Why Tether and Circle Are Minting on Tron and Solana — The Cross‑Chain Stablecoin Surge

Summary

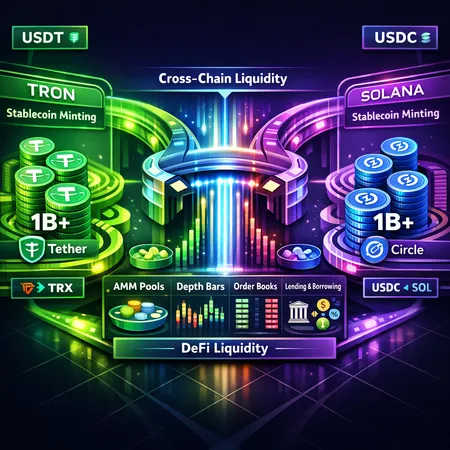

Cross‑chain stablecoin minting: the recent moves and why they matter

Late 2025 and early 2026 brought a renewed wave of cross‑chain stablecoin minting: Tether minted 1 billion USDT on Tron and Circle minted 1 billion USDC on Solana. These are not just headline figures — they represent strategic injections of liquidity into two very different ecosystems. The immediate effect is an increase in available stable capital where traders, automated market makers and lending markets can access it, but the longer story is about chain choice and how it shapes DeFi liquidity structures.

Both announcements were covered in contemporaneous reporting: the Tether/USDT and Circle/USDC mints are documented in press coverage noting a 1B issuance on the named chains (Tether and Circle mints). Meanwhile, analyses of Tron’s positioning help explain why issuers might favor networks like TRON over others in certain cycles (Tron resists bearish trend).

These moves underscore a simple truth: stablecoin minting is no longer a single‑chain affair. Cross‑chain liquidity is now an instrument issuers use to reach users where they already trade and borrow.

Why issuers mint stablecoins on different chains

Stablecoin minting decisions are a mix of technical calculus and commercial strategy. Issuers looking to expand USDT or USDC supply across chains evaluate several variables in tandem.

Technical reasons: fees, throughput, and operational reliability

Networks differ on transaction fees, block times and maximum throughput. Tron historically offers very low per‑tx costs and high throughput for simple transfers — attractive when you want cheap, frequent transfers for arbitrage and AMM rebalancing. Solana provides even higher theoretical throughput and ultra‑low fees for complex DEX activity and NFT ecosystems, though it has had higher operational risk (outages) in the past. For liquidity managers, those fee differentials translate directly into execution cost for rebalance loops, market‑making and bridging. If you are running thin arbitrage strategies, cheaper rails reduce friction and boost returns.

Commercial reasons: partnerships, user bases and rails

Chain choice also reflects business relationships and where end users reside. Circle’s decisions have historically aligned with partners and developer demand; minting USDC on Solana can be driven by institutional or exchange demand to settle large trades or to underwrite Solana‑native DeFi instruments. Tether’s move to mint USDT on Tron reflects both the chain’s strong trading volume in certain regions and Tron’s positioning as a liquidity hub with active DEXes and custodial integrations. Commercially, issuers prioritize where on‑ramps/off‑ramps and exchange custody are easiest to coordinate.

Regulatory and operational angles

Issuance and custody arrangements, KYC expectations and compliance workflows differ by issuer and by chain integration partners. These constraints shape not just where a stablecoin appears, but how much is minted at any given time. Central issuers are increasingly hedging regulatory and operational risk by diversifying supply across multiple chains.

Short‑term DeFi liquidity impacts: AMMs, lending and markets

A billion‑token mint on a given chain is a liquidity event. How that liquidity flows through AMMs, lending markets and bridges determines the short‑term market picture.

AMMs and trading depth

When USDT or USDC lands on a chain, decentralized exchanges see immediate effects: deeper pools, lower slippage, and compressed bid‑ask spreads for stable‑pair trades. For traders, that reduces cost on large trades and increases feasibility of margin and leveraged strategies that rely on low slippage exits. In the short term, active liquidity providers (LPs) will seed pools — some are protocol incentives, others are market makers arbitraging cross‑chain price spreads.

However, liquidity depth is not uniform. If the new supply sits in centralized exchange custody or is concentrated in a few LPs, AMM depth may lag. The net result frequently is a period of liquidity migration and price convergence via arbitrage bots and cross‑chain bridges.

Borrowing markets and interest rates

Lending markets respond mechanically: a surge in stablecoin supply on a chain increases available collateral or borrowable stablecoins, which tends to push borrow rates down. For protocols that support cross‑chain markets, rates will normalize as capital flows where demand is highest. Builders should expect temporary mismatches — for instance, supply could outstrip borrowing demand on Solana for USDC while borrowing demand remains high on Ethereum for the same dollar liquidity, creating arbitrage opportunities for cross‑chain lenders.

Bridging and fragmentation risks

Cross‑chain minting reduces the need for bridges in absolute terms (users can mint directly on the chain they need), but it also fragments liquidity. Bridging remains critical when traders want to move capital between ecosystems quickly. That said, bridges add latency and counterparty and smart contract risk; if liquidity managers over‑rely on bridges to rebalance LP exposure, they expose protocols to slippage and bridge failures.

Tron vs Solana: chain‑level competition and strategic positioning

The twin mints highlight a point of competition: networks are effectively vying to be the preferred stablecoin hub.

Tron’s advantage is straightforward: low fees, large retail trading volume in certain regions, and a DEX ecosystem that moves high stablecoin volume. Coverage of Tron’s relative resilience in bearish periods explains why issuers like Tether may allocate sizeable USDT to Tron to capture that regional and tactical flow (Tron resists the bearish trend).

Solana competes on throughput and composability. For strategies that require high‑frequency DEX swaps, composable on‑chain order flows or large NFT/DEX primitives, USDC on Solana reduces friction. Circle’s mint on Solana signals that issuers see demand for settlement and settlement‑adjacent liquidity in that ecosystem, not just a desire to chase volume.

Both chains also differ in developer tooling, wallet support and institutional integrations — factors that determine how fast minted stablecoins actually get deployed into AMMs and lending protocols rather than sit on exchange custody.

Practical guidance for DeFi builders and liquidity managers

If you’re deciding where to source and deploy stablecoin liquidity, here are concise, actionable considerations.

Match the rail to the use case. If you need low‑cost frequent rebalances and retail flow, USDT on Tron may be optimal. If you need high throughput for composable DEX strategies or programmatic order processing, USDC on Solana could be better.

Measure real execution cost, not just nominal fees. Account for bridge fees, expected slippage, and the time cost of cross‑chain rebalancing. A low fee chain with concentrated liquidity can still produce higher total cost.

Diversify counterparty and chain risk. Keep exposure to both USDT and USDC across multiple chains to reduce dependence on one issuer or rail. This is especially important for market‑making desks that require deterministic uptime.

Monitor on‑chain signals continuously. Track TVL in relevant AMMs, borrow rates in lending markets, and on‑chain transfer flows. Quick shifts in TVL often preface spreads and rate changes.

Design fallback paths. When bridging is necessary, plan alternate routes (multiple bridges, liquidity pools, or centralized rails) and size your positions so you can absorb delays or temporary bridge outages.

Factor regulatory and custodial considerations into capital allocation. Different issuers and chain integrations come with differing compliance postures; your risk appetite should guide the split.

For platform operators and developers building integrations, remember that user preferences can be local — some user cohorts prefer TRX rails while others prefer SOL. Tools like on‑chain routing and multi‑chain treasury management can make the difference between profitable LP strategies and stranded liquidity. Bitlet.app and similar services are part of the evolving toolkit for moving and managing funds across these rails.

What this means for traders, projects and the broader market

In the immediate term, traders gain more on‑chain choices: deeper pools on Tron and Solana reduce slippage for large stablecoin trades. Projects gain alternatives for sourcing stable liquidity without relying entirely on bridge flows from Ethereum. But the architecture of liquidity is getting more complex: cross‑chain liquidity means more places to watch, more operational decisions, and more vectors of risk.

Strategically, expect issuers to continue allocating supply dynamically across chains as demand patterns shift. For DeFi builders and liquidity managers the imperative is to instrument your stacks to respond: automate rebalancing, instrument rate arbitrage, and maintain diversified custody arrangements.

Conclusion

The billion‑token USDT mint on Tron and USDC mint on Solana are more than one‑off events — they are signals that stablecoin issuers are optimizing distribution across chains to meet demand, reduce friction, and capture on‑chain activity. For liquidity managers the decision matrix is technical, commercial and regulatory: choose rails that match your use case, hedge chain and issuer risk, and prioritize operational resilience. As cross‑chain stablecoin supply grows, the market will reward teams that can move fast, measure costs precisely, and manage the subtle trade‑offs between liquidity concentration and distribution.