How Spot Bitcoin ETFs and Fed Rate‑Cut Bets Are Driving BTC’s Latest Rebound

Summary

Executive snapshot

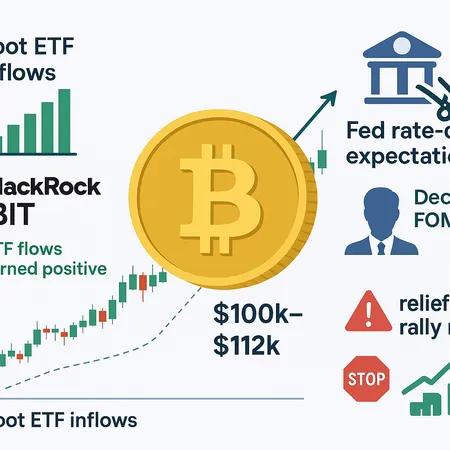

The recent BTC rebound looks different from a typical short squeeze: it combines a clear change in institutional demand via US spot ETFs and a macro backdrop that is increasingly pricing Fed rate cuts. Evidence shows ETF flows have stopped the bleeding and turned positive, while market commentary links rate‑cut bets to a path toward $100k and beyond. Below I unpack the ETF evidence, how flows are interacting with technicals up to $100k–$112k, the role of Fed policy events as catalysts, and practical trade and portfolio rules for intermediate investors and allocators.

ETF flows: the evidence they’ve turned positive and IBIT’s rising role

The clearest near‑term story is flows. After weeks of net outflows, US spot Bitcoin ETFs recently recorded net inflows — the most immediately cited datapoint was a break in a negative streak with roughly $70 million of net buying on the day that signaled renewed appetite. That pivot from outflow to inflow matters because it flips the marginal balance of buyers and sellers in an otherwise thin market for large spot allocations (Bitcoinist).

More than raw dollars, composition matters. BlackRock’s IBIT (iShares Bitcoin Trust) has quickly become a central distribution vehicle: industry reporting shows BlackRock’s spot Bitcoin ETFs are generating material revenue and have become a top business driver relative to some legacy funds, underscoring institutional demand and product placement strength (ZyCrypto). For allocators this is important — strong product-level demand from a firm like BlackRock lowers friction for large, taxable and pension investors to obtain spot exposure.

Why this flips the market: spot ETF inflows are true spot demand, not leverage on derivatives. Sustained, sizable inflows remove available exchange liquidity (coins leave exchanges into custody), tighten the spot basis versus futures, and reduce sell pressure coming from miners or spot holders who were willing to sell into a weak market.

How ETF inflows map into price action and technical targets

Flow events and price moves are rarely one‑to‑one, but the data and mechanics line up: when the outflow streak stopped and flows turned net positive, BTC received a clear catalyst to retest higher levels. Practically, ETF inflows provide base support near recent consolidation zones and make breakouts more probable when combined with favorable macro impulses.

From a technical standpoint, the most direct path is a sequence: reclaim and hold near‑term resistance (the recent local highs), then push toward prior cyclical targets. Several market analysts now model $100k as a key psychological and technical milestone if momentum continues, with extended targets in the $100k–$112k band if the rally gains conviction and macro conditions ease (FXEmpire). These targets are not arbitrary — they reflect measured moves from crack points on weekly charts, Fibonacci extensions off the base, and options market strikes that concentrate liquidity.

A few practical price‑action observations:

- The initial ETF‑driven legs often happen quickly — hours to days — as on‑chain transfers into custody reduce readily available float. Expect sharp moves through thin liquidity bands.

- Confirmation of a sustainable breakout typically requires several days of follow‑through and continuation of weekly inflows. A single spike with a reversion to negative flows is more consistent with a bounce.

- Derivatives activity (futures basis, funding rates and options skew) will reveal whether professional players are leaning into the move or merely trading it intraday; sustained positive basis and rising call‑skew support the $100k+ scenario.

For many traders and allocators, juxtaposing ETF flow data with these technical levels provides a practical framework: treat early gains as a favorable environment for staged accumulation, but demand flow persistence to downgrade the chance of a short‑term relief rally.

Macro catalyst: Fed rate‑cut bets, Powell’s speech and the December FOMC

Macro expectations are the second major pillar. As markets price an eventual Fed easing cycle, two mechanics directly support risk assets including BTC: lower real yields and a weaker dollar. Both reduce the opportunity cost of holding non‑yielding assets like BTC and make carry and risk positions more attractive.

Analysts tying a Fed pivot or even a slower‑for‑longer Federal Reserve to BTC upside point to a path toward $100k as sentiment improves and liquidity searches for yield in non‑cash instruments (FXEmpire). That narrative is fragile, however, and highly event‑dependent. Two events deserve special attention in the near term:

- Powell’s public remarks (recent commentary flagged that his December 1 speech could be a market mover). If Powell signals a hawkish stance, or tempers easing expectations, BTC could see an abrupt re‑pricing (Blockonomi).

- The December FOMC meeting — where the committee’s dot plot and forward guidance will be parsed for timing and magnitude of potential cuts — is the calendar event markets are leaning on to confirm or refute rate‑cut bets.

Put simply: spot ETF demand provides the buyer; macro expectations determine whether buyers are confident to add bigger, longer‑dated exposure. If rate‑cut bets strengthen, expect ETF demand + macro tailwinds to reinforce each other; if the Fed surprises on the hawkish side, ETFs can provide only limited support against a rapid risk‑off move.

Relief rally vs sustained trend reversal: signals and risks

Every rally needs a scoreboard. Here are the primary indicators that separate a relief bounce from a sustained trend reversal:

Lead indicators favoring a sustainable reversal

- Persistent weekly net inflows into spot ETFs over several consecutive weeks (not just a single day).

- Declining spot supply on exchanges and increasing custody inflows to institutional vehicles (IBIT and peers).

- Positive futures basis (contango flipping to backwardation is a red flag; mild contango with increasing open interest can be constructive when real demand arrives).

- Options market behavior: elevated call buying and higher put skews can indicate conviction; sellers willing to write naked calls en masse suggest skepticism.

- Macro confirmation: falling real yields, lower term premium and clear messaging from the Fed that supports eventual easing.

Signals that point to a short relief rally

- ETF inflows that reverse to outflows within days; short‑lived spikes in custody transfers.

- Rising funding rates and rapid influx of retail leverage (a crowded trade becomes a target for liquidations).

- No change or worsening in on‑chain selling pressure: miners or long‑term holders still moving supply to exchanges.

- Hawkish Fed communications or data prints that push rates and the dollar higher.

Risk management note: even with strong ETF demand, BTC is still a high‑beta asset that reacts violently to macro surprises. The presence of large spot ETFs reduces some structural frictions but does not immunize BTC from volatility.

Practical trade and portfolio implications (actionable rules)

For intermediate investors and allocators who want to convert the thesis into execution, here are pragmatic steps and guardrails:

Allocation and sizing

- Start with a target allocation (e.g., 1–5% of investable assets for conservative allocators; larger for more aggressive allocations) and build toward it using staged buys rather than lump sums.

- If you are overweight cash, use a DCA (installment) approach to add exposure across multiple ETF inflow/catalyst calendars — tools like Bitlet.app can automate installment buys for long‑term exposure.

Entry tactics

- Staged entry: split buys across 3–6 tranches sized by conviction (small initial tranche after breakout, larger tranches if weekly inflows continue and derivatives metrics align).

- Use options for defined risk: buying calls to express upside with limited capital or selling put spreads to collect premium if you’re comfortable taking the underlying at a lower price.

Hedging and protection

- Consider protective collars if you hold a concentrated spot position (buy downside protection while monetizing some upside with sold calls).

- Keep a short, liquid hedge (inverse futures or options) sized to limit drawdown during policy shock windows (Powell speech, FOMC). Hedge sizing should be tactical and time‑limited.

Monitoring checklist

- Weekly ETF flow reports: focus on sequence (3+ weeks of inflows) rather than single‑day headlines.

- Exchange balances and custody inflows: are supply trends tightening?

- Futures basis and funding: are pro traders positioning for a sustained move?

- Macro calendar: Fed speakers, CPI/PCE prints and payrolls can flip sentiment quickly.

Exit/trim rules

- Trim into strength: take partial profits at predetermined technical milestones (for example, reduce exposure incrementally as BTC approaches $100k and again toward $112k unless flows and macro remain supportive).

- Rebalance back to target allocations on outsized moves rather than letting exposure drift unchecked.

Decision framework: buy, wait, or hedge?

- Buy more (staged): if weekly ETF inflows persist, custody inflows continue, and macro indicators (falling real yields, softening dollar) align. Use DCA and optionality to keep downside defined.

- Wait (observe): if the move is driven by a single‑day flow reversal with mixed derivatives signals and no macro confirmation.

- Hedge/trim: if Fed speakers or data point to persistent hawkishness or if funding rates surge suggesting crowded leverage.

Closing perspective

The recent BTC rebound is notable because it combines both structural demand (spot ETF flows, with IBIT a clear leader) and a macro narrative (rate‑cut expectations) that can materially change the risk premium for crypto. That combination raises the odds of a more durable advance, but it is not a guarantee: policy surprises and derivative market dynamics can swiftly turn a hopeful rally into a painful mean reversion.

For intermediate investors and allocators the pragmatic approach is clear: recognize the informational value of ETF flows, monitor macro events like Powell’s speeches and the December FOMC, and manage risk with staged allocation, optionality, and clear exit rules. Treat the current environment as an opportunity to scale into a long‑term allocation rather than an excuse for reckless concentration.

Sources

- BlackRock’s spot Bitcoin ETFs becoming a top revenue source

- US Bitcoin spot ETFs broke a multi‑week outflow streak (~$70M)

- Analysis linking Fed rate‑cut bets to improved BTC sentiment toward $100k

- Powell’s December 1 speech could determine the next Bitcoin move

For broader context on market structure and to follow ongoing ETF flow updates and derivatives signals, readers can also look to primary data platforms and exchange flow trackers. For those considering a staged buy plan, installment services like Bitlet.app can simplify execution while you monitor the macro and ETF flow tape.

For more on the broader ecosystem, remember that Bitcoin often sets the market tone and that rotating liquidity to broader DeFi narratives can follow if the BTC uptrend proves durable.