liquidity pools and LP overlap: Vault strategies often use the same AMMs or concentrated liquidity pools. A sudden withdrawal or unwind can slosh through the same liquidity, moving prices and tripping on-chain liquidations elsewhere.

Collateral and oracle entanglement: If multiple protocols rely on the same price feeds or oracle aggregation, a price shock (or delayed oracle update) caused by a vault unwind can lead to correlated margin calls.

Account model and rent/locking quirks: Solana’s account model forces programs to pre-allocate and lock certain accounts during batched operations. If a vault’s withdrawal flow locks accounts or fails mid-execution, it can leave user funds temporarily inaccessible and spark withdrawal runs.

These channels mean that even when teams design vaults to be “isolated,” the broader financial plumbing often bridges them. When liquidity and fungibility intersect with on-chain automation, a single failure can propagate rapidly.

Smart-contract and bridge UX failures that escalate panic

Technical flaws are one thing; the social reaction is another. UX and messaging failures turn manageable bugs into collapse scenarios.

Ambiguous error messages: Generic reverts like "operation failed" without clear provenance (which program, which instruction) force users to assume worst-case outcomes and withdraw funds from anywhere else they can.

Lack of straightforward status dashboards: Users want a single source of truth during incidents — DAOs, multisig transactions, and emergency pauses are meaningful only if communicated clearly and on-chain. Without transparent state on withdrawals and vault health, rumor fills the void.

Poor bridge UX and communication: Bridges are often the escape valve in panic. If bridge providers or front-ends don’t clearly denote bridging limits, queued transactions, or expected latency, users double down on simultaneous withdrawals and chain hops, increasing network congestion and slippage.

Overconfident marketing vs. engineering nuance: Promises of "no contagion" or guarantees that sound absolute raise expectations. When reality differs, trust evaporates fast.

In Jupiter’s case, the combination of complicated vault mechanics and assertive early language turned engineering caveats into a visible run dynamic across Solana. Poorly explained emergency controls and lack of living on-chain telemetry made third parties and traders assume the worst.

Concrete mitigation steps for builders (product managers, dev teams)

Here are actionable controls and design patterns teams should adopt to reduce systemic risk and calm user panic when incidents occur.

1) Prioritize comprehensive, layered audits and on-chain attestations

- Go beyond a single external audit: combine code audits, economic audits, and on-chain behavior simulation (forks, mainnet dry-runs). Use fuzzing and property-based tests that exercise batched cross-program sequences. Maintain an on-chain audit log or light attestations so users and other protocols can verify the deployed bytecode and key invariants.

- Publish a concise engineering risk matrix for each vault strategy that lists shared dependencies (oracles, AMMs, bridges) and their failure modes.

2) Design with defensive financial primitives

- Withdrawal throttles and per-account limits: Implement rate limits and staggered withdrawals so an individual unwind cannot wipe out thin AMM depth. Time-locks for significant withdrawals help avoid flash sloshes.

- Emergency pause and safe-exit flows: Provide circuit breakers that pause new positions while enabling orderly redemptions. Make these on-chain and verifiable, not just backend flags.

3) Governance and ops safety: multisig + redundancy

- Use multisig with geographically and institutionally diverse signers for emergency actions. Rotate signers and require N-of-M thresholds that balance speed and safety.

- Maintain pre-authorized emergency-run playbooks and test them in non-production environments so that multisig ops don’t stall during a panic.

4) On-chain transparency and tooling

- Real-time health dashboards: publish vault TVLs, pending withdrawals, debt ratios, and collateralization on-chain or via authenticated oracle endpoints. Transparency reduces rumor-driven runs.

- Signed state proofs: teams can publish signed statements (attestations) referencing on-chain state; third-party watchers can automate alerts.

5) UX and crisis communication protocols

- Craft short, precise, non-technical initial messages for incidents and follow with technical updates. Users react worst to silence or conflicting statements.

- Provide recommended action steps for users (e.g., “do not bridge until X is confirmed”) and pin these across channels. Make sure front-ends (and integrators) surface the same message.

Practical steps for traders and risk-focused users

Traders can’t delegate all risk to protocols. Operational risk controls you can apply:

- Vet shared dependencies: explicitly track which oracles, liquidity pools, and bridge providers your positions rely on. Reduce correlation by diversifying AMMs and oracles across strategies.

- Keep a liquidity buffer: do not assume instant withdrawal at peg; size positions so that a 10–30% reduction in immediate redeemability won’t force catastrophic liquidation elsewhere. That buffer differs per strategy.

- Prefer protocols with on-chain pause controls, audited multisig signers, and transparent emergency procedures. If a project has opaque governance or central keys, treat it as higher counterparty risk.

- Use program-level allowance limits where possible (time-limited approvals) and prefer wallets that let you granularly sign instructions. Avoid blanket approvals to unknown programs.

A quick checklist for product managers building vaults

- Have you listed all shared dependencies and run failure-mode simulations? (Oracles, AMMs, bridges)

- Are withdrawals rate-limited or staggered to protect thin liquidity venues?

- Is there an on-chain emergency pause and an audited multisig with tested procedures?

- Do you publish concise risk disclosures plus an engineer-focused annex that enumerates cross-program interactions?

- Is there a real-time public dashboard exposing pending redemptions and vault health?

Lessons learned: governance, honesty, and the value of slow comfort

The Jupiter episode reiterates several high-level lessons that are easy to state and hard to operationalize: be explicit about uncertainty; avoid absolute language; test emergency processes until they feel routine; and invest in tools that turn opaque program state into verifiable facts.

From a governance standpoint, having pre-committed, tested emergency playbooks and diverse multisig signers reduces the chance that a responsible pause becomes an opaque black box. For communications, teams should default to conservative language: acknowledge unknowns and provide the immediate, practical steps users should take.

One practical point for the Solana ecosystem specifically: because programs and liquidity are highly composable, threat modeling should treat protocols as financial services rather than isolated products. That change in mindset — and the tooling that supports it — is central to reducing contagion risk.

Closing thoughts for risk-focused traders and PMs

This was not merely a code quality failure; it was a design, ops, and communication failure. Traders should update their risk models to account for UX-induced runs and shared liquidity exposures. Product managers should ensure vaults have technical mitigations (rate limits, multisig, audited emergency flows) and social mitigations (clear disclosures, tested comms). Platforms like Bitlet.app increasingly emphasize these pragmatic controls in their integrations and due-diligence flows.

If you manage or trade leveraged or yield-bearing positions on Solana, carve out time to review the checklist above and validate the actual on-chain attestations of the projects you rely on. In DeFi, transparency and humility beat bravado every time.

Sources

- Initial reporting on Jupiter Lend’s risk disclosure and contagion concerns: https://ambcrypto.com/we-have-limited-risk-jupiter-lend-addresses-solana-defi-contagion-fears/

- Follow-up coverage documenting Jupiter exec's acknowledgment about overstated claims: https://www.theblock.co/post/381602/jupiter-exec-acknowledges-zero-contagion-claim-was-not-100-correct-after-backlash-over-vault-design

For broader reading on Solana composability and DeFi risk, see DeFi and monitoring on Solana.