Can the Fusaka Hard Fork Reverse ETH Selling Pressure? Throughput, L2 Fees and Real Demand

Summary

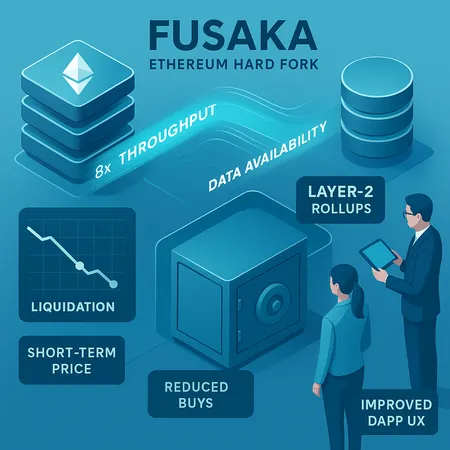

What Fusaka actually changed — a technical baseline

The Fusaka hard fork, which went live recently, focuses on expanding Ethereum’s data availability capacity and improving throughput for rollups and on‑chain dApps. Implementation details indicate a substantial uplift in the amount of data that can be posted on‑chain and a measurable increase in effective throughput for Layer‑2 traffic — estimates from observers put that uplift at up to ~8x versus pre‑Fusaka conditions. This is not merely theoretical: the fork modifies how blocks carry data and optimizes certain data paths so rollups can compress and post calldata more cheaply and at higher rates. For a technical audience, the headline is simple: more DA and throughput reduces the fundamental cost barrier for batch‑posting rollup proofs and large dApp state updates. See reporting that summarizes the upgrade’s DA and throughput improvements for more detail.

The immediate engineering outcome is clear: rollups that rely on on‑chain availability and calldata can price out transactions more cheaply because the marginal on‑chain data cost has dropped. But real economics depends on how that marginal cost reduction is distributed across the stack — sequencers, aggregators, relayers, and the dApps themselves.

Immediate effects on Layer‑2 fees and dApp UX

Lower data availability costs create headroom to reduce Layer‑2 fees, but the pass‑through is not automatic. Practically, three actors determine what users pay: rollup operators (sequencers), application teams, and market competition among L2s. When calldata becomes cheaper, rollups can either lower per‑tx fees, increase throughput without raising fees, or keep fees steady and capture higher revenue per batch. A sensible rollup will try a mix: reduce consumer friction (better UX, lower microfees) to attract volume while preserving some revenue to pay sequencers and fund development.

In the near term, traders and users will notice better UX more than they will see headline‑breaking fee drops. Faster finality and fewer stuck transactions mean higher effective throughput for trading, NFTs, and composable DeFi flows. For front‑running‑sensitive strategies, reduced congestion widens the window for reliable execution. That said, measurable L2 fee declines will depend on competition. If several rollups race to lower fees, users win quickly. If incumbents keep fees steady, UX improves but user savings are deferred.

Why better protocol primitives don’t automatically raise ETH demand

This is the critical market question: does a protocol upgrade that enhances throughput and reduces L2 costs increase ETH demand? The short answer: not directly, at least not at scale and immediately. Real token demand requires either buyers (treasuries, on‑chain projects, institutions), usage that creates token sinks, or speculative flows that reprice expectations.

We have recent on‑chain evidence that challenges the naive upgrade=buy narrative. Reports show Ethereum treasuries bought only about 370,000 ETH in November, a sign that large custodial or corporate demand slowed even as upgrades arrived. That mismatch — improving fundamentals but muted on‑chain treasury accumulation — suggests upgrades alone struggle to overcome macrotailwinds, deleveraging, and profit‑taking. The market has become sophisticated: protocol improvements matter for long‑term value, but short‑term price action follows liquidity, leverage and narrative.

The gap is not new. Infrastructure upgrades reduce friction and can expand long‑term Total Value Locked (TVL) and fees, but they do not by themselves create the immediate, coordinated, non‑speculative buying that pushes price higher. Instead, upgrades are necessary conditions for sustainable growth, not sufficient ones.

Short‑term price and liquidation dynamics after Fusaka

Upgrades often produce two short‑term market patterns. First, an initial speculative bid as traders front‑run adoption and position for improved fundamentals. Second, a pullback when macro or leverage conditions reassert themselves. The Fusaka rollout followed this script: technical celebration was coupled with profit‑taking and liquidation cascades in weak markets. Analysts have asked publicly whether Fusaka can renew ETH momentum after recent price stress and liquidations, and the consensus is cautious — upgrades help, but they don't erase overhangs.

Why do liquidations matter here? Many market participants hedge or lever positions expecting gradual fundamental improvements; when upgrades arrive but broader sentiment remains negative, leveraged longs are vulnerable. Upgrades can reduce future transaction‑cost risk, but they do not rescue positions that are underwater due to prior price declines. Unless upgrades trigger fresh, large buyer flows — from treasuries, institutions, or renewed retail activity — the immediate price impact will likely be modest.

What would it take for Fusaka to translate into renewed bullish momentum?

If you’re a trader or protocol analyst asking what would convert technical wins into market wins, focus on these concrete vectors:

Sustained, measurable user growth. Lower DA must lead to durable increases in daily active users and transaction volume. Short bursts of activity (gasless airdrops, marketing splashes) aren’t enough; the market rewards sticky usage.

Fee capture and token‑economic sinks. Rollups and apps need to create predictable ETH or protocol revenue flows (e.g., fee accrual to stakers, buybacks, protocol fees burned) that materially reduce circulating supply or increase treasury demand.

Treasury and institutional accumulation. The Cryptopolitan data point about low treasury buys in November shows how important coordinated accumulation is. If major custodians, DAOs or corporations return to accumulating ETH — or if treasuries adopt on‑chain buyback policies funded by new revenue — narrative and flows change rapidly.

Improved developer tooling and composability. Lower DA is only useful if developer cycles convert it into products users want. Better tooling reduces time‑to‑market for new L2 features and improves UX, accelerating adoption.

Positive macro and risk‑on environment. Even excellent upgrades struggle to break through when macro liquidity tightens. Low rates or renewed risk appetite turbocharge upgrade narratives into price momentum.

Visible coordination among L2s. If leading rollups explicitly commit to passing savings to users (or at least partially reducing fees), users will migrate and volume will concentrate — a flywheel that markets can price.

Practical takeaways for traders and protocol teams

Traders: Treat Fusaka as a structural improvement that lowers execution risk and reduces long‑term fee expectations. But don’t assume it removes short‑term selling pressure. Look for signals of sustained user growth and institutional accumulation before repositioning aggressively.

Protocol analysts: Measure the flow‑through rate — the share of DA savings that becomes lower consumer fees versus captured revenue. Track active users, sequencer revenue, and whether L2s adjust fee schedules.

Builders and DAOs: Consider capturing part of the uplift via on‑chain revenue mechanisms (partial fee burns, treasury allocations) to convert infrastructure gains into token demand.

Traders using platforms like Bitlet.app should align position sizing with the likelihood that Fusaka’s benefits will materialize over months rather than days. Short windows after upgrades can be noisy.

Conclusion — upgrades matter, but context rules the market

Fusaka is a meaningful technical step: better data availability and higher throughput lower the structural cost of operating rollups and large dApps. The upgrade improves UX and creates room for lower Layer‑2 fees, but whether that becomes demand for ETH depends on economic choices made across the stack and the broader market environment. Recent on‑chain behavior — including the drop in treasury purchases — underscores the uncomfortable truth: protocol wins do not automatically equal immediate price reflation. For Fusaka to catalyze renewed bullish momentum, its technical gains must convert into sustained user growth, revenue capture, and visible accumulation by large buyers, all while macro conditions cooperate.

Sources

- Reporting on Fusaka’s DA and throughput improvements: Fusaka hard fork goes live on Ethereum with massive data availability boost

- On‑chain treasury buy data and market interpretation: Ethereum treasuries bought only 370,000 ETH in November

- Analysis on whether Fusaka can renew momentum after price stress: Can the Fusaka upgrade renew Ethereum’s momentum after recent price hit?

For readers tracking narratives, also watch movement among rollups and daily active addresses on Ethereum and shifts in DeFi fee capture — those metrics will tell you whether Fusaka’s technical advantages are turning into market value.