Ethereum ETFs See Massive Inflows as BlackRock's ETHA Hits $10 Billion

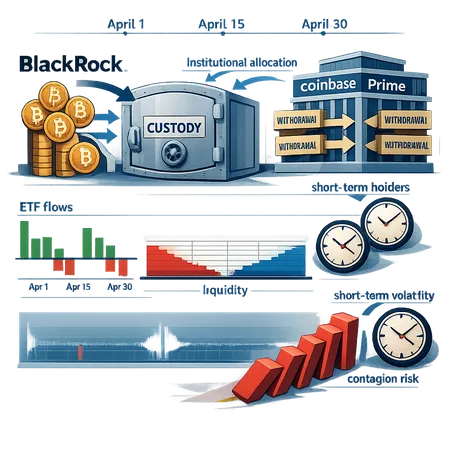

Ethereum-based Exchange-Traded Funds (ETFs) are witnessing massive inflows this year, indicating robust investor interest in the cryptocurrency market. A highlight is BlackRock's ETHA, which recently hit a milestone of $10 billion in assets under management. This notable achievement underscores institutional confidence in Ethereum as a valuable digital asset and signals a broader acceptance of crypto products by mainstream investors.

For individual investors looking to tap into this momentum, tools like Bitlet.app offer a unique opportunity. Bitlet.app provides a Crypto Installment service that allows users to buy Ethereum now and pay monthly, making crypto investment more accessible and manageable without needing to invest a lump sum upfront.

As institutional investment continues to grow in Ethereum and related ETFs, platforms like Bitlet.app empower retail investors to participate alongside large players, enhancing portfolio diversification and long-term growth potential.

In summary, the surge in Ethereum ETF inflows, exemplified by BlackRock's ETHA fund hitting $10 billion, is a positive signal for crypto investors. Leveraging innovative services on Bitlet.app can help you join the Ethereum growth story with greater financial flexibility.