Decoding Recent BTC Whale Flows: 580k Withdrawals, SpaceX Move, Coinbase Migrations and What Traders Should Do

Summary

Executive snapshot — what happened and why it matters

In the last stretch of market headlines we saw several large on-chain stories play out at once: an analysis reported roughly 580k BTC withdrawn from exchanges in under a week, a major corporate wallet (SpaceX) moved about $105M in BTC to new addresses, Coinbase disclosed a large fund migration between its own wallets, and macro liquidity events coincided with a day that saw roughly $100B flow into crypto markets. Each of those facts alone is headline-worthy; together they require careful disambiguation.

This piece breaks down what these flows actually tell us about accumulation vs distribution, how to separate custody migrations from real demand, how derivatives metrics should be layered on, and practical positioning rules for different risk profiles. For many traders, Bitcoin remains the market bellwether — so reading its flows correctly is essential.

Parsing the raw on-chain signals: withdrawals, inflows and the liquidity lens

The simplest on-chain metric — net exchange balance — is powerful because exchanges are the primary liquidity pool for immediate selling. When exchange reserves fall, immediate sell-side liquidity is reduced; the same buy order moves price further.

The 580k-BTC figure reported by CryptoPotato is a large aggregate withdrawal signal. At face value, such a rapid drop in centralized exchange reserves is an illiquidity and accumulation signal, because there are fewer BTC available for instant sale on order books [CryptoPotato].

But big on-chain outflows can come from different sources: true long-term cold storage (HODL accumulation), transfers to OTC/third-party custodians, or internal/external custodial migrations. The market effect differs across those categories.

Huge withdrawals vs. inflows — how to read the difference

- Net withdrawals (exchanges -> outside wallets) typically reduce float available for immediate sale, increasing vulnerability to upward moves if buying resumes.

- Net inflows (outside wallets -> exchanges) increase available liquidity and hint at potential selling pressure or preparation for exchange-based buying (e.g., market-making, arbitrage).

Context is everything: if withdrawals are concentrated into newly labeled exchange-custody addresses, the move may be operational. If withdrawals land in long-dormant cold-storage clusters (addresses with long-term holding characteristics), that's clearer accumulation.

Custodial migrations vs genuine accumulation: why the distinction matters

Not every large on-chain move equals buying or selling pressure.

Operational migrations: Companies and exchanges periodically rebalance their internal wallet architecture for security or compliance. Coinbase’s recent disclosed fund migration — described as moving assets from legacy wallets to new ones — is a canonical example of this [CrowdfundInsider]. These are operational noise for market direction if they originate and terminate within the same custodial umbrella.

Corporate custody moves: When an entity like SpaceX moves $105M in BTC to new wallets, the interpretation depends on whether funds moved to self-custody long-term storage or between custodial providers. SpaceX’s move is notable because high-profile corporate custody often signals balance-sheet-level allocation decisions and can be read as accumulation when funds go off-exchange to cold wallets [ZyCrypto].

Retail/whale accumulation: Transfers from exchanges to clusters with no history of spending (or to addresses that later interact with known cold-storage patterns) are more likely true accumulation.

Practical rule: before acting, check whether a movement is an internal migration (same entity), a custody handoff, or a cold-storage transfer. Tools that cluster addresses and tag entities materially reduce false signals.

Whale/institution moves: what SpaceX’s transfer and others imply

High-dollar transfers from corporates or known entities serve multiple functions: signaling to markets, consolidating treasury holdings, or preparing for tax/accounting changes. SpaceX’s move is an example of a corporate treasury allocation shift; whether it’s continued accumulation or a one-off is unclear from a single transaction [ZyCrypto].

Large, repeated withdrawals to long-term cold wallets accompanied by rising off-exchange supply is a stronger cumulative accumulation signal. Watch for these patterns:

- Repeated multi-day net exchange outflows, concentrated to non-custodial address clusters.

- Tagged corporate wallets consistently moving funds to cold storage.

- Time-stamped wallet behavior showing low-frequency withdrawal activity after transfer (indicating intent to hold).

Contrast that with the Coinbase migration: documented internal reorganization is likely neutral for price since it doesn’t change available float on exchanges if assets remain under the same custody umbrella [CrowdfundInsider].

Layering derivatives and funding indicators on top of flows

On-chain flows are a necessary but not sufficient signal. Derivatives markets reveal how traders have positioned around those flows — and whether the market is levered in a way that amplifies moves.

Key metrics to monitor alongside net exchange flows:

- Funding rate (perpetual swaps): A persistently positive funding indicates longs are paying shorts, meaning leveraged bullish bets are active and a squeeze could amplify upside. Conversely, negative funding suggests levered shorts dominate.

- Futures basis / cash-futures spread: A widening positive basis suggests strong spot demand (or institutional ETF-style buying), while a collapsing basis signals reduced demand or heavy selling pressure.

- Open interest (OI): Rising OI concurrent with rising price + net exchange outflows is bullish (new money). Rising OI with falling price can mean leveraged shorts and squeezed longs.

- Options skew and put-call ratios: Heavy call-buying and compressed skew can imply bullish hedging; heavy put demand can be protective accumulation or fear.

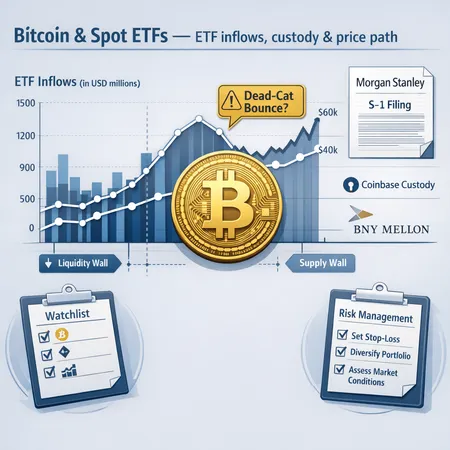

Example: The $100B single-day inflow reported by Finbold suggests fresh fiat/ETF-related buying which, when aligned with exchange outflows, creates a liquidity squeeze scenario — buyers consuming a shrinking pool of sellable BTC and pushing price higher [Finbold]. But if derivatives funding is overheated (high positive funding), a sharp mean reversion or liquidation cascade remains a risk.

Practical signals and risk filters for traders and analysts

Below are concrete rules-of-thumb for converting these flow signals into actionable positioning ideas.

Core metrics to track (real-time)

- Net exchange balance change (24h/7d): look for sustained >30–50k BTC weekly outflows to consider structural accumulation. The 580k figure is unusually large and should be analyzed by breakdown into clusters [CryptoPotato].

- Cluster tagging: separate movements to tagged custodians, corporate wallets, and anonymous/non-spending clusters.

- Funding rate 8–12h average across major perpetuals.

- Futures basis (1–3 month) and change in open interest.

- Spot volume on major venues vs DEXs: rising DEX or OTC activity with falling exchange reserves is stronger accumulation evidence.

Position sizing & risk filters by profile

Conservative (capital preservation): Wait for confirmation across at least two domains — sustained net withdrawals and neutral-to-cool funding + positive but non-exuberant basis. Size small, use cash or spot-only allocations; prefer dollar-cost averaging.

Balanced (swing trader / medium-term): Enter on pullbacks if net exchange outflows continue and funding is flat/neutral. Use partial leverage (if any) with clear stop rules tied to liquidation clusters and a funding-rate threshold (e.g., avoid >0.05%/8h sustained funding).

Aggressive (short-term alpha seeker): Trade directional breaks when net exchange outflows accelerate and open interest lags price (sign of organic spot-buying). Use tight stops and monitor funding; be prepared for violent retracements if on-chain flows reverse or derivative funding spikes.

Filters to avoid false signals

- Discount internal migrations: cross-check on-chain addresses and entity tags (Coinbase’s disclosed migration is a reminder these events occur) [CrowdfundInsider].

- Require alignment: spot flow + derivatives + volume on spot exchanges (or OTC) before assuming a sustained directional move.

- Watch for counterparty concentration: if most outflows go to a single new custodian, that’s different from broad retail cold-storage accumulation.

Scenario mapping: what could happen next

Sustained accumulation scenario — continued large net outflows to cold storage + neutral/positive basis + rising ETF/fiat inflows: higher probability of a multi-week rally as liquidity tightens.

Operational noise scenario — the headline outflows mainly reflect custody migrations (Coinbase-style) and corporate wallet reorganization: short-term volatility but no structural shift in available float.

Liquidity squeeze then snapback — large inflows drive price up into an environment where leveraged longs are crowded (high funding). A sudden derivatives unwind could produce sharp retracements even while long-term on-chain accumulation persists.

Each scenario requires different sizing and stop logic; the common thread is always to combine on-chain flow taxonomy with derivatives posture.

Putting it together: a simple checklist for the next 48–72 hours

- Confirm whether large outflows are to tagged custodians (operational) or cold-storage clusters.

- Monitor funding rate and 24h change; avoid entering aggressive leveraged longs if funding is >0.03%/8h and rising.

- Watch 1–3 month futures basis; if basis >2–4% and OI is rising alongside spot flows, institutional buying is likely real.

- Track spot volume shift from centralized exchanges to OTC/DEX activity — rising OTC+DEX with falling centralized reserves is strong accumulation.

Practical trading note: Bitlet.app users who rely on installment and P2P flows will find these dynamics affect liquidity and slippage — always factor in order-book depth when scaling buys.

Conclusion — flows are signals, not certainties

The recent headlines (580k BTC withdrawn, SpaceX moves, Coinbase migrations, and massive fiat inflows) create a compelling narrative of reduced sell-side liquidity meeting fresh buying. But the market impact depends on the nature of the transfers. Distinguish custodial migrations from genuine cold-storage accumulation, and always read derivatives positioning and volume to avoid being trapped by a liquidity squeeze that later reverts.

For active traders and on-chain analysts, the edge is in classification: tag the flows, check derivatives posture, and only trade when multiple layers align. Keep scenario playbooks and tight risk controls; the market can remain irrational longer than models expect, but a disciplined overlay converts signals into repeatable outcomes.