What Binance’s $1B SAFU-to-Bitcoin Move Means for BTC, Exchanges and Markets

Summary

Executive snapshot

Binance announced and finalized the conversion of a $1 billion SAFU reserve into Bitcoin, a process reported across industry outlets and visible in on‑chain flows. Coverage by Cointelegraph, Crypto.news and The Block confirmed the operation and provided the rough sizing that industry observers have been parsing: the conversion represents roughly 15,000 BTC added to Binance’s treasury. This piece explains how that conversion likely happened, what 15,000 BTC on an exchange balance sheet actually means for floating supply and market behaviour, and the regulatory and risk‑management questions it raises.

Mechanics and timeline: how a $1B SAFU-to-BTC conversion typically occurs

The public reporting indicates Binance moved about $1 billion from its SAFU (Secure Asset Fund for Users) reserve into BTC over a short window. Industry writeups and on‑chain trackers showed a finalization of the conversion rather than a single megatransaction, which matches standard execution strategy:

Pre‑trade planning and OTC sourcing. To reduce on‑chain slippage, exchanges usually source a large portion of BTC through OTC counterparties rather than flooding spot order books. Reports around the move referenced in‑exchange documentation and on‑chain receipts that imply staged execution rather than one block trade (Cointelegraph, Crypto.news).

On‑chain settlement windows. Even with OTC fills, the ultimate custodied BTC appears on Binance addresses across several deposits. The Block’s reporting summarized the final totals and timing, confirming the conversion completed in its reported tranche sizes (The Block).

Bookkeeping and disclosure. Exchanges must register these assets on internal ledgers and — depending on jurisdiction and voluntary transparency efforts — disclose them in public statements or proof‑of‑reserves snapshots. Binance characterized the operation as a SAFU reserve transition into Bitcoin rather than a customer asset shift, which is a crucial distinction for solvency optics.

Taken together, the timeline looks like: planning and sourcing → staged OTC/spot buys → on‑chain settlement → public confirmation. That sequence minimizes price impact while delivering the headline result: a $1B Bitcoin reserve added to the Binance treasury.

Quantifying the effect: 15,000 BTC, floating supply and on‑exchange inventories

At first glance, 15,000 BTC is a headline‑worthy number. Contextualizing it is key:

Percent of total supply. 15,000 BTC is well under 0.1% of Bitcoin’s total mined supply; as a share of the ~19–19.5 million BTC already in circulation it is roughly 0.07–0.08%. Numerically, that’s small against total supply.

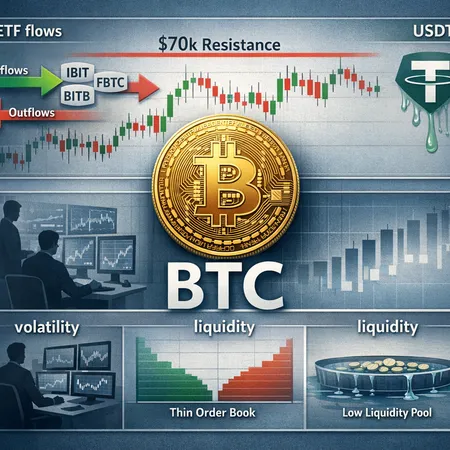

Relative to exchange inventories and daily volumes. The more relevant comparison is to on‑exchange liquid supply and daily spot volumes. Exchanges often hold only a fraction of circulating BTC as immediately withdrawable liquidity. A single exchange adding 15k BTC to its treasury can meaningfully change that exchange’s lendable and borrowable inventory and, therefore, BTC borrowing rates used by short sellers and market makers.

Liquidity and slippage considerations. If those 15k BTC are held long term (off‑market custody) rather than offered into lending or margin pools, the effective float accessible to traders tightens. That can drive tighter spot‑futures basis (if demand outstrips lendable supply) or push borrow rates higher, increasing costs for leveraged shorts.

In short: 15,000 BTC is modest in macro supply terms but can exert outsized influence on exchange‑level liquidity, repo/borrow markets, and short‑term funding dynamics.

Short‑term market reactions vs longer‑term trust and treasury precedents

Short term, the market reaction to the Binance SAFU conversion was muted but constructive. Why?

Muted immediate price reaction. Because the conversion was executed in stages and likely via OTC channels, spot liquidity was not shockingly disturbed. Traders prefer predictable, staged buys to single large market orders — the market appeared to digest the flow without a sustained spike.

Sentiment signal matters more than math. Where the move matters is in the optics: an exchange voluntarily holding BTC as an insurance reserve communicates confidence in Bitcoin as a treasury asset and provides a narrative of alignment with long‑term holders. That can be supportive for ETF demand and passive flows.

Precedents from other exchanges and treasuries. Exchanges and crypto firms (and some corporates) increasingly treat BTC as a treasury asset — a practice that became more visible after major firms started public allocations. The key difference for centralized exchanges is the counterbalancing need to maintain liquid pools for customers while managing solvency perceptions. Whether other exchanges emulate Binance will depend on their business model, regulatory constraints, and whether they can publicly demonstrate segregation of customer assets from exchange treasuries.

Regulatory and risk management implications

Holding volatile crypto on a corporate balance sheet raises distinct regulatory and operational questions.

Custody and insurance

- Custody model. If BTC is held in cold, multisig, or institutional custody, counterparty and operational risks are lower than hot‑wallet holdings. Regulators and auditors will watch where and how those private keys are controlled.

- Insurance scope. SAFU was created to protect users; converting a reserve into BTC moves the protection from stable assets to a volatile asset. That raises questions about the effective level of protection: in a price crash the nominal USD value of the BTC reserve can fall quickly unless hedges are in place.

Solvency optics and proof‑of‑reserves

- Valuation volatility. Holding BTC as a reserve introduces mark‑to‑market swings on reported capital buffers. Exchanges that choose this path need stronger disclosure and stress testing to avoid panic during drawdowns.

- Proof‑of‑reserves and segregation. To maintain trust, exchanges should clearly demonstrate that SAFU or any insurance pool remains segregated from customer custody. Auditable proof‑of‑reserves (with appropriate privacy protections) becomes more important when reserve assets are volatile.

Regulatory signaling

Regulators may interpret the move two ways: prudent treasury diversification or imprudent asset substitution that heightens systemic risk. The answer will depend on the legal framing (is SAFU a corporate reserve or a user protection fund?) and local regulatory expectations around custody, capital adequacy, and disclosures.

Spillovers to ETF flows and derivatives markets

The Binance move has several channels of potential spillover:

ETF flows. A visible exchange treasury allocation to BTC subtly underwrites narratives that Bitcoin remains a credible store‑of‑value for corporate balance sheets. For institutional allocators assessing ETF products, such signals matter; they may nudge marginal flows into ETFs, especially if perceived counterparty risk from exchanges is declining.

Derivatives: basis, funding, and open interest. A reduction in lendable BTC — even if limited to one exchange — can push up borrow rates for shorts and widen the cost of carrying short positions. That affects the perpetual futures funding rate dynamics and can flatten or steepen the spot‑futures basis depending on whether demand for leverage is to the long or short side.

Volatility and implied pricing. Treasury holdings that are explicitly long BTC may reduce available inventory for market‑making desks, increasing short‑term realized and implied volatility if market participants are forced to trade against thinner books.

Practical takeaways for analysts and traders

- Treat exchange treasury moves as structural signals more than immediate macro shocks: they change the supply landscape at the margin and influence counterparty perceptions.

- Monitor on‑chain flows, exchange borrow/lending rates, and proof‑of‑reserves disclosures for early indicators of whether a treasury is held for the long term or being rotated into liquid pools.

- Watch derivatives markets for increasing borrowing costs and shifts in the spot‑futures basis; these are often the fastest channels transmitting the economic effect of reduced lendable inventory.

For many traders, Bitcoin remains the primary bellwether — but exchange treasury strategies now participate in the signal set. Platforms that track exchange balances and lending rates, including services inside the Bitlet.app ecosystem, will continue to be useful barometers.

Conclusion

Binance’s conversion of approximately $1 billion of SAFU into roughly 15,000 BTC is not transformational in absolute supply terms but is meaningful at the exchange level. The mechanics favored staged, low‑slippage execution; the immediate market moved little, but the signal — exchanges treating BTC as a treasury asset — matters for sentiment, borrowing dynamics, and regulatory scrutiny. The long‑term implications depend on transparency, custody rigor, and whether other exchanges follow the playbook. For investors and analysts, the priority is to watch disclosure, proof‑of‑reserves practices, and on‑exchange liquidity metrics — those will determine whether this is a one‑off portfolio choice or the start of a broader structural shift.