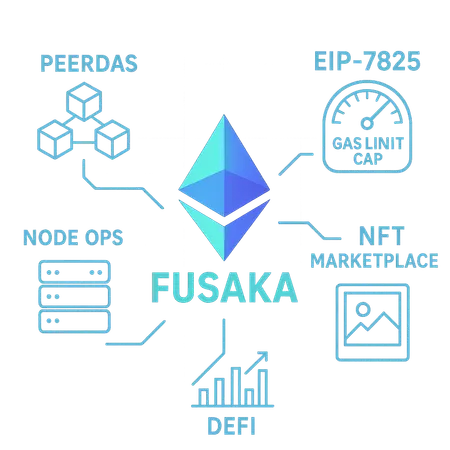

Ethereum Fusaka Hard Fork and EIP‑7825: Technical Explainer for Developers and L2 Architects

Summary

Executive summary

Fusaka (often referenced as Fulu‑Osaka in early documentation) and EIP 7825 together represent one of the most consequential infrastructure changes proposed for Ethereum in the near term. In plain terms: Fusaka brings Peer Data Availability Sampling (PeerDAS) optimizations that reduce the need for every node to download and store every byte of block data, while EIP 7825 changes how transaction gas limits are capped per transaction. Taken together, proponents claim these changes could unlock orders‑of‑magnitude improvements in logical block capacity for rollups and high‑data workloads — but the devil will be in the operational details.

This article explains the mechanics behind the hard fork, how PeerDAS works at a high level, why EIP 7825 could change gas‑market behavior and block capacity, and what teams building NFTs, DeFi and layer‑2s must do to prepare.

What the Fusaka hard fork changes and why PeerDAS matters

Fusaka is a consensus/consensus‑adjacent hard fork that layers in a set of changes designed to optimize data availability, peer sampling, and the client‑to‑client data exchange patterns that limit throughput today. The headline improvement is Peer Data Availability Sampling (PeerDAS) — an approach that lets clients probabilistically verify that data for a block is available without every full node downloading every byte.

PeerDAS — concept and practical effect

At a conceptual level, PeerDAS uses coordinated peer sampling and light sampling proofs so that a node only needs to retrieve random chunks of an erasure‑coded block (or coded data shards) from a diversity of peers to gain confidence the full dataset is available. This probabilistic approach has two practical effects:

- It reduces per‑node bandwidth and storage pressure because nodes no longer need to fetch the full block immediately.

- It enables larger logical payloads to be published on‑chain (useful for rollups and data‑heavy L2 sequencers) because the data availability risk is managed with sampling rather than full replication.

Proponents argue that with robust PeerDAS, block producers can include much larger data blobs without causing every full node to become a bandwidth bottleneck. That’s the origin of the oft‑quoted “100x scaling” phrasing seen in coverage: increasing on‑chain data throughput for rollups and sequencers by orders of magnitude mainly through network and sampling optimizations rather than radical changes to Ethereum’s base‑state model. See a technical overview and the broader context in reporting on the Fusaka fork for additional detail: Fusaka hard fork overview.

Practical constraints and safety nets

PeerDAS relies on a diverse, honest‑peer network and robust sampling parameters. If sampling rates or peer diversity are misconfigured, an attacker might withhold data while still passing lightweight availability checks. That’s why client implementations and network health monitoring are core to realizing benefits safely: you need tuned sample sizes, peer discovery improvements, and fallback paths for full retrieval when suspicion is raised.

EIP 7825: Transaction Gas Limit Cap — mechanics and market effects

EIP 7825 proposes a protocol‑level change to how a single transaction’s gas usage is bounded relative to block and network parameters. In plain language, instead of leaving extreme per‑transaction gas consumption solely to mempool and miner/validator gatekeeping, EIP 7825 sets a clearer cap on transaction gas exposure.

How the cap affects block construction and mempool

There are a few mechanisms through which a per‑tx gas cap can affect behavior:

- Fewer single transactions can dominate an entire block. If a single tx could previously consume most of a block’s gas budget, a cap prevents this, making block capacity more evenly distributable across transactions.

- Validators and block proposers can raise aggregate block gas limits more confidently, knowing that pathological transactions won’t immediately starve the block.

- The priority fee/auction dynamics change: proposers can include more lower‑gas transactions rather than prioritizing a single very high‑gas outlier. This can reduce expected variance in inclusion latency for typical user transactions.

For a practical perspective on market outcomes, consider the NFT market: when per‑tx failures or outlier gas spikes occur, users experience failed mints and sudden cancellations. By capping per‑tx gas, the user experience for many NFT buyers and DeFi users could become more predictable — assuming other pieces (mempool etiquette, sequencer behavior) evolve accordingly.

Possible side‑effects and MEV implications

Capping per‑transaction gas changes the incentives for MEV searchers and block builders. Some MEV strategies rely on single, high‑gas transactions (or bundling) to capture value. A cap could push searchers toward different strategies: more multi‑tx bundles, more off‑chain coordination with sequencers, or different frontrunning patterns. There may also be short‑term shifts in gas price volatility as the market re‑learns equilibrium under the new constraints.

How the combined changes could affect NFT and DeFi UX and fees

When PeerDAS improves data availability handling and EIP 7825 reduces per‑tx gas extremes, the combined system could materially improve user experience in data‑heavy use cases.

- NFT marketplaces and minting drops that rely on large calldata payloads (e.g., metadata batches, lazy‑minting proofs) could push these payloads into L1 blocks with less fear of choking node bandwidth. That could reduce the need for centralized metadata relays and the UX rough edges that come with them.

- DeFi applications that depend on high‑frequency state updates (or on L2 rollups posting large batches) may see lower effective fees per user when throughput increases and per‑tx gas variance decreases.

However, real outcomes are conditional. Recent NFT market metrics show demand and sales are sensitive to fees and UX. For example, reporting on Q2 NFT sales highlights how transactional friction affects volumes; lower on‑chain costs and fewer failed transactions could lift activity meaningfully if marketplaces and L2s coordinate their rollouts (see NFT market context reporting for reference)NFT sales context.

What developers, rollup teams and dApp builders must do next

The technical improvements don’t automatically translate into better UX — they require coordinated engineering and operational changes across clients, sequencers, relayers and marketplaces. Below is a practical checklist broken down by role.

Node operators / client teams (node ops)

- Upgrade clients to Fusaka‑compatible releases before mainnet activation. Test on public and private testnets.

- Enable and tune PeerDAS modules. Validate sampling rates and peer diversity settings in controlled environments.

- Increase monitoring for network‑level metrics: peer churn, sample success/failure rates, anomalous data‑availability alerts, and bandwidth saturation.

- Reassess storage pruning and archival strategies: while PeerDAS reduces immediate fetch needs, full‑data retrieval paths must work reliably for forensic and sync operations.

- Prepare fallback paths for full data retrieval in the event sampling flags missing pieces.

Layer‑2 sequencers and rollup architects

- Revisit batch sizes and posting cadence. With higher logical on‑chain payload capacity you can post larger batches, but test end‑to‑end latency and dispute/workflow timeouts.

- Update sequencer relayers to be PeerDAS‑aware: diversify peers, implement retry logic, and instrument sampling diagnostics.

- Recalculate challenge windows and fraud/proof timelines. If block times or data posting patterns change, game theory around rollup challenges may shift.

- Coordinate mempool and bundle submission logic with L1 client behavior so that per‑tx gas caps (EIP 7825) are respected and fee estimation is accurate.

dApp builders, NFT marketplaces and DeFi teams

- Update gas estimation and fee‑bumping logic to account for per‑tx gas caps and new inclusion dynamics.

- Re‑test UI flows for drops and batch mints under scenarios with higher on‑chain payloads but capped per‑tx gas: you may be able to replace off‑chain metadata hacks with on‑chain payloads.

- Prepare to handle fewer failed transactions but potentially different fee distributions. Update UX signals (estimated confirmation time, expected fee) accordingly.

- Coordinate with L2 partners and sequencers to validate that batch posting will not inadvertently push too many large batches into mempool at once.

Observatory and monitoring recommendations (cross‑cutting)

- Deploy real‑time dashboards for sample pass/fail rates, block gas utilization histograms, and mean/median gas per transaction.

- Track MEV extraction patterns and searcher behavior: expect new strategies to appear and monitor unusual bundle markets.

- Run simulations of large drops and high‑concurrency mints on a testnet with Fusaka+EIP 7825 toggled to observe end‑to‑end failure modes.

Operational playbook: rollout and fallback

- Testnet first: run end‑to‑end tests that include client updates, sequencer posting, and dApp flows.

- Canary upgrade: roll out client upgrades to a subset of validators/node operators and monitor telemetry for 24–72 hours.

- Traffic shaping: sequencers should gradually increase batch sizes while monitoring network health; avoid sudden spikes.

- Emergency revert paths: maintain a plan to revert to conservative posting (smaller batches) if sampling errors rise or peer diversity decreases.

- Communication: coordinate release notes and operational guidance to L2 partners and marketplaces so UX expectations are aligned.

Conclusion — realistic expectations and timing

Fusaka’s PeerDAS and EIP 7825 are promising because they attack two complementary constraints: data availability and per‑tx gas risk. If implemented and operated safely, they could unlock meaningful throughput and improve UX for NFT and DeFi use cases. But these gains are not purely automatic — they depend on careful client implementations, network health, and coordination among rollups, sequencers and dApp teams.

Teams should start with testnet validation, update clients and sequencer logic, and instrument extensive monitoring. The market impact on fees and volumes remains uncertain; recent NFT market trends show how sensitive demand is to fees and UX, so improved throughput could be a meaningful lever to restore activity if applied thoughtfully. For planners and operators curious about the implications to marketplaces and P2P flows, platforms like Bitlet.app will be watching these changes because they touch execution latency and fee predictability across ETH trading and on‑chain services.

Sources

- Fusaka hard fork and PeerDAS overview: This EIP brings 100x scaling to Ethereum — overview of the Fusaka hard fork and PeerDAS optimization

- NFT market context and sales metrics: NFT sales show modest $77M; Ethereum NFT sales drop 13%

For additional context on how on‑chain data availability and gas mechanics affect Layer‑2 optimizations, consult developer docs from your client vendors and rollup frameworks. Also see how broader market indicators (e.g., DeFi activity and comparative trends like Bitcoin) may influence adoption timing and sequencing of upgrades.