How Babylon’s Trustless Vaults Could Rewire Bitcoin DeFi Liquidity and Institutional Flows

Summary

Why Babylon’s trustless vaults matter now

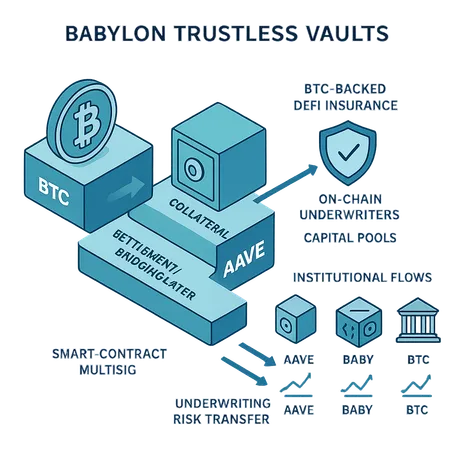

Babylon’s plan to add native Bitcoin‑backed lending via Aave — and to follow with BTC‑backed DeFi insurance — is notable because it attempts to close a long‑standing gap: moving large amounts of BTC into permissionless lending markets without relying on centralized custodians. The initial announcement frames this as a liquidity and risk‑transfer innovation that could energize both retail and institutional flows (Coindesk announcement).

For many traders and builders, Bitcoin remains the primary market bellwether. At the same time, growing institutional infrastructure — from new pricing and vol indices to Bitcoin‑denominated funds and mainstream bank allocations — makes on‑chain institutional flows more tractable, but also more demanding in terms of custody, auditability and capital efficiency (CME indices; 3iQ fund launch; Bank of America allocation story).

This article unpacks the technical mechanics of Babylon’s approach, the economics and risks of BTC‑backed DeFi insurance, the implications for Aave (and tokens AAVE and BABY), interactions with institutional adoption, and practical next steps for DeFi builders and institutional allocators.

How the trustless vault + Aave integration works (technical mechanics)

Native BTC as collateral on Aave: core design choices

At a high level, Babylon’s trustless vaults aim to let BTC holders deposit coins in a trust‑minimized construct that issues on‑chain collateral usable inside Aave. There are a few approaches the industry has used to bring BTC on‑chain; Babylon’s “trustless” language indicates an attempt to avoid a single custodial federation and instead rely on cryptographic proofs, multi‑party computation (MPC) or federated vaults with strong slashing/governance backstops.

Practically this means BTC deposited into a vault will result in an ERC‑20 representation (call it an on‑chain BTC token) that Aave will accept as collateral. Aave will then treat that token like other collateralized assets: assign a collateral factor, configure liquidation thresholds and supply/borrow caps, and integrate it with existing lending pools and rate strategies. Builders should expect Babylon and Aave to coordinate on oracle feeds (price and vol), collateralization parameters and liquidation paths.

Bridging and settlement: trade‑offs and failure modes

Bringing BTC on‑chain introduces two dominant trade‑offs:

- Settlement finality vs. speed: native Bitcoin has slower finality than many EVM chains and is exposed to reorg risk. Trustless vault designs must choose how many confirmations constitute finality for minting/burning on the destination chain — more confirmations lower reorg risk but increase time‑to‑liquidity.

- Trust assumptions: designs vary from fully SPV/proof‑based systems to MPC federations. Each choice affects custodial risk, recovery options and regulatory surface area.

Operationally, these dynamics affect Aave’s liquidation mechanics and oracle cadence. For example, if minting on Aave has a delay while BTC confirm, liquidity providers could be exposed to interim price moves. Babylon will need robust oracle attacks and MEV mitigations, and Aave will need to calibrate parameters like LTV and liquidation incentives for the new asset.

Oracles and institutional pricing

Institutions require high‑quality pricing and model inputs. The emergence of formalized indices and vol surfaces from venues like CME makes it easier to tie on‑chain assets to institutional benchmarks, reducing basis risk when moving between off‑chain and on‑chain instruments (CME indices). Expect Babylon and Aave to rely on diversified oracle stacks combining on‑chain data, centralized price feeds and institutional indices to minimize manipulation risk.

BTC‑backed DeFi insurance: economics, underwriting and risks

Babylon’s stated intention to layer BTC‑backed DeFi insurance is the second, economy‑shifting leg of this project. If executed well, it closes the loop for institutions: native BTC collateral + on‑chain hedging/insurance = a fuller risk suite.

Who underwrites, and capital efficiency

DeFi insurance models fall into three broad categories:

- Pool underwriting (community capital provided to cover claims);

- Tokenized / parametric products where claims trigger automatically when on‑chain conditions are met;

- Institutional third‑party capital that provides reinsurance or wraps on‑chain policies.

BTC‑backed insurance can be capital efficient versus traditional insurance only if risk is accurately priced and diversified. Parametric triggers (e.g., collateral insolvency events, oracle divergence) reduce claims friction but require ironclad oracle integrity. Institutional capital providers — reinsurers, hedge funds or dedicated insurance syndicates — can improve capacity, but they will demand measurable returns and legal clarity.

Moral hazard and correlated exposures

Insurance creates moral hazard: borrowers might take on riskier positions because losses are insured. In a BTC‑backed insurance market this could lead to correlated defaults during severe BTC drawdowns. Mitigations include:

- Staggered coverage (time‑decay and attachment points),

- Reinsurance layers and capital‑at‑risk for underwriters, and

- On‑chain slashing or governance‑based penalties for manipulative behavior.

Designing parametric triggers that don’t open false claims during oracle outages or cross‑chain latency will be essential. Babylon’s approach should prioritize transparency in claims modelling and a multi‑tier underwriting stack.

What this means for Aave: composability, TVL and tokenomics

Composability and TVL dynamics

Integrating a native BTC asset into Aave expands composability immediately. BTC collateral can be used to borrow stablecoins, provide liquidity in AMMs, or be rehypothecated into structured products. That composability can drive meaningful TVL inflows — both from retail BTC holders seeking yield and from institutions looking to access borrowed USD without selling BTC.

However, rapid TVL growth brings concentration risk. A large percentage of Aave’s TVL in a small set of BTC vaults could amplify systemic liquidation cascades if BTC price moves quickly. Aave governance will likely impose supply/borrow caps and conservative collateral factors initially to manage this.

Tokenomics: AAVE and BABY implications

A more BTC‑centric Aave increases fee revenue potential (borrow interest, liquidation fees), which is positive for protocol tokenomics. For BABY, Babylon’s native token, there are layered effects: increased utility and demand for vault governance/staking could propel BABY usage, while token holders might be required to provide insurance capital or governance votes.

AAVE holders should watch for changes in protocol fee accrual, safety module sizing and insurance treasury dynamics. If Babylon’s vaults enlarge Aave’s revenue base materially, this could be reflected in governance decisions about fee splits, reserve factors and safety module incentives.

Interaction with institutional adoption and custody standards

Institutional appetite for BTC yield is growing: from dedicated funds like 3iQ’s new Bitcoin‑denominated offering to mainstream banks testing allocations (3iQ launch; Bank of America allocation). At the same time, institutions require custody, audit trails and risk models that stand up to fiduciary scrutiny.

Babylon’s trustless model weakens the single‑custodian argument by reducing counterparty custody risk, but institutional buyers will still want legal assurances, proof of reserve transparency, and integration with preferred custody stacks. CME‑style indices and pricing make hedge accounting and valuation easier, which further helps institutions reconcile on‑chain positions with off‑chain reporting (CME indices).

Practical institutional considerations include:

- Auditability: on‑chain proofs and third‑party attestations for vaults;

- Insurance capacity: can on‑chain insurance scale to absorb institutional-sized losses?;

- Regulatory and tax clarity: cross‑border custody and insurance structures remain uncertain.

Practical takeaways for builders and allocators

For DeFi builders (intermediate to advanced)

- Design oracles for redundancy: combine on‑chain moves, CEX feeds and institutional indices to reduce manipulation risk.

- Build liquidation paths that account for Bitcoin settlement latency; consider multi‑step liquidations and auction windows.

- Isolate risk: use per‑vault caps, per‑borrower limits and concentrated collateral pools to avoid single‑point TVL concentration.

- Make insurance capital transparent and layered: parametric first‑loss pools with institutional reinsurance provide scalability and governance clarity.

For institutional allocators and treasury teams

- Do operational due diligence on vault mechanics: confirmation thresholds, redemption lags and governance recourse.

- Model correlated tail risk: insured losses during a BTC crash may be larger than naive VaR shows; stress test for oracle failure and liquidity crunches.

- Evaluate custody + insurance stack as a package: trustless vaults reduce custodial risk but do not eliminate execution, counterparty or regulatory risk.

- Consider staged exposure: pilot allocations, use of wrapped‑BTC liquidity, and buying protection (if available) in early windows.

Conclusion: a connective tissue for Bitcoin DeFi — with caveats

Babylon’s trustless vaults and BTC‑backed DeFi insurance represent a pragmatic attempt to bring BTC into the permissionless liquidity economy while offering on‑chain risk transfer. If the project nails oracle design, settlement rules and layered insurance capital, it can materially deepen on‑chain BTC liquidity and attract institutional flows looking for yield and composability. But the gains come with new operational, concentration and moral‑hazard challenges that Aave, Babylon and market participants must jointly manage.

For builders and allocators eyeing this shift: treat the integration as infrastructure, not just a product launch. Audit the settlement assumptions, understand insurance attachment points, and prepare for governance coordination across protocols. The technical plumbing that enables native BTC lending is one part of the story — sustainable risk transfer and institutional confidence are the other.

Bitlet.app users and teams building yield or borrowing strategies should track governance proposals from both Babylon and Aave closely, and factor in oracle resiliency and insurance capacity when designing production systems.

Sources

- Babylon’s trustless vault announcement and roadmap: https://www.coindesk.com/business/2025/12/02/babylon-s-trustless-vaults-to-add-native-bitcoin-backed-lending-through-aave

- CME indices and institutional pricing tools: https://crypto.news/cme-unveils-bitcoin-ether-solana-xrp-pricing-and-vol-indices/

- 3iQ’s $100M Bitcoin‑denominated fund example: https://cointelegraph.com/news/further-3iq-launch-100m-bitcoin-denominated-crypto-fund?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Bank of America allocation signal for Bitcoin exposure: https://bitcoinist.com/bank-of-america-opens-bitcoin-4-crypto-allocation/