Uniswap’s UNI Burn & Fee‑Switch: A Critical Tokenomics Assessment

Summary

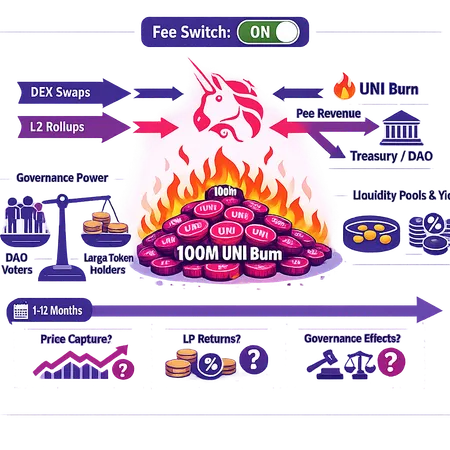

What changed: the $100M UNI burn and the fee switch

Uniswap’s DAO just approved two consequential moves: a roughly $100 million UNI burn and the activation of the long‑dormant fee switch. The burn is an immediate, one‑time reduction in circulating UNI supply. The fee switch redirects a portion of trading fees — previously consigned to liquidity providers or other protocol sinks — toward the DAO treasury instead of leaving them only in the AMM’s automated flows. Together these changes convert a governance token with limited direct cash flow into a vehicle that can capture and monetize protocol revenue.

The decision is as much a policy pivot as it is a market signal: a large burn signals commitment to deflationary pressure on supply, while the fee switch creates a recurring revenue stream the DAO can deploy. Coinspeaker covered the approval and activation details, noting how the DAO framed this as a structural tokenomics upgrade for UNI reporting the $100M burn and fee‑switch activation.

How the moves convert UNI into a revenue proxy

At face value, a burn reduces supply and can raise per‑token scarcity. But the strategic lever is the fee switch: revenues that flow into the treasury can be used in several ways that materially affect UNI holders and LPs:

- Buybacks and burns: The treasury can buy UNI on the open market and burn it, creating an ongoing supply sink and linking swap volume to token value capture. This makes UNI a burn‑driven proxy for protocol fees.

- LP incentives and reinvestment: Fees can fund liquidity mining on new pools and L2 deployments, improving product-market fit at the potential cost of immediate buybacks.

- Treasury diversification: Revenues can be converted into other assets or invested in growth initiatives, providing optionality but diluting direct revenue capture for holders.

The net effect: UNI’s value will increasingly depend not only on governance claims, but on what the DAO does with the fee stream. In that sense, UNI becomes a hybrid — part governance token, part revenue token if the treasury elects pro‑buyback policies.

Context: why fee capture matters now

Market sentiment in 2025 has favored protocols and tokens that demonstrably capture revenue. As reported in a market overview, investors are rotating toward revenue‑generating protocols even as many Layer‑1 tokens struggle, increasing the premium placed on cash‑flow rights and fee capture mechanisms Crypto.News analysis of 2025 market trends. That backdrop explains the DAO’s urgency: tokenomics that link protocol activity to holder returns can attract capital and stabilize token price discovery.

This is not unique to Uniswap. Across the ecosystem, governance bodies are adapting: some choose direct fee distributions, others prefer buybacks, and a few route fees into treasury growth funds.

Governance implications and power dynamics

Activating the fee switch materially raises the stakes of governance decisions. Previously, many UNI votes were symbolic or narrowly targeted to protocol parameter changes. Now, votes about treasury allocation determine real cash flows and token scarcity.

Key governance dynamics to watch:

- Concentration of influence: Entities or coalitions that can coordinate voting (or influence off‑chain decision makers) will have outsized control over treasury policy. That can centralize power unless DAO mechanisms — timelocks, quorum thresholds, redemption rights — are tightened.

- Short‑term vs long‑term tradeoffs: Voters must choose between immediate buybacks (which support price) and long‑term growth investments (which support more swap volume). This tension will shape market behavior and lobbying inside the DAO.

- Proposal economics: Expect a surge of proposals that monetize fees differently — token burns, airdrops to LPs, on‑chain grants for L2 integrations, or cross‑protocol partnerships.

In short, governance becomes operationally consequential. For token holders deciding on voting or LP behavior, assessing the governance roadmap is now as important as reading AMM metrics.

Comparative examples: how other DEXes capture revenue

Looking across DEX models helps clarify possible paths for Uniswap:

- SushiSwap historically used fee diversion and treasury allocations to bootstrap growth and launched on‑chain buybacks and buyback+burn campaigns at times — a more activist treasury approach to capture value.

- Curve uses the veCRV locking model to align long‑term holders with protocol revenue and gauge fees; that model skews power toward long‑lockers but creates steady revenue capture for stakers.

- Balancer and some AMMs offer direct fee accrual to pool LPs, leaving the token mostly governance-focused unless the protocol layers additional revenue mechanics.

Each model has tradeoffs: direct fee distribution maximizes LP yield but reduces treasury flexibility; ve‑style locking concentrates voting power but ties token holders to long‑term incentives; buyback/burn policies can prop price but may underinvest in product growth.

Uniswap’s new levers let the DAO pick a spot on this spectrum — and that choice will determine whether UNI behaves more like a revenue token (akin to buyback models) or stays governance‑centric with occasional market interventions.

What this means for liquidity providers and UNI holders over 12 months

For DeFi strategists and holders weighing LP or voting changes, here are pragmatic scenarios and signals to monitor over the next year.

- Conservative buyback path (pro‑burn):

- Treasury prioritizes buying UNI to burn. Result: upward price pressure, less reinvestment in incentives. LPs could see lower short‑term rewards but benefit indirectly from higher token value. UNI holders who participate in governance and support buybacks benefit most.

- Growth reinvestment path (pro‑incentives):

- Fees fund L2 integration, liquidity mining, or grants to grow TVL. Result: potentially higher swap volume and long‑term revenue, but slower immediate price reaction. LPs stand to gain if incentives are targeted and sustain AMM depth.

- Mixed, opportunistic allocation:

- Treasury splits proceeds: portion to buybacks, portion to incentives, portion to diversified investments. This hedges risk but complicates valuation models for UNI — investors must model multiple cash‑flow destinations.

Indicators to track (short list):

- Treasury proposals and enacted allocations (watch multisig/DAO proposals).

- Actual on‑chain flow of fees to buybacks or incentive pools.

- Changes in LP APRs after the fee switch and any reallocation of fee income.

- Market depth and TVL on L2s where Uniswap is deployed.

If the DAO leans toward buybacks, token holders who reduce selling and engage in governance could capture outsized returns. If funds are spent aggressively on L2 incentives without clear ROI, LPs may win while UNI price lags. Smart LPs will reweight exposures across pools and L2s based on where incentives land.

Practical decision guidance for holders and strategists

- For active UNI holders: participate in governance. The economics are now vote‑sensitive. Supporting clear, transparent treasury policies (e.g., a portion of fees auto‑allocated to buybacks plus a measurable growth budget) reduces uncertainty.

- For LPs: diversify. If incentives shift to L2s, follow the liquidity incentives but monitor impermanent loss vs short‑term APR. Use position sizing to avoid over‑allocating to incentivized pools without long‑term depth.

- For yield seekers: prefer pools where fee accrual remains favorable after the fee switch. If the DAO redirects most fees away from LPs, look for alternative AMMs or strategies that still pay direct LP fees.

Bitlet.app users and DeFi strategists should treat the UNI changes as a structural event — one that merits re‑running risk models and governance scenarios rather than a simple re‑rate.

Risks and open questions

- Governance capture: If a small group consistently wins votes, treasury policies may favor insiders.

- Execution risk: Poorly executed buyback programs or ill‑timed investments could harm token value.

- Market expectations: The burn is priced in to some extent; expected revenue capture may already be reflected in UNI’s market price. If revenues underperform, sentiment could reverse.

Conclusion: a conditional step toward revenue capture

The $100M UNI burn and fee‑switch activation mark a meaningful tokenomics shift. They give Uniswap tools to turn protocol activity into shareholder‑style value capture, but the outcome depends on governance choices. The fee switch enables revenue capture; it does not guarantee that UNI will behave like a pure revenue token. Over the next 12 months, the clearest winners will be participants who monitor treasury allocations, engage in governance, and align LP strategies with the DAO’s chosen mix of buybacks and reinvestment.

For DeFi strategists, the practical takeaway is simple: re‑assess both your LP allocations and voting stance, watch on‑chain treasury flows, and be prepared to update models as the DAO reveals its preference for growth vs immediate token value capture.

Sources

- Uniswap approves $100M UNI burn and activates fee switch — Coinspeaker: https://www.coinspeaker.com/uniswap-approves-100m-uni-burn-activates-fee-switch/

- "Layer‑1 tokens crumble as users flee and Bitcoin dominance grows in 2025" — Crypto.News: https://crypto.news/layer-1-tokens-crumble-as-users-flee-and-bitcoin-dominance-grows-in-2025/

(Also referenced broader market context including DeFi trends and revenue capture strategies; for further reading see protocol docs and DAO proposals.)

For perspective on how macro narratives are shifting capital allocations in crypto, compare Uniswap’s move to broader market trends and consider how DeFi revenue models are evolving alongside Bitcoin dominance.