Aave Roadmap 2026: What SEC Clearance Means for DeFi, RWAs, v4 and a Consumer App

Summary

Executive snapshot

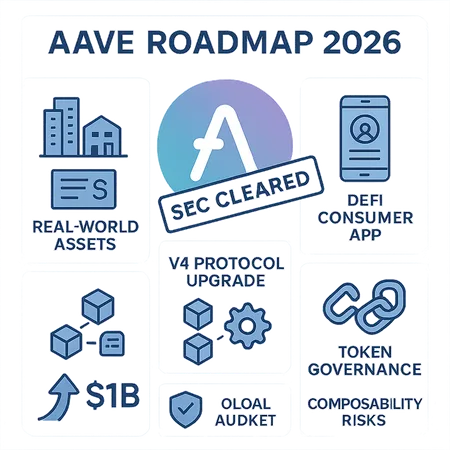

Aave’s recent regulatory development and public roadmap have the potential to reshape DeFi’s growth trajectory. With the SEC ending its four‑year probe into Aave, the protocol has signalled an intent to scale aggressively toward a $1 billion DeFi target through a 2026 program focused on real‑world assets (RWA), a technical v4 upgrade, and a consumer‑facing mobile app. For DAO governors, builders and sophisticated investors this is both an opportunity and a design problem: how to convert regulatory breathing room into durable, secure capital flows without sacrificing the composability and decentralisation that made DeFi powerful.

Why SEC clearance matters beyond headlines

When a major regulator winds down a probe, the effect is not binary lawful/illegal—it's mostly about signal. The SEC’s closure of its investigation into Aave is best read as a reduction of immediate regulatory overhang, which: 1) lowers short‑term legal tail risk for public initiatives, 2) improves counterparty confidence among institutional entrants, and 3) loosens a choke point that had constrained roadmap disclosure and fundraising.

That signal is outlined in reporting on the probe’s end and its implications for Aave’s next steps (see coverage of the SEC ending the probe). In practice, clearance does not grant immunity: other regulators, civil suits or future enforcement priorities could still affect outcomes. But the cleared status materially changes market psychology—allocations that were previously discounted for regulatory uncertainty may be re‑priced.

For the broader DeFi ecosystem, the precedent is meaningful. A visible, well‑capitalised protocol advancing a public roadmap after an SEC pause nudges tradfi allocators to revisit custody, legal wrappers and compliance models for on‑chain credit products. That dynamic could accelerate liquidity migration into tokenised credit markets and other on‑chain instruments.

Aave’s $1B DeFi ambition: mechanics and likely capital flows

Aave’s announced ambition to chase a $1B DeFi growth target after clearance is as much strategic signaling as it is a financial target. The ambition will likely be deployed across three vectors: protocol treasury deployment, integrations that attract third‑party capital (e.g., RWA partners), and product distribution (consumer app + channels).

- Treasury power: A larger protocol treasury enables market interventions—liquidity mining, insurance, or seed capital for RWA originators. Public reporting on Aave’s post‑clearance strategy highlights how the team expects to marshal funds toward growth [Cryptopolitan coverage].

- Institutional onboarding: With clearer regulatory optics, service providers (custodians, KYC/AML middleware, compliance layers) can offer safer rails for passthrough capital. That reduces friction for pension funds, family offices and structured credit desks to participate.

- Retail distribution: A consumer mobile app aimed at mainstream users lowers UX friction and increases velocity of small ticket flows into Aave’s markets.

Collectively, these mechanisms could change capital flows by shifting allocators from off‑chain private credit and money‑market products into tokenised equivalents that benefit from yield transparency and composability. Expect the largest initial inflows to target low‑volatility, income‑oriented RWA markets rather than speculative memecoin pools.

Roadmap deep dive: RWA, v4, and the mobile app

Real‑World Assets—more than a label

Aave’s explicit focus on RWAs in the 2026 master plan represents a strategic pivot from purely crypto‑native lending to hybrid markets where on‑chain primitives meet legal wrappers. The roadmap coverage and independent summaries lay out a timeline of integrations and product experiments geared toward tokenised credit and short‑term yield instruments ([Aave CEO roadmap details], [Independent summary]).

Why RWAs matter:

- They attract insurance companies, treasuries and corporate treasuries that prefer yield with legal recourse.

- They create larger nominal pool sizes because real‑world balance sheets dwarf on‑chain liquidity today.

- They change risk composition: legal risk, custody, and counterparty risk become as important as smart‑contract risk.

Operationally, RWAs demand new architecture: on‑chain token standards for claims, off‑chain legal agreements, and trusted gatekeepers for originator due diligence. Aave will need to balance permissioned flows (required for legal compliance) with the composability that drives DeFi innovation.

v4 protocol upgrades—scaling, fee economics and permissioning

Aave’s v4 upgrade is the technical backbone for the roadmap. Public reporting on the v4 horizon emphasizes modularity, improved risk‑management primitives, and hooks for RWA integrations. v4 is likely to introduce configurable pools, upgraded interest rate models, and new treasury interfaces that allow the DAO to support different market types under a unified protocol.

From a capital flow perspective, v4 matters because it can:

- Reduce friction for onboarding new asset types via standardised pool templates.

- Allow bespoke fee/taxonomy models that make RWA economics viable (e.g., tranche‑specific fees, reserve sinks).

- Introduce permissioning layers that enable regulated counterparties to interact without exposing the entire protocol to on‑chain governance attacks.

Consumer mobile app—the gateway to mainstream liquidity

Turning DeFi into a mainstream product requires a distribution layer that nontechnical users trust. Aave’s planned consumer mobile rollout aims to be that layer: simple onboarding, embedded compliance where necessary, and seamless access to yield products. The team’s public roadmap narrative highlights consumer UX as a priority for scaling demand-side liquidity ([CEO roadmap article]).

A consumer app can create massive micro‑flows—savings, payroll redirection, or treasury parking—that aggregate into substantial TVL. But it also raises UX governance challenges: who controls risk parameters exposed to retail, and how are disclosures and consumer protections enforced?

Governance and AAVE token implications

AAVE holders will face consequential votes. The DAO must decide how much flexibility to give protocol teams, how to allocate treasury for market‑making or insurance, and how to structure permissions for RWA originators. Key governance battlegrounds likely include:

- Treasury deployment: seed programs for RWA originators vs. buybacks or incentives for liquidity.

- Permissioning frameworks: whether the DAO adopts a whitelist for RWA providers and what due‑diligence standards are codified.

- Upgrade cadence: enabling v4 transitions, emergency pause controls, and risk‑parameter toggles.

Token economics may evolve: as RWAs and consumer flows increase, AAVE’s utility as a governance and fee‑sink token could strengthen, but so could demands for on‑chain voting safeguards and delegated governance to subject‑matter committees. Expect governance proposals to grow in technical complexity and legal oversight.

Practical risks that remain

SEC clearance reduces one type of risk but does not erase others. Builders and governors should keep a clear checklist:

- Smart‑contract risk: v4 introduces new code; the attack surface expands with RWA adapters and mobile integration. Continuous audits, formal verification, and layered insurance remain non‑negotiable.

- Composability fragility: permissioned components or off‑chain legal hooks can break the open composability model, creating brittle linkages across protocols.

- Legal and custody risk for RWAs: tokenised assets need enforceable legal claims. The interplay between on‑chain tokens and off‑chain legal contracts will be litigated and may vary by jurisdiction.

- Operational centralization: whitelists, guardians or oracles may be necessary for RWAs, but they concentrate control and become regulatory focal points.

- Under‑insured systemic events: larger TVL in RWAs exposes the protocol to correlated shocks; adequate reserve models and reinsurance strategies must scale accordingly.

Aave’s team and DAO will need to design mitigations—multi‑party custody, diversified originator sets, clear liquidation mechanics and robust audit trails—to make RWAs practice resilient.

What builders, governors and investors should watch next

- Governance proposals that define RWA onboarding standards and treasury allocations—these are the practical levers that will steer capital.

- The technical specifics of v4: check upgrade modules, emergency controls and how permissioning is implemented.

- Mobile app compliance posture: is custody custodial or non‑custodial, what KYC is embedded, and how user funds are isolated?

- Auditor and insurer market responses: new attestations or insurance products targeted at tokenised credit will be key enablers.

For those evaluating the reopening of protocol activity after regulatory de‑risking, firm diligence on counterparty legal structures and operational controls is now as important as on‑chain security proofs.

Conclusion

Aave’s cleared regulatory status and its ambitious 2026 roadmap are a meaningful inflection point for DeFi. The combination of RWA focus, v4 protocol upgrades and a consumer mobile app could materially redirect capital flows from legacy finance into programmable credit markets. But with scale comes a new set of tradeoffs: permissioning and legal plumbing vs. composability; treasury power vs. decentralised governance; mainstream UX vs. institutional controls.

DAO governors, builders and sophisticated investors should treat SEC clearance as an enabling condition—not a guarantee. The pathway to a durable, scaled hybrid DeFi will require rigorous engineering, sharper governance, and innovative legal frameworks. Expect heated DAO debates and complex technical rollouts in the months ahead as Aave implements its master plan.

Bitlet.app users and DeFi practitioners should follow these developments closely: the playbook that emerges could redefine how mainstream capital accesses on‑chain yield.

Sources

- SEC ends four‑year probe into Aave and what it means

- Aave sets $1B DeFi goal after SEC clearance

- Aave CEO details 2026 roadmap centered on v4, RWAs and mobile rollout

- Independent summary of Aave’s 2026 Master Plan

Note: This analysis references the AAVE protocol and ecosystem developments and is intended for experienced DeFi stakeholders evaluating protocol-level strategy and risk.