What WLFI's World Swap and USD1 Stablecoin Mean for Forex, Remittances, and U.S. Policy

Summary

Quick orientation: what WLFI announced

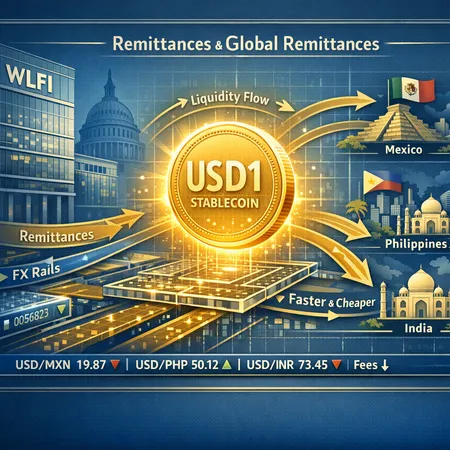

World Liberty Financial (WLFI), a firm described in recent coverage as politically linked to former President Donald Trump, launched a forex and remittance product called World Swap and said it will build a payments rail around a USD‑pegged stablecoin named USD1 (ticker: USD1). Initial reporting frames World Swap as a platform aimed at lowering fees and simplifying remittances while using USD1 as a settlement layer to move value between FX corridors faster than traditional rails (CoinGape and CoinPedia). Reuters summarizes the pitch and highlights the expected regulatory scrutiny in plain terms: lower fees, simplified services, and the political optics of a Trump-linked project entering payments and FX markets (Reuters).

This piece analyzes commercial strategy, likely market impact on cross‑border FX liquidity and fees, competitive dynamics with incumbents and stablecoin rails, and the regulatory — especially AML — questions that will dominate policy reactions.

How the USD1 stablecoin is positioned and why it matters

WLFI’s commercial narrative is straightforward: introduce a USD‑pegged token (USD1) as a common settlement medium to reduce counterparty FX legs, shrink settlement times, and lower fees for remittance corridors. In practice, the value proposition depends on three interlocking elements:

- Trust in the peg and reserves — For USD1 to function as a substitute for on‑chain USD settlement, market participants must trust how the peg is maintained, audited, and redeemed. Centralized stablecoins have always traded off transparency for convenience.

- Liquidity on-ramps/off-ramps — Rapid conversion between fiat and USD1 in major corridors (e.g., USD/MXN, USD/INR, USD/NGN) determines whether USD1 reduces FX spreads or merely adds a new layer.

- Interoperability with FX rails and existing DeFi/CEX infrastructure — USD1 must plug into exchanges, remittance partners, and correspondent banking alternatives to move from niche to mainstream.

If WLFI can deliver deep on- and off-ramps, credible reserve attestations, and partnerships with payouts in local currencies, USD1 could lower settlement frictions. But issuance governance, custody arrangements, and the choice to centralize vs. diversify reserves will define adoption speed. For readers tracking cross‑chain rails, this is a reminder that stablecoin adoption doesn’t happen in isolation — it requires payments partnerships and trust anchors similar to those that helped Bitcoin and other assets find market footholds.

Political and regulatory significance of a Trump-linked firm entering FX and remittances

A few facts change the dynamic beyond a standard fintech launch: WLFI’s public political associations elevate scrutiny. Regulators don’t operate in a vacuum — political optics matter for enforcement priorities, licensing, and interagency coordination. Reuters notes the expected attention from regulators as much as it notes the marketing claims (Reuters).

Why that matters:

- Heightened enforcement probability: A politically connected issuer draws quicker, more public regulatory inquiries. Agencies that might otherwise take a measured approach could act faster to signal impartiality.

- Licensing and KYC expectations: U.S. state and federal licensing regimes — money transmitter licenses, MSB registrations with FinCEN, and potential bank partnerships — will be scrutinized more heavily. Courts and regulators often emphasize public interest when interpreting ambiguous statutory authority.

- Geopolitical spillovers: In corridors where U.S. influence is contested (Latin America, parts of Africa, South Asia), local regulators may treat USD1 differently depending on diplomatic relationships, creating patchwork acceptance.

That combination raises a threshold WLFI must meet. The product will be judged on technical merits, but also on how convincingly WLFI can demonstrate compliance and insulation from illicit use. For policy‑minded investors this is a defining risk factor — regulatory headlines can move perceived counterparty risk faster than technical metrics.

Could USD1 change cross-border FX liquidity and fees?

The core hypothesis WLFI sells is that a widely accepted USD1 reduces the need for multiple FX conversions and correspondent banking fees. There are plausible mechanisms for real impact:

- Fewer on‑chain FX legs: If senders convert local fiat to USD1 locally and receivers redeem USD1 for local fiat, the transaction avoids multiple correspondent bank hops and batching delays that drive remittance fees.

- Near‑instant settlement windows: Blockchain settlement compresses time-based FX risk; that can reduce spreads demanded by liquidity providers.

- Programmability and batching: Stablecoin rails enable automated liquidity routing, rail‑level netting, and automated FX execution — features that incumbents often lack.

But the degree of fee compression depends on scale. Major remittance players achieve low fees through scale and regulatory certainty; a new rail must reach critical mass in pay‑in and payout nodes to materially narrow spreads. Without deep liquidity, USD1 could even widen spreads in thin corridors due to conversion slippage. Also remember that on‑chain settlement reduces some costs but adds custody, smart‑contract, and bridge risk.

Competitive dynamics: incumbents, stablecoin rails, and new rails

World Swap and USD1 compete on multiple axes: price, speed, reach, regulatory safety, and trust. Key competitors include traditional remitters (Western Union, MoneyGram), bank-led rails, and existing stablecoin-powered providers that use USDC, USDT or algorithmic alternatives.

- Incumbent remitters have network reach and regulatory licenses. They can match price via scale but are often slower and more expensive at the long tail of corridors.

- Established stablecoins (USDC, USDT, etc.) already provide rails and on‑ramps via exchanges and payouts, making it hard for USD1 to become the de facto peg unless WLFI offers better liquidity, lower fees, or critical partnerships.

- Niche on‑chain rails and DeFi liquidity providers can offer lower fees in certain corridors but suffer from volatility of counterparties and operational complexity.

A differentiated play for WLFI is vertical integration: combine a user‑facing remittance app, a stablecoin with strong fiat redemption channels, and partnerships with local payout networks. That model echoes winners in payments history. Still, USD1 must avoid the trap of being another proprietary token without open liquidity; interoperability with established exchanges, custodians, and DeFi pools will be essential if WLFI wants USD1 to function as a broad FX rail.

On‑chain compliance and AML considerations

Stablecoins working across borders attract AML/CTF scrutiny. WLFI will need to satisfy multiple obligations:

- Robust KYC and transaction monitoring at on/off ramps, with proof that suspicious patterns are detected and reported.

- Chain analytics and partnership with forensic firms to trace fund flows, tag sanctioned wallets, and provide audit trails to regulators.

- Governance and transparency about reserve composition, custody arrangements and redemption mechanics to reduce sanctions and sanctions‑evasion concerns.

A particular challenge: purely on‑chain monitoring can flag transactions but often lacks contextual beneficiary data that banks provide. WLFI’s compliance model must therefore marry on‑chain telemetry with off‑chain identity and reconciliation systems. That hybrid approach is what regulators increasingly expect from licit stablecoin operators. Practical operational questions — how WLFI will reconcile pooled fiat accounts to on‑chain USD1 issuance or whether it will run segregated custodial flows — will shape both market trust and regulatory outcomes.

Likely market and policy reactions in the U.S. and major corridors

In the United States

- Expect rapid inquiries from FinCEN, state regulators, and possibly congressional oversight hearings given the political link. Transparency and audited reserve attestations will be essential to avoid enforcement escalations. Politicized coverage can drive preemptive caution from banking partners.

In major corridors (Mexico, Philippines, Nigeria, India)

- Local regulators will assess whether USD1 undermines FX controls or faces local licensing hurdles. Nations that rely on remittance inflows will be pragmatic — faster, cheaper remittances are attractive — but central banks will guard monetary sovereignty and AML controls.

Short term market reactions

- Liquidity providers may test USD1 pairs on centralized exchanges and OTC desks to assess slippage and depth. Price discovery will likely be choppy.

Medium term

- If WLFI secures bank partners, audited reserves, and strong payout networks, USD1 could become a niche rail in specific corridors and exert downward pressure on fees. If WLFI struggles to prove compliance or faces political enforcement, the opposite — flight to established stablecoins and traditional rails — is likelier.

Practical signals to watch (what investors and analysts should monitor)

- Reserve attestations and auditor credibility: independent, frequent reports reduce risk.

- Banking and custodian partners: announcement of global fiat corridors and payout partners.

- Licensing milestones: state money transmitter licenses, FinCEN registration, and any foreign remittance licenses.

- On‑chain liquidity metrics: USD1 circulation, DEX/CEX orderbook depth, and on‑chain velocity in target corridors.

- Compliance tooling: named partnerships with analytics forensics firms and transparent KYC workflows.

Conclusion: opportunity wrapped in regulatory risk

WLFI’s World Swap and the USD1 stablecoin present a commercially sensible attempt to reduce remittance costs via a USD‑pegged rail — but the political association amplifies regulatory risk. USD1 could compress FX spreads in corridors where WLFI secures deep on‑ and off‑ramps, transparent reserves, and credible AML controls. Without that, USD1 is more likely to remain a niche experiment that pressures incumbents in a handful of corridors.

For investors and policy watchers the core tradeoff is clear: potential fee and latency gains versus elevated enforcement and reputational risk. Track the hard, verifiable signals — audits, bank partnerships, licensing — rather than marketing claims. And remember that stablecoin adoption is as much about trust and compliance as it is about technology: no rail becomes dominant from protocol merit alone; it needs regulatory legitimacy and liquidity plumbing in each market.

For additional background reading on the initial product framing and expected regulatory attention, see the early coverage by CoinGape, CoinPedia and Reuters cited below. Bitlet.app users and crypto payments observers should watch USD1’s on‑chain metrics and the firm’s compliance disclosures as early indicators of real market impact. Also consider how the move interacts with broader rails and narratives in the crypto payments space, which includes both centralized stablecoins and DeFi rails that continue to evolve.