Bitcoin-Backed Municipal Bonds: New Hampshire's $100M Test for Public Finance

Summary

Why New Hampshire's $100M Bitcoin-Backed Bond Matters

New Hampshire's $100 million Bitcoin-backed municipal bond is the first high-profile, municipal-level experiment that explicitly ties a public debt instrument to BTC reserves. Reporters described it as a test case for bringing crypto collateral into mainstream public finance and for accessing parts of a much larger debt market. Coverage framing this move as exploratory highlights both the novelty and the careful choreography behind the deal: the goal is to offer a municipal security whose economics or credit enhancement is linked to BTC holdings rather than — or in addition to — traditional cash or pledged revenues. This development puts questions of custody, fiduciary duty, and regulatory risk front and center for municipal issuers and their underwriters. For context on the issuance itself see reporting from Cryptopolitan and Blockonomi, and a market-size take in Coingape.

For many market participants, Bitcoin remains the primary crypto bellwether; using BTC as a reserve or backing asset for public debt therefore makes this a high-visibility experiment with outsized implications.

How a Bitcoin-Backed Municipal Bond Is Structured

At a basic level, a Bitcoin-backed bond combines traditional municipal bond mechanics with an overlay of BTC reserves or contractual links to BTC price movements. There are several structural templates that could be used:

Collateralized model: An issuing municipality or a special-purpose entity (SPE) holds BTC as collateral in a trust. Bondholders have a security interest in the trust assets, comparable to other collateralized municipal credits. The trust's BTC can be sold or liquidated under defined events of default or to meet debt service shortfalls.

Credit enhancement model: BTC holdings are used as a credit enhancement — a supplemental source of repayment — alongside pledged revenues. The bond's official statement (offering document) defines how BTC is tapped to cover missed interest or principal.

Indexed/structured payout model: Coupons or principal amounts are tied to BTC price performance, either directly or via derivative overlays. This creates embedded basis risk between fiat-denominated obligations and BTC denominated reserves.

Operationally, the bond remains a fiat-denominated security for most municipal markets, meaning coupons and principal are paid in USD. BTC reserves are therefore an asset held by the issuer (or a backstop trust) that may be liquidated to meet USD obligations. That creates immediate liquidity management and timing considerations: when must BTC be converted to USD? Under what price assumptions? Who executes the sale? These questions drive custody requirements and risk controls.

Blockonomi's coverage of New Hampshire's move provides a useful outline of the basic mechanics and market intent behind the issuance.

Practical mechanics and waterfall design

A defensible waterfall must specify triggers and fungibility rules: thresholds for liquidation, price bands for partial sells, permitted exchanges/counterparties, and priority between bond tranches. It is common to use an SPE to isolate municipal balance-sheet exposure; the SPE holds BTC and issues the bond. Offering documents should include stress scenarios showing how BTC drawdowns are used to honor payments and how liquidity is replenished once markets calm.

Custody: Operational Controls, Insurance, and Bank Roles

Custody is the single most consequential operational issue for Bitcoin-backed bonds. Unlike cash or Treasuries, BTC custody is a specialized service that mixes technology, operational security, and legal considerations. Key custody questions include:

- Who holds the keys? Multisignature architectures split control and reduce single-point-of-failure risk. Cold storage and hardware security modules (HSMs) are industry norms for long-term holdings.

- What insurance exists? Custodians may offer coverage against theft, hacking, or insider fraud, but coverage limits, exclusions, and claim processes vary widely.

- How is transfer and liquidation executed? Liquidity providers and exchange relationships matter when converting BTC to USD to meet debt service.

Historically, municipalities have limited counterparties to highly regulated banks or trust companies. For Bitcoin reserves, jurisdictions must evaluate crypto-native custodians against banks with custody capabilities. The recent OCC guidance that clears banks to hold crypto for network fees — while narrow — signals an evolving regulatory posture toward bank involvement in crypto operations. That guidance could help banks expand services that support BTC custody and settlement for municipal deals (more on the OCC later).

Operational governance should require independent custodianship with periodic audits, multi-party approvals for key movements, replicated ledgers or attestations, and a clear incident-response protocol. Municipal credit officers will want to see third-party proof of reserves, SOC-type reports, and clearly defined insurance policies.

Legal and Fiduciary Considerations for Municipal Issuers

Municipal law, fiduciary duty, and securities regulation intersect in unusual ways with crypto. Issuers must consider:

- Statutory authority: Many municipal charters and statutes define permissible investments and borrowing structures. Issuers need legal opinions confirming that holding BTC or structuring a BTC-backed security is within their statutory powers.

- Fiduciary duty and prudence: Public finance professionals are fiduciaries. Incorporating a volatile asset like BTC requires careful documentation showing that the decision is prudent, necessary, and consistent with the issuer's investment policy or governing approvals.

- Disclosure and MSRB compliance: The Municipal Securities Rulemaking Board (MSRB) requires accurate disclosure. Offering statements must explain BTC-related mechanics, valuation policies, and material risks in plain language so investors can price the risk.

- Tax treatment: Bond tax status and investor tax considerations depend on the instrument's structure. Credit enhancements, collateral transfers, or exotic payoff features should be evaluated for adverse federal tax consequences.

Legal work should include robust opinion letters addressing instrument validity, enforceability of security interests in BTC, and remedies in cross-border scenarios (for example, if a custodian is foreign). These are not theoretical concerns: the fast-evolving legal landscape around crypto custody and property rights may create novel enforceability issues that differ materially from traditional collateral.

Market Size: How Big Could Bitcoin-Backed Debt Become?

Proponents make an ambitious case: the global debt market is roughly $140 trillion in size across sovereign, corporate, and municipal credits. If BTC-linked or BTC-backed instruments could achieve even a sliver of that volume, new capital flows into crypto and deeper integration of digital assets with mainstream finance would follow. Coingape and Blockonomi have explored the theoretical addressable market, arguing the opportunity is massive if operational and regulatory barriers fall.

But realistic adoption curves are slower. Key limiting factors include:

- Risk appetite of conservative investors and rating agencies.

- Municipal legal and policy constraints.

- Operational maturity around custody, settlement, and hedging.

- Regulatory clarity from federal and state authorities.

A conservative, plausible scenario: pilot issuances like New Hampshire's could open the door for niche offerings (e.g., credit-enhanced muni paper for tech-forward municipalities or special-purpose infrastructure projects). Broad adoption into the mainstream — measured in trillions of dollars — would require multi-year improvements in custody, clear supervisory frameworks, wide insurer participation, and standardized product designs. Even then, uptake will vary by jurisdiction and investor type.

Counterparty, Market, and Regulatory Risks

Bitcoin-backed bonds introduce a matrix of interlocking risks that demand new mitigation tools. The most salient are:

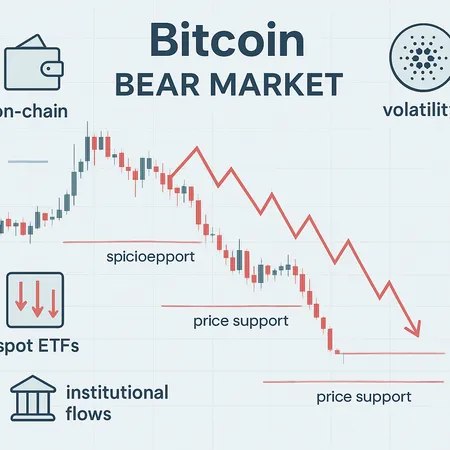

- Price/volatility risk: BTC is materially more volatile than fiat assets. A precipitous drop in BTC could force rapid liquidations, creating realized losses or fire-sale conditions that impair bond payments.

- Liquidity and timing risk: Converting large BTC positions to USD in stressed markets can be slow and costly. Execution risk becomes an issuer risk when bond payments are due.

- Custodian counterparty risk: Custodians may suffer hacks, insolvency, or legal actions that impede access to assets. Municipal investors must assess custodian balance sheet strength, regulatory supervision, and contractual rights.

- Legal enforceability and cross-border exposure: If custodial arrangements or exchanges are subject to foreign jurisdictions, remedies may be limited in bankruptcy or dispute scenarios.

- Regulatory risk and enforcement: Shifting positions from the SEC, CFTC, state regulators, and MSRB could alter permissible structures, disclosure burdens, or compliance costs. New rules could retroactively change the economics of outstanding bonds.

- Reputation and political risk: Municipal officials could face political backlash for perceived speculative behavior with public funds.

Mitigants include conservative sizing of BTC reserves (e.g., using them as partial credit enhancement rather than sole repayment), automatic rebalancing thresholds, prearranged liquidity lines with banks, and hedging via OTC counterparties to limit exposure to downside moves.

OCC Guidance: An Enabler, But Not a Panacea

The Office of the Comptroller of the Currency (OCC) recently issued guidance allowing U.S. banks to hold cryptoassets for the purpose of paying network transaction fees. While narrow in scope, the OCC decision matters symbolically and operationally. It signals regulatory comfort with banks interacting with crypto assets under defined conditions and reduces one obstacle to banks offering custody or settlement services for crypto-related instruments.

This guidance does not by itself authorize banks to custody crypto as a core custody business for clients, nor does it solve insurance gaps or the need for clear prudential rules about holding volatile assets on municipal balance sheets. Still, it provides a stepping stone: banks can build operational expertise, connect to on-chain systems, and create service rails that could facilitate BTC-backed bond liquidity. Blockonomi's reporting on the OCC move highlights this incremental but meaningful shift.

If banks expand capabilities beyond network-fee holdings — through charters, trust powers, or partnerships with regulated custodians — they could provide familiar counterparty relationships to municipal issuers: insured custody accounts, settlement facilities, and maybe even liquidity backstops. That would address some counterparty concerns and possibly make rating agencies and conservative investors more comfortable with BTC-linked structures.

Practical Recommendations for Municipalities and Investors

For public finance professionals and institutional investors considering Bitcoin-backed structures, a conservative, staged approach is advisable:

- Start small and pilot: Use limited pilot issuances with explicit caps on BTC exposure and clear contingency plans. Document lessons and update policies.

- Rigorous legal review: Obtain layered legal opinions covering statutory authority, security interests, tax consequences, and enforceability across jurisdictions.

- Choose regulated, transparent custodians: Prefer custodians with audited controls, insurance, SOC reports, and bank partnerships. Require proof-of-reserves and regular attestations.

- Stress testing and scenario planning: Model extreme price moves, liquidity windows, and counterparty failures. Include worst-case scenarios in offering disclosures.

- Transparent disclosure and governance: Update investment policies, involve elected oversight, and disclose material risks to investors and rating agencies.

- Consider hybrid structures: Use BTC as partial credit enhancement or in derivative overlay strategies to limit direct exposure.

Institutional investors should demand clear documentation about how BTC is acquired, held, valued, and liquidated. They should also insist on counterparties with deep liquidity and transparent risk-management frameworks.

Outlook: Cautious Experimentation with Significant Upside

New Hampshire's $100M Bitcoin-backed bond is not a declaration that BTC will replace traditional reserves, nor is it a panacea for municipal funding challenges. Instead, it is a pragmatic experiment: a way to test operational models, interrogate legal frameworks, and explore whether crypto assets can play a measured role in public finance. If pilots are executed with transparent governance, conservative sizing, and robust custody, they could pave the way for broader, albeit gradual, integration into certain corners of the $140T debt market.

Regulatory developments — including further clarity from federal agencies and practical bank custody solutions — will determine whether this experiment scales. The OCC's guidance is a constructive early step, but more formalized frameworks, standardized product templates, and insurer participation will be necessary to move from novelty to mainstream adoption.

For public finance professionals and policymakers, the key takeaway is to treat Bitcoin-backed bonds as an operational and governance challenge first, and a market opportunity second. Done carefully, these structures could offer innovative tools for credit enhancement or diversification; done hastily, they risk exposing public balance sheets to outsized volatility.

Bitlet.app and other market infrastructure providers will be watching how custody, regulation, and investor appetite evolve. For those studying the intersection of crypto and public debt, the New Hampshire issuance is an invitation: learn fast, document deeply, and prioritize prudent controls before scaling up.

For further background reporting on the issuance and market implications see Cryptopolitan's report on New Hampshire's announcement, Blockonomi's coverage of the $100M issuance and the OCC guidance, and Coingape's analysis of the broader $140T debt opportunity.