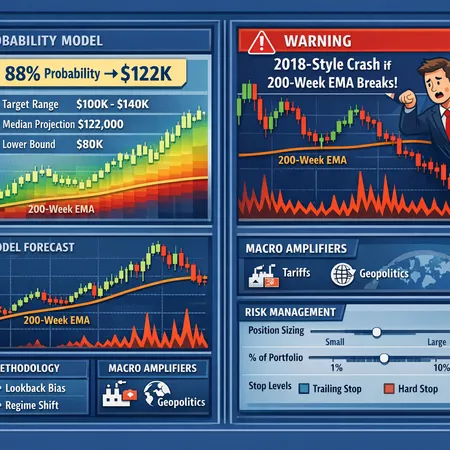

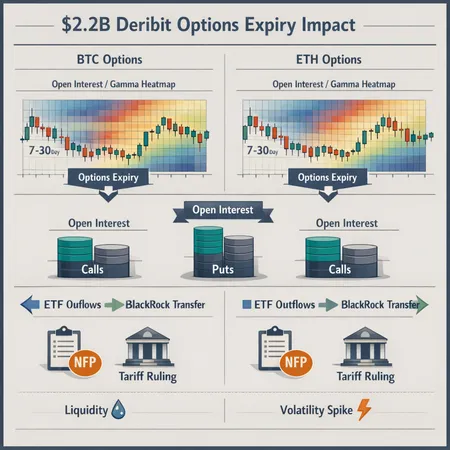

How the $2.2B Deribit Options Expiry and U.S. Macro Risks Are Shaping BTC & ETH Volatility

Summary

Executive snapshot

The $2.2B options expiry on Deribit landed into an unusually low open interest (OI) environment, concentrating gamma exposure and creating asymmetric liquidity risk for BTC and ETH. Add two macro wildcards — U.S. nonfarm payrolls (NFP)/unemployment data and a Supreme Court tariff ruling that could put $133B–$150B of trade at stake — and you get a near-term backdrop where delta-hedging flows, ETF positioning, and outright liquidation risk can all feed on each other. This piece unpacks chronology and OI context, explains why simultaneous macro catalysts magnify gamma and liquidity danger, reviews institutional flow evidence, and gives pragmatic trade and risk-management scenarios for the next 7–30 days.

Chronology of the expiry and open interest context

What happened on expiry day

On the Deribit expiry, roughly $2.2B of BTC and ETH options contracts expired — a sizeable headline figure but important only in context. Reporters flagged that the expiry coincided with historically low open interest and a thin liquidity backdrop, which raises the effective market impact of delta-hedging and pinning dynamics. See the detailed report on the $2.2B expiry and the low OI backdrop for the day here.

Why open interest matters here

Open interest acts as a proxy for the outstanding hedging demand options sellers will generate as they and market makers adjust exposures. When OI is high, delta-hedging flows are dispersed; when OI is low but concentrated around certain strikes, you get local liquidity stress. That concentration increases the chance of price pinning (where spot gravitates to a strike) or of violent intraday moves as delta-hedges get unwound. Add thin futures basis and low exchange depth and the same nominal expiry size produces outsized volatility.

Why simultaneous macro catalysts amplify gamma and liquidity risk

Gamma from options forces market-makers to trade the underlying to remain delta-neutral. Around an expiry, gamma is large and concentrated. Under normal conditions, those hedging flows are absorbed by liquidity providers and systematic liquidity — but that changes when macro events are collocated in time.

When traders expect a major U.S. macro print like NFP or an impactful legal decision (the Supreme Court tariff ruling with $133B–$150B at stake), several things happen at once:

- Risk capacity tightens. Banks and prop desks widen spreads and pull risk limits ahead of macro prints.

- Volatility premia increase; implied vols reprice, adjusting OI and skew.

- Bid-ask depth on spot and perpetuals thins, so delta-hedging trades move markets more.

- ETF managers may pause rebalancing or face redemption flows that force on-exchange execution.

This interaction turns gamma from a smoothing mechanism into an amplifier. A small skew repricing can cascade into futures basis moves, liquidation cascades, and forced delta adjustments — especially when ETF flows are already biased toward outflows.

Institutional position shifts: evidence and implications

Several public data points show institutions were redeploying or reallocating capital in recent sessions — a relevant context for expiry and post-expiry dynamics.

BlackRock reportedly moved roughly $359M in BTC and ETH to Coinbase amid a selloff, a signal of institutional rotation or internal liquidity rebalancing that can presage exchange-side selling pressure as custodians prepare for redemptions or trade execution (Crypto.News).

Spot Bitcoin and Ether ETFs recorded outflows in January, which subtracts a structural buyer at the margin and means liquidity demand can flip during stressed sessions (Cointelegraph).

Macro headlines are stacking: U.S. jobs data looming and court timing created a higher baseline for event-driven trading and headline sensitivity (market wobble under $90K cited in coverage ahead of U.S. jobs) (Coinpaper — jobs; Coinpaper — tariff ruling).

Taken together, these flows reduce the odds of orderly absorbtion of expiry-related hedging trades. For asset managers and desks, that means increased slippage risk, wider realized vols versus implied vols, and potential mark-to-market pain if positions are not proactively managed.

Practical trade and risk-management scenarios

Below are actionable scenarios and recommended mitigations tailored for spot, futures/perp, and options desks. Apply size and timing adjustments to suit firm mandates and risk tolerances.

Spot desks

Scenario A — Short-term liquidity squeeze: If price becomes pinned near a large strike and depth thins, spot desks may face outsized slippage executing large orders.

- Mitigation: Break trades into smaller TWAP slices, widen execution windows, and use limit-only strategies with automated iceberg algorithms.

- Tactical idea: Use small aggressive fills to test depth; if fills degrade rapidly, pause and reprice.

Scenario B — ETF-driven flows: ETF outflows (or redemptions) can compel custodians to place spot sells on exchange.

- Mitigation: Coordinate with prime brokers and custodians to understand expected rebalancing windows; execute over longer windows when possible.

- Tactical idea: If you expect sustained selling, build staged buys at support bands rather than hero orders.

Futures and perpetual desks

Scenario A — Rapid delta squeezes and funding spikes: Delta-hedging from options can push perpetual funding into extreme territory that triggers basis compression.

- Mitigation: Reduce carry positions; tighten liquidation buffers; implement dynamic risk limits tied to funding and open interest metrics.

- Tactical idea: Use calendar spreads to capture expected basis normalization rather than directional leveraged longs.

Scenario B — Crowded leverage unwind: Liquidations can cascade when funding and liquidation engines interact.

- Mitigation: Maintain conservative margin buffers and prefer cross-exchange hedges to reduce single-exchange concentration.

Options desks (market-makers and traders)

Scenario A — Gamma blowout around strike clusters: When OI clusters at discrete strikes, market-makers can face asymmetric losses as realized vol overshoots implied.

- Mitigation: Pre-hedge large short-gamma exposures or roll strikes wider; increase ATM hedging frequency to control gamma exposure.

- Tactical idea: Convert large short-gamma positions into structured risk reversals or buy back short-dated calls/puts and replace with longer-dated hedges.

Scenario B — Vol repricing with skew steepening: Macro risk may steepen put skew as downside protection demand rises.

- Mitigation: Short-dated strangles become riskier; consider buying OTM puts as tail protection and finance them with narrow-call spreads if required.

- Tactical idea: For directional views, use protective collars or small-sized straddles around key macro windows (NFP) rather than naked exposures.

Cross-desk coordination tips: maintain a single source of truth for OI, funding rates, and exchange-level balances. If possible, pause large rebalances 1–2 hours before NFP prints or Supreme Court announcements when risk-off orderbooks are likely thinnest.

Likely market paths over the next 7–30 days (scenarios and probabilities)

No forecast is certain, but framing plausible market paths helps position sizing and hedging.

Scenario 1 — Event-driven volatility spike (40%): NFP surprises or an unexpected tariff ruling outcome triggers a 5–10% move in BTC/ETH within 24–48 hours. Delta-hedging amplifies moves; ETF managers face redemptions leading to secondary selling. This produces elevated realized volatility and possible short-term capitulation. Short-term trade: buy cheap tail protection; reduce levered exposure.

Scenario 2 — Pin and mean-revert (30%): Price pins near a cluster of strikes for several sessions as options decay and flows are absorbed; realized vol is elevated intra-day but closes the week with mean reversion. Short-term trade: gamma scalping if you can hedge intraday; market-makers benefit.

Scenario 3 — Calm repricing and rotation (20%): Macro prints are in line with expectations, and institutional flows stabilize after the expiry; implied vols fall as OI rebuilds. Short-term trade: opportunistic directional positions with tight risk controls.

Scenario 4 — Prolonged risk-off (10%): Tariff ruling materially changes macro outlook, triggering a broader risk-off that drags BTC/ETH lower over weeks. ETF outflows persist and funding sinks, favoring short or hedged positions.

These probabilities are directional. The key is that concentrated gamma + macro events increase the chance of Scenario 1 or 2 versus a benign repricing.

Monitoring checklist: what desks and traders should watch now

- Exchange-level open interest and strike concentration (Deribit/other venues).

- Funding rates and basis across major venues.

- ETF flows and custody inflows/outflows (watch management commentary and custodial movements like the BlackRock transfer to Coinbase for signals) (Crypto.News).

- Implied vs realized volatility term structure; steepening skew indicates rise in downside protection demand.

- U.S. macro calendar: NFP/unemployment print timing and preprint surveys. Market pricing for rate expectations will move vols quickly.

- Legal/macro headlines: updates on the Supreme Court tariff ruling and related market commentary (Coinpaper — tariff ruling).

A compact real-time dashboard combining these metrics reduces reaction time when gamma-driven flows hit thin orderbooks.

Tactical takeaways for intermediate-to-advanced traders

- Respect concentrated gamma: don’t assume headline OI totals tell the whole story — strike-level concentration matters more for intraday liquidity.

- Reduce leverage into macro windows and the immediate post-expiry session if you are net long gamma sellers.

- If you are an options seller, prefer rolled structures and shorter execution windows rather than naked short-dated strangles across major macro prints.

- Use ETFs and custody flow signals as leading indicators of spot pressure. January outflows from spot ETFs are a reminder that structural demand can flip unexpectedly (Cointelegraph).

- Finally, coordinate with counterparties and custodians. Institutional transfers (e.g., BlackRock to Coinbase) can presage exchange-side liquidity moves and should be treated as actionable intelligence, not noise (Crypto.News).

Closing thoughts

The $2.2B Deribit options expiry was more consequential than its headline number implied because of the low open interest backdrop and strike concentration. Layer on top the U.S. NFP/unemployment print and a potentially market-moving Supreme Court tariff ruling, and you have a near-term environment where gamma, liquidity and institutional flows interact to create asymmetric risk. Traders and asset managers should prioritize coordination, downsize or hedge levered exposure into macro windows, and use a concrete monitoring checklist to respond quickly. For desks that need streamlined trade execution or custody coordination under these conditions, platforms like Bitlet.app can be part of a broader operational toolkit, but the onus remains on active risk management and cross-desk communication.

Sources

- Report on the $2.2B Bitcoin & Ethereum options expiry and low OI backdrop: https://coinpedia.org/news/2-2b-bitcoin-ethereum-options-expiry-today-amid-oi-hit-2022-low/

- Markets wobble under $90K as traders await U.S. jobs data: https://coinpaper.com/13637/bitcoin-wobbles-under-90-k-as-u-s-jobs-data-looms-and-weekly-relief-rally-setup-holds?utm_source=snapi

- Supreme Court tariff ruling could put $133B–$150B at stake: https://coinpaper.com/13638/133-b-150-b-at-stake-in-supreme-court-tariff-ruling-bitcoin-braces?utm_source=snapi

- BlackRock moves $359M in BTC/ETH to Coinbase amid selloff: https://crypto.news/blackrock-moves-359m-in-bitcoin-ethereum-to-coinbase-amid-selloff/

- Spot Bitcoin and Ether ETF outflows in January: https://cointelegraph.com/news/bitcoin-ether-etf-outflows-january-2026-pullback?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

For additional deep dives on options analytics and gamma exposure tools, consult exchange-level OI dashboards and options analytics providers that break OI by strike and tenor.