Custody vs Code: Mapping Legal Risks for Non‑Custodial Developers and Exchanges

Summary

Executive summary

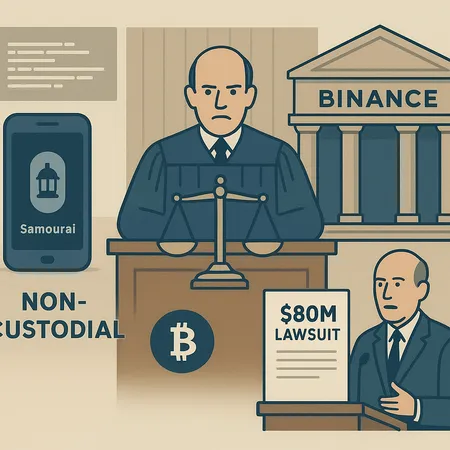

The legal debate over who — and what — can be held criminally or civilly liable in crypto is intensifying. Recent developments include a Washington‑based think tank and Bitcoin community pushback against efforts to punish Samourai Wallet developers, a Florida appeals court allowing a refiled $80M civil claim against Binance, and public remarks from SEC Chair Gary Gensler that separate BTC from other tokens for regulatory emphasis. Together these threads form a practical risk map for compliance officers, in‑house counsel, and crypto executives weighing custody models and developer exposure.

The three headline cases to watch

1) Samourai Wallet: criminalizing code or protecting customers?

A public fight erupted when voices in policy circles suggested treating developers of non‑custodial tools as potential criminal actors if their software materially facilitated illicit finance. That framing hit a flashpoint around Samourai Wallet, provoking a coordinated pushback from a Washington think tank and wide swathes of the Bitcoin community who argue that jailing developers for writing non‑custodial software would criminalize legitimate code and set a dangerous precedent. Coverage of this debate highlights the risk to open‑source authors and the chilling effect on privacy‑enhancing tools (Cointelegraph).

Why compliance teams should care: the Samourai episode is not just academic. If prosecutors treat the act of writing or maintaining certain non‑custodial code as criminal, developers and firms that ship privacy features or transaction‑routing code could face legal exposure — even if no centralized custody or fiat movement occurs.

2) The reopened $80M Binance lawsuit: civil liability for custodians

Separately, the civil bar is active. Florida’s appeals court recently allowed a refiled $80M claim against Binance to proceed, underlining that users and plaintiffs will continue to pursue large damages claims against centralized exchanges for losses or alleged misconduct (Cryptopolitan).

Implication for institutional onboarding: centralized custodians and exchanges face mounting exposure to high‑value litigation. Counterparties — especially institutions — will demand stronger legal covenants, clearer indemnities, and independent audits before entrusting assets.

3) Gensler’s stance: BTC occupies a different regulatory posture

SEC Chair Gary Gensler has publicly distinguished Bitcoin from a swathe of other tokens, signaling where enforcement resources may concentrate. While this does not immunize BTC from regulation, it does suggest that tokens with features resembling securities or centralized control will draw sharper scrutiny (Cointribune).

Practical read: regulators are prioritizing activity that looks like securities issuance or centralized intermediation. That increases the likelihood that legal risk for developers and platforms will hinge on how custodial relationships and token models are structured.

How these developments reshape custody models

The combined momentum of criminalization talk, high‑value civil suits, and regulatory focus produces three overlapping pressures on custody design:

- Increased demand for legal clarity: counterparties will push for contracts that explicitly allocate custody risk, dispute resolution clauses, and on‑chain evidence standards.

- Shift toward hybrid custody and enriched attestations: institutions may prefer custody arrangements that combine technical controls (multisig, threshold signatures) with clear legal wrappers (custodial agreements, auditor attestation, insurance riders).

- Avoidance of ambiguous custody semantics: neutral custody (purely non‑custodial key control) will be harder to sell to large institutions without supplemental contractual and operational guardrails.

Concrete custody options to evaluate

Custodial (third‑party) with legal wrapper

- Pros: familiar contract model, clear liability counterpart, insurers know the playbook.

- Cons: centralization and counterparty risk — the Binance suit is a reminder that custody by an exchange is not a legal panacea.

Non‑custodial (client holds keys) with compliance overlays

- Pros: minimizes counterparty loss vectors and preserves decentralization.

- Cons: developer risk increases if the law treats software authors as actors; institutions may balk at KYC/AML or audit requirements.

Hybrid (multisig, delegated signing, legal escrow)

- Pros: balances operational usability and legal clarity; better suited to institutional governance.

- Cons: complexity and coordination costs; requires careful contractual design to allocate custody risk.

Developer risk: from open‑source authors to corporate teams

The Samourai debate crystallizes a new vector of exposure: criminal and civil liability for software that enables peer‑to‑peer value transfer. Compliance teams must think beyond traditional AML/CTF vectors and consider legal defenses for developers.

Key risk areas for developers

- Allegations of facilitation: prosecutors could argue that certain features materially aid illicit transactions.

- Contractual exposure: companies shipping non‑custodial tools may face civil suits from users or regulators.

- Export‑control and sanctions risk: distributing code that aids sanctioned entities can trigger separate enforcement streams.

Mitigations and operational playbook for legal teams

- Maintain documented compliance‑by‑design: design decisions, threat models, and intended use cases should be logged and defensible.

- Require legal review of privacy‑enhancing features, with rationale and risk assessments retained in engineering records.

- Use robust contributor license agreements and code provenance: these limit corporate exposure and clarify roles between volunteer maintainers and corporate sponsors.

- Preserve decentralization evidence: show technical and social decentralization (e.g., multiple maintainers, lack of central control) to blunt “operator” allegations.

- Consider geo‑jurisdictional deployments and legal advice: avoid shipping features that create clear conflicts with local laws in high‑risk jurisdictions.

Institutional onboarding: new expectations

Institutions will recalibrate onboarding checklists in response to the above signals. Expect the following hardening items:

- Stricter counterparty due diligence: legal opinions, SOC‑type audits, AML program documentation, and traceability commitments.

- Insurance and reserve proofs: exchanges and custodians must demonstrate credible insurance and proof of reserves to counter litigation and solvency claims.

- Escrowed operational keys or multi‑party computation (MPC): technical models that give institutions better control and evidence trails.

- Contractual innovation: clear indemnities, dispute resolution forums, and clawback mechanics tied to on‑chain proofs.

Operational checklist for compliance officers

- Map custody risk in contracts: align custody language with operational reality and ensure defaults aren’t ambiguous.

- Insist on periodic and on‑demand attestations: balance transparency with security.

- Require reproducible audit trails for developer changes: code commits, release processes, and deployment logs.

- Build escalation paths: legal, engineering, and public relations must have rehearsed responses to both civil claims and criminal inquiries.

Legal precedent scenarios and what they mean

We can sketch three plausible precedent paths and their implications:

Narrow enforcement (most likely): regulators and courts limit liability to actors who exercise substantial control over funds or who intentionally facilitate crimes. Outcome: custodial intermediaries remain primary enforcement targets; non‑custodial developers retain relative safety but face reputational pressure.

Expanded civil exposure (already visible): courts permit large suits against centralized platforms and their executives (Binance suit indicates this). Outcome: centralized exchanges face heavier litigation costs and insurance premiums; institutions move to hybrids or custody providers with clearer legal buffers.

Criminalization of code (worst‑case for developers): prosecutors successfully argue that writing or operating certain non‑custodial code is criminal. Outcome: chilling effect on open source, talent flight, increased centralization as firms move to legally safer custodial models.

Compliance teams should plan on the first two paths while preparing contingency playbooks for the third.

Recommendations — practical steps today

For compliance officers, legal counsel, and senior executives:

- Reassess custody agreements now: sharpen definitions of custody, control, and liability.

- Harden developer governance: require legal sign‑offs for risky features; keep thorough design records.

- Favor hybrid custody for institutional flows: combine multisig/MPC with explicit legal covenants and insurance.

- Budget for litigation risk: allocate reserves and buy tailored E&O and crime insurance that contemplates crypto‑specific exposures.

- Engage regulators proactively: clarify product models and controls; explain how non‑custodial tools operate in practice — remember Gensler’s emphasis on token characteristics will matter in those dialogues (Cointribune).

Closing view: balance technical freedom with legal reality

The crypto industry sits at a crossroads. Technical architecture and legal accountability are converging in ways that will reshape custody economics and developer incentives. For many traders, Bitcoin remains the primary market bellwether — and regulators’ relative tolerance of BTC versus other tokens is a useful signal — but civil litigation and prosecutorial theory can travel along different tracks.

Companies and teams that want to preserve non‑custodial design principles should document intent, decentralization, and compliance controls. At the same time, institutions onboarding crypto assets should treat custody risk and developer liability as core legal exposures, not peripheral technical details. Platforms and service providers (including those offering installment, earn, or P2P capabilities like Bitlet.app) will need to combine clear contractual frameworks with robust technical attestations to survive the next wave of legal tests.

Sources

- https://cointelegraph.com/news/bitcoin-policy-institute-samourai-pardon?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- https://www.cryptopolitan.com/floridas-court-reopens-80m-lawsuit-binance/

- https://www.cointribune.com/en/gensler-reasserts-bitcoins-unique-standing-as-most-crypto-tokens-face-scrutiny/?utm_source=snapi