Base’s Solana Bridge: Vampire Attack or Pragmatic Interoperability?

Summary

Quick framing: why this debate matters

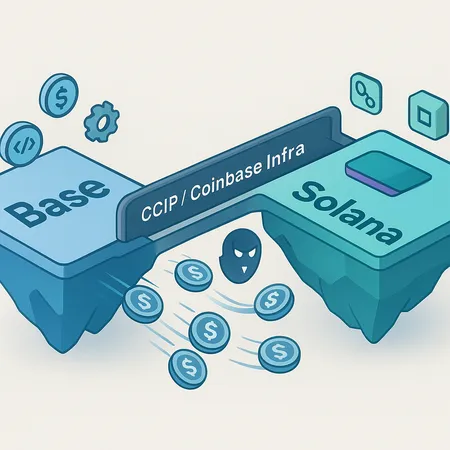

When Base announced a bridge to Solana, the reaction was immediate and polarized. For many Solana builders the worry was familiar: will a better UX and deep pockets from a L2 like Base pull away liquidity — especially stablecoins — and hollow out on‑chain activity? For others, the move looks like pragmatic interoperability: expanding optional rails for users who want to move assets between ecosystems without forcing winners or losers.

This piece unpacks the technical design, the central claims and counterarguments, tangible short‑to‑medium term outcomes for liquidity and stablecoins, and practical guidance for protocol teams weighing multi‑chain strategy.

The technical design at a glance: CCIP, Coinbase infra, and early integrations

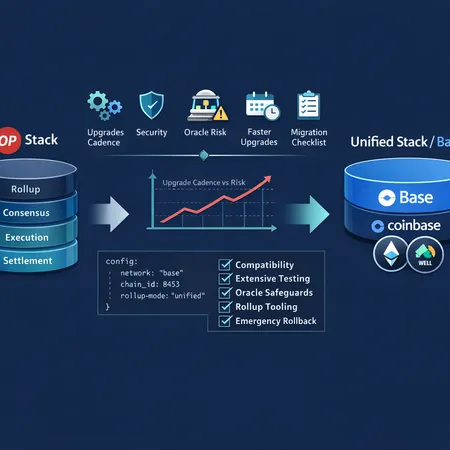

At the center of the conversation is how the bridge is built. Base’s bridge to Solana uses Chainlink CCIP as the cross‑chain messaging layer and leverages Coinbase infrastructure on the custodial/operational side. That combination is notable for a few reasons:

- Chainlink CCIP provides a standardized cross‑chain message and token transfer protocol intended to be blockchain‑agnostic. It’s meant to enable authenticated messages and asset movements without bespoke bridge logic for every pair.

- Coinbase infrastructure — custody, relayers, and off‑chain orchestration — injects an institutional posture: faster integrations, stronger KYC/AML posture for fiat onramps, and the ability to route liquidity through centralized custody when required.

Early integrations that accompanied the launch prioritized stablecoin corridors and some consumer‑facing flows, which explains why stablecoin movement immediately became the focal point. The CryptoSlate explainer lays out this architecture and the early partners and integrations that made the launch visible to the ecosystem (read more on the Base-Solana bridge architecture and early integrations here).

Why the stack matters technically

Using CCIP means the bridge is less about bespoke bridging contracts and more about message integrity and standardized routing. Pairing CCIP with Coinbase rails allows for hybrid custody models: on‑chain settlement combined with off‑chain custody or liquidity provisioning. That hybrid model can produce low‑friction UX — but it also concentrates liquidity in custodial paths, which fuels the ‘vampire’ narrative.

The ‘vampire attack’ claim and the counterarguments

The case for a vampire attack

Solana builders and some community members argue that bridges which make it trivially easy to move stablecoins and liquidity to an L2 create an arbitrage pathway that siphons the most valuable part of an ecosystem: deep, composable stablecoin liquidity. The mechanics are simple in principle:

- Projects and users chase yield and TVL; if an L2 offers more attractive yield, lower fees, or better UX, liquidity shifts.

- Stablecoins are the plumbing for DeFi. When stablecoin supply moves off Solana, lending markets, AMMs, and margin flows can weaken.

- Institutional rails (Coinbase custody) can further centralize where capital is held, reducing on‑chain composability.

This framing is evocative: a vampire doesn’t kill a protocol overnight but bleeds composability and native liquidity away over time, making Solana less attractive for builders who rely on deep on‑chain markets.

The counterargument: interoperability is pragmatic, not predatory

On the other side, proponents point out several mitigating realities:

- Multichain demand is endogenous. Users and developers want the option to route flows where UX and costs are better. Bridges that simplify this are responding to demand rather than orchestrating theft.

- Liquidity can be additive. Easier routing may bring in capital from outside the Solana ecosystem into Solana‑denominated markets (and vice versa). Cross‑chain market‑making strategies can intermediate and increase overall activity.

- Security and standards reduce fragmentation. A CCIP‑based approach can be less risky than a proliferation of bespoke bridges. Standardized messaging and audit practices may raise the bar for secure transfers versus ad‑hoc solutions.

The debate then centers on incentives and implementation: is the bridge designed to capture liquidity by offering incentives and a superior UX, or to connect liquidity in ways that make both chains more useful?

Short‑to‑medium term implications: liquidity, stablecoins, and developer economics

Solana liquidity and composability

In the short term, expect measurable flow of pegged assets out of Solana pockets that prioritize low friction and familiar custodians. That flow will be most acute for users and protocols that:

- Prefer centralized custody or institutional counterparties.

- Need fiat rails or are focused on consumer payments.

However, composability isn’t a simple zero‑sum. Protocols that rely on constant arbitrage or deep on‑chain liquidity might experience tighter spreads and reduced lending depth. But this may also encourage on‑chain liquidity providers to improve yields, introduce deeper incentives, or innovate UX to keep capital native.

Stablecoin supply dynamics

Solana has seen record levels of stablecoin supply tied to growing on‑chain demand; recent reporting highlights how stablecoin issuance and holdings on Solana surged as more use cases matured. That context matters: the bridge’s initial target — stablecoin corridors — directly touches the highest‑utility token class on Solana and therefore the most politically charged asset flows. If significant stablecoin volumes migrate to custody paths tied to Base or Coinbase, on‑chain Solana markets could feel reduced depth for a time.

But several counter‑forces exist: cross‑chain market makers, arbitrage bots, and liquidity mining programs can move capital back to where it’s profitable. The net effect will depend on relative yields, fees, and the UX friction of moving funds back to Solana.

Developer economics and protocol strategy

For protocol teams, the bridge changes the calculus in three ways:

- Distribution decisions become multi‑dimensional. Launch incentives, farming, and airdrops must consider where users are coming from and what custody patterns they prefer.

- Composability trade‑offs grow. If liquidity is fragmented, integrations must coordinate across chains; teams face higher integration and operational costs but potentially larger aggregated audiences.

- Security and compliance matter more. Working with hybrid custody models introduces counterparty risk considerations and compliance pathways that previously native‑only deployments could avoid.

How projects should think about multi‑chain strategy and UX trade‑offs

Be explicit about objectives

Start by asking: are you optimizing for total TVL, active users, on‑chain composability, or revenue capture? Different goals imply different strategies. If composability is core, double down on on‑chain liquidity incentives and tooling. If user acquisition is the priority, prioritize low‑friction bridges and custody options.

Design incentives, not just migrations

If you fear being drained, don’t only block or lament bridges. Offer reasons to stay native: better yields, exclusive primitives, gas‑efficient UX, or composability advantages that can’t be replicated cross‑chain. Time‑restricted liquidity mining and protocol revenue shares are blunt but effective tools.

Prioritize UX while keeping an eye on security

Users will choose the path of least resistance. If Base+CCIP offers a smoother experience, mirror that effort: reduce click‑throughs, simplify bridging UX, and provide clear guidance about security and slippage. At the same time, maintain rigorous audits and clarify the custody model so developers and treasuries can make informed decisions.

Think like a liquidity engineer

Liquidity is fungible but costly to recreate. Build predictable market‑making incentives and multi‑chain strategies. Invest in bridges yourself (or partner with standards like CCIP) so that your protocol can be present wherever users live. This is how teams move from reactive to proactive.

Practical checklist for protocol teams

- Map where your users hold assets today and how they move them.

- Run scenario analyses: what happens if 10–30% of stablecoins migrate off‑chain or to custodial paths?

- Design retention incentives that reward on‑chain interactions, not only TVL snapshots.

- Consider partnering with standardized messaging like CCIP to reduce bespoke bridge risk.

- Communicate clearly to your community about trade‑offs and architecture decisions.

Conclusion: competition, collaboration, or both?

The Base–Solana bridge debate isn’t binary. Elements of both narratives are true: the bridge can pull liquidity in the short term if it offers superior UX and custodial comfort, but standardized interoperability also creates opportunities for new kinds of cross‑chain markets and aggregated liquidity. The real outcome will be shaped more by economic incentives, UX, and how quickly Solana builders adapt than by the existence of the bridge alone.

For infrastructure teams and protocol leads the takeaway is straightforward: treat multi‑chain as product design, liquidity engineering, and risk management at the same time. Bridges like Base’s — built on CCIP and supported by Coinbase rails — change where decisions are made, but they do not eliminate the choices that projects must make about segmentation, incentives, and user experience.

Bitlet.app users and teams evaluating integrations should weigh these trade‑offs practically: interoperability can be a growth lever, but only if you design to capture the right kind of activity.

Sources

- CryptoSlate — In‑depth piece on Base’s Solana bridge, Chainlink CCIP, and Coinbase integrations: Is Base’s Solana bridge a vampire attack on Sol liquidity or multichain pragmatism?

- Crypto‑Economy — Reporting on record stablecoin supply levels on Solana amid growing demand: Solana stablecoin supply hits record levels amid growing demand

For additional context on cross‑chain standards and developer choices, see discussions around Solana and DeFi integrations across ecosystems.