What BlackRock’s Coinbase Prime BTC Withdrawals Reveal About Institutional Behavior

Summary

Executive snapshot

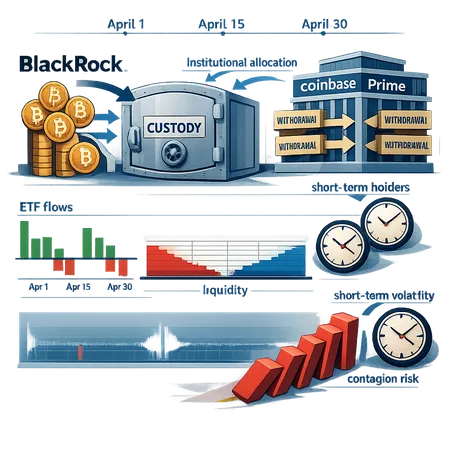

BlackRock’s recent movements of BTC out of Coinbase Prime during a brief price pullback forced a simple but important question: did the world’s largest asset manager sell into the dip or merely reallocate custody? The answer matters because large custodial transfers can look like sell pressure on-chain even when they aren’t, and they interact with other institutional channels—ETF flows, public-company holdings, and short-term retail behavior—to shape real liquidity and price impact. For many active observers, Bitcoin is no longer just a retail market; it’s a layered institutional plumbing problem with real trading consequences.

What were the Coinbase Prime withdrawals? The facts and timeline

In mid‑January, on‑chain observers and market reports showed a tranche of BTC leaving a Coinbase Prime account associated with BlackRock. News pieces documented both the movement and the subsequent market chatter—some framed it as a potential sell signal, others as custody reshuffling. TokenPost confirmed that BlackRock moved a portion of its BTC holdings from Coinbase Prime, and CoinGape reported multiple withdrawals as BTC slipped in price toward lower levels.

The important timeline elements are:

- Accumulation context: publicly available data and reporting show BlackRock has been accumulating or allocating to BTC via different channels across months; this withdrawal didn’t occur in isolation from earlier inflows.

- The withdrawal coincided with a short-term price pullback, which caused onlookers to speculate the movement was a sale.

- Subsequent reporting and lack of a large immediate market dump suggest the move may have been custodial (internal ledger updates, cross‑custody transfers) rather than a simple market sell.

Understanding that sequence—accumulation, then a custody move during a dip—helps separate narrative from likely market mechanics.

How ongoing accumulation and ETFs change the demand picture

Institutional demand for BTC today isn’t a single pipeline. It’s at least three things at once: direct institutional accumulation (treasury buys), broker‑dealer custody flows (Coinbase Prime, other custodians), and ETFs that aggregate retail/institutional demand into NAV changes and creation/redemption activity. Analysts have argued that ETF flows and structural signals are now central to decoding on‑chain demand—these flows can either soak up supply or exacerbate a shortage depending on net direction and timeliness.

Two implications follow:

- ETFs smooth some demand via authorized participant (AP) mechanics, but they also add a speed layer. Large redemptions require APs to source BTC quickly, which can push APs to market and affect spot liquidity.

- Public companies and direct institutional allocations (outside ETFs) create concentrated pools of supply that rarely trade, but when they rebalance they can do so in lumps. Blockonomi highlights why some institutions still prefer gold over Bitcoin—diversification and regulatory comfort—illustrating that institutional allocation is heterogeneous, not monolithic.

For asset managers, this means that apparent supply/demand numbers (exchange balances, ETF inflows) must be interpreted together: an inflow into an ETF might coincide with an institution shifting custody off-exchange, leaving visible exchange balances unchanged while liquidity in the order book tightens.

Exchange liquidity and short‑term holder behavior: a fragile overlay

On-chain indicators showed short-term holders moving BTC to exchanges during the rally, a classic sign of potential near‑term selling pressure. NewsBTC’s reporting of short-term holders transferring coins to exchanges is a timely reminder: when short-term holders flow into exchanges at scale, they create a stock of supply available to meet demand—or to fuel a cascade if market prices trigger stop-losses and margin calls.

At the same time, custodial withdrawals by large institutions reduce the free float available on major exchanges. Even if custodial transfers aren’t sales, they matter because:

- They tighten visible liquidity: fewer BTC on order books means wider spreads and more slippage for large market orders.

- They concentrate risk: if institutions keep large sums with a few custodians and then rebalance or reallocate simultaneously, poor liquidity can amplify price moves.

These two dynamics—short-term holders bringing supply to exchanges and institutions removing custody—can coexist and create local liquidity imbalances that look dramatic from a trading perspective.

Scenarios for price impact and contagion risk

Below are realistic scenarios to help frame trading and risk decisions. Each assumes similar market starting conditions—thin liquidity compared with the size of potential institutional flow—and differs by the direction and timing of institutional rebalancing relative to retail behavior and ETF mechanics.

Scenario A — Custodial shuffle, minimal market impact

- What happens: BlackRock (or another institution) transfers BTC between custodians or from a broker‑custody account to an insured vault without selling. ETF flows are net neutral.

- Market effect: Limited. On‑chain transfer looks large but liquidity isn’t hit because the coins don’t hit exchange order books. Spreads remain stable.

- Risk: Misinterpretation by algos and retail leads to short‑term volatility, but no structural move.

Scenario B — Coordinated rebalancing with ETF redemptions (moderate impact)

- What happens: An institution decides to reduce exposure; at the same time ETFs see redemptions or APs source BTC into the market to satisfy redemptions inefficiently.

- Market effect: Visible selling pressure; order‑book depth thins, spreads widen, and slippage increases for large taker orders.

- Risk: Margin liquidations among leveraged long positions amplify the move, producing a multi‑percent drawdown within hours.

Scenario C — Contagion: simultaneous institutional liquidations (high impact)

- What happens: Multiple large actors (treasury sales, ETF APs, and a fund manager) rebalance near-simultaneously while short-term holders are already placing sell pressure by moving coins to exchanges.

- Market effect: Severe price dislocation. Price gaps, cascading liquidations, and cross‑asset correlation spikes (crypto risk-off) occur. Hedging desks struggle to source liquidity at reasonable prices.

- Risk: Contagion into altcoins, DeFi funding markets, and correlated risk premia. If credit lines or prime brokers tighten, the sell pressure could feed back into traditional markets.

Which scenario is most likely? Right now, Scenario A is plausible given reporting that BlackRock’s move may be custody related, but the presence of exchange inflows from short-term holders raises the tail risk for B or C—especially if ETF AP behavior or public-company decisions coincide with these moves.

Market‑microstructure signals to monitor (actionable)

For crypto asset managers and advanced traders, watching a handful of metrics will separate noise from actionable preconditions for larger moves:

- Exchange balances by venue and custodial concentration: sudden withdrawals from Coinbase Prime reduce the backstop for liquidity on Coinbase-derived order books.

- ETF real-time flow data and AP activity: net creations vs redemptions and the latency of APs sourcing BTC from the spot market.

- Short-term holder flows and age-band movement: increased transfers from short-term cohorts to exchanges are a warning sign (see NewsBTC coverage for recent examples).

- Order‑book depth and spread on major venues for large block sizes: slippage estimates should be stress-tested against potential institutional order sizes.

- Funding rates, perp basis, and option skews: sharp moves in these instruments can precede or confirm liquidity stress.

Bitlet.app users and desk traders should pair these on‑chain and market signals with counterparty checks—are custodians reachable, are APs pricing spreads realistically—and keep hedges ready (options, inverse ETFs, or dynamic delta hedges).

Practical hedges and execution tactics

If you suspect an elevated risk of institutional rebalancing, consider:

- Staggered execution: slice orders using algos that minimize market impact and monitor slippage-adjusted realized prices.

- Option structures: buying put protection or collars to cap tail risk while retaining upside exposure.

- Cross‑venue sourcing: work liquidity across OTC desks and multiple exchanges to avoid concentrated slippage on one venue.

- Temporary reductions in position sizing: reduce aggressive levered exposure when exchange balances fall and short-term holder supply grows.

Each tactic has cost—hedges eat returns and OTC sourcing requires relationships—but they are preferable to being forced to liquidate at distressed prices.

Final takeaways

BlackRock’s Coinbase Prime withdrawals were a reminder that visible on‑chain flows are ambiguous: large transfers can be custody operations, operational reallocations, or bona fide sales. Institutional allocation to BTC is now a multiplex of direct holdings, ETF mechanics, and public-company treasuries—each with different liquidity signatures.

For traders and asset managers the practical implication is this: don’t treat on‑chain transfers in isolation. Combine custody flow monitoring with ETF flow data, short‑term holder movement, order‑book liquidity, and derivatives skews to infer the true supply/demand elasticity. When those signals align—especially with concentrated custodial moves—the market’s ability to absorb large trades diminishes and the risk of contagious price moves rises.

The institutionalization of BTC has improved market depth in many ways, but it also introduced new plumbing risks. Read those pipes carefully and plan execution accordingly.

Sources

- CoinGape — BlackRock makes multiple BTC withdrawals as Bitcoin price slips: https://coingape.com/blackrock-makes-multiple-btc-withdrawals-as-bitcoin-price-slips-to-95k-is-a-sell-off-coming/

- TokenPost — Confirmation that BlackRock moved a portion of its Bitcoin holdings from Coinbase Prime: https://www.tokenpost.com/news/business/18342

- Crypto‑Economy — Analysts: ETF flows and structural signals central to Bitcoin demand: https://crypto-economy.com/bitcoin-narratives-analysts-are-watching-beyond-price-action/

- NewsBTC — Short‑term holders moving BTC to exchanges during the rally: https://www.newsbtc.com/news/bitcoin/bitcoin-price-to-100k-eyes-are-on-short-term-holders/

- Blockonomi — Why institutional investors choose gold over Bitcoin in current market: https://blockonomi.com/why-institutional-investors-choose-gold-over-bitcoin-in-current-market/

(Reference mention: Bitlet.app for platform context.)