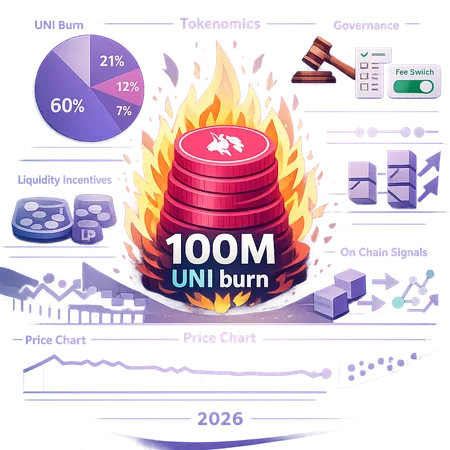

Why Uniswap’s 100M UNI Burn Didn’t Spark a Rally: A Tokenomics Post‑Mortem

Summary

Quick framing: what happened and why it mattered

In mid‑2025 Uniswap’s community executed a high‑profile action: a 100 million UNI token burn. Numerically, that’s a large headline figure — and in isolation it reads like a classic supply‑shock narrative. But markets barely budged. Understanding why requires drilling into the burn mechanics, the governance backdrop (notably the fee switch debate), short‑term on‑chain signals, and longer‑term tokenomics implications around liquidity incentives and distribution.

For many DeFi watchers, UNI burns looked like an obvious bullish lever. Yet outcomes teach a lesson: not all burns are created equal. This post explains what changed — and how traders and token‑economics researchers should think about similar supply‑reduction moves in 2026. For broader market context, remember that DeFi flows are often the real driver behind token moves, not headline supply figures.

Burn mechanics: how the 100M UNI was executed

The burn itself was simple on a technical level: a governance‑approved proposal moved 100 million UNI to an irrecoverable address, reducing total supply. That transaction was public, verifiable on‑chain, and intentionally transparent as a credibility signal from governance.

However, the raw mechanics don’t tell the whole story. Important qualifiers:

- Which supply bucket was reduced? A burn’s impact depends heavily on whether it removes circulating tokens versus long‑term vested allocations or protocol reserves. In Uniswap’s case a sizeable portion of the burned tranche came from addresses that were not actively liquid in markets — meaning the removal didn’t materially tighten the daily tradeable float.

- Timing and market expectations. The burn was telegraphed during governance discussions and the media cycle, so traders could have pre‑priced it.

That distinction — headline size versus tradeable supply — is central to why the market response was muted.

Governance rationale and the fee switch context

The burn didn’t happen in a vacuum. It was wrapped into a governance narrative where UNI holders debated the fee switch — a mechanism that would let token holders redirect protocol fees to a community treasury. Proponents argued that coupling a burn with forward governance tools strengthened the long‑term value proposition: fewer tokens + potential ongoing protocol revenue for holders.

Opponents raised classic concerns: centralization of power, uncertain future fee flows, and the risk that burns are cosmetic political moves rather than sustainable economic policy. Coverage at the time explained both the immediate vote mechanics and broader implications; AmbCrypto’s piece on UNI price and the fee switch framed the debate around support/resistance and market psychology, noting that the vote introduced as much political uncertainty as it did potential upside (see their governance analysis).

Put bluntly: the burn was as much a governance signaling device as it was a monetary event. Without a credible, clear roadmap for how fee revenues would be captured and used, the burn had limited conviction-building power.

Short‑term price reaction and on‑chain signals

Market reaction: underwhelming. The burn’s immediate effect on UNI price was muted, with a short, shallow uptick followed by sideways price action. CoinTribune covered this exact outcome, noting that despite the sizable burn, markets did not ignite.

On‑chain signals help explain the narrative tension:

- Orderbook and liquidity: Post‑burn, liquidity concentrated in lower slippage ranges; yet there was no sustained buyer pressure to consume that liquidity. Many liquidity providers rebalanced positions rather than increase exposure.

- Whale behavior: Large UNI holders showed mixed activity. Some reduced exposure (profit taking or rebalancing into other DeFi assets), while others simply shifted tokens between cold and hot wallets — not a clear accumulation signal.

- Exchange flows: Net flows to centralized exchanges did not spike in the way a panic sell would show, nor did they collapse into an accumulation pattern. In short, the burn didn’t change trading incentives overnight.

This pattern — a verifiable supply reduction without follow‑through demand — is why prices stayed broadly stable.

Why the market didn’t treat the burn as durable value creation

Several overlapping explanations account for the disconnect between a big headline number and a small price move:

Illiquid supply removed: Removing tokens that were already locked, vested, or reserved reduces headline supply but barely changes the circulating float that traders care about.

Unclear revenue model: The fee switch debate made future cash flows uncertain. A burn that is not paired with credible, contract‑level revenue capture (and distribution mechanics) is less valuable. Traders price certainty; governance possibilities are not the same as guaranteed yield.

Expectation management: The market had time to digest and price the event. When a burn is preannounced, its rally potential often dissipates as traders front‑run or hedge the move.

Liquidity incentives still dominant: In AMM ecosystems, tokens confer governance and sometimes fee rights, but liquidity incentives (yield for LPs) are the proximate driver of economic activity. Unless a burn meaningfully changes those incentives — for example by increasing rewards per remaining token or changing protocol subsidy dynamics — it's primarily cosmetic.

Taken together, these forces explain why UNI’s price reaction was so restrained.

Longer‑term tokenomics: distribution, incentives, and durability

To assess whether burns create durable value, tokenomics researchers must look beyond one‑off reductions and examine persistent changes:

Distributional shifts: Who benefits from a burn? If a burn disproportionately helps large, illiquid holders while leaving LPs and active traders’ economics unchanged, it can worsen perceived fairness and hurt long‑term community cohesion.

Liquidity incentives: Many protocols subsidize LPs via emissions. If burns reduce total supply but do not alter the emission schedule or the reward rate per LP share, then the economic position of LPs is unchanged. Conversely, a burn that coincides with a reduction in emissions or a shift to fee capture could materially raise yield per token — that would be meaningful.

Governance credibility: Repeated governance actions that are predictable, transparent, and paired with economic updates increase the chance that supply changes have durable effects. One isolated burn, absent follow‑through (e.g., fee switch implementation), is a weaker signal.

Token velocity and utility: Long‑term value depends on token utility (governance, fee rights, staking, etc.) and velocity. If the burn does nothing to increase utility or reduce velocity, its impact is limited.

For Uniswap specifically, the path from a headline burn to sustained price appreciation required credible progress on fee capture and improved economics for holders — neither of which was fully resolved at the time of the burn.

How traders should evaluate supply‑reduction moves in 2026

If you’re sizing positions or constructing research in 2026, use a checklist approach rather than treating burns as automatic catalysts:

- Ask which supply bucket was burned. Circulating float reduction matters more than total supply headline numbers.

- Evaluate governance follow‑through. Is there a legally‑enforced or algorithmic mechanism (smart contract changes) to capture new revenue streams, or is the move largely political theater? Look at multisig rules, timelocks, and on‑chain proposal code.

- Model LP economics. A burn that affects staked vs. unstaked tokens can shift incentives for liquidity providers. Recalculate APR and token reward per unit of TVL after the burn.

- Check holder concentration and behavior. If a burn centralizes value among a few actors, the risk profile changes (higher tail risk from single‑actor moves).

- Price in expectation. Determine whether the burn was surprise or widely telegraphed. Surprise burns have a higher chance of a short tactical move; telegraphed ones are often neutralized.

- Compare to precedent. Study prior burns across protocols and note the accompanying policy or reward changes. Some burns were paired with clear revenue capture and led to multi‑month re‑rating; others did not.

Practically: view burns as one input among many. For DeFi investors and token‑economics researchers, durable gains come from persistent changes to incentives and value capture, not from a single headline reduction in supply.

Practical trade ideas and risk management

- Short window trades: If a burn is announced unexpectedly, short‑term momentum trades can work, but size them tightly and use liquidity‑aware entries to avoid slippage.

- Event‑driven arb: If burns are paired with governance changes that alter emission schedules, consider relative value trades (e.g., long UNI / short competing governance token) to isolate the impact on holder economics.

- Long‑term position sizing: For multi‑quarter holds, require proof that rewards per token or protocol revenue capture have meaningfully improved.

- Hedging: Use options or concentrated liquidity strategies to limit downside if whales re‑allocate after a burn.

Remember: Bitlet.app users often watch tokenomic changes closely — combining on‑chain signal monitoring with behavioral analysis of large holders can improve timing and conviction.

Conclusion: Burns are necessary but not sufficient

Uniswap’s 100M UNI burn was a clear governance statement. But without decisive changes to fee capture and liquidity incentives, it was insufficient to move markets materially. The muted reaction highlighted a broader truth for DeFi tokenomics in 2026: supply shocks matter only when they alter the economics facing active participants (LPs, stakers, and yield seekers) and when governance credibility turns optional policy into enforceable revenue mechanics.

For investors and researchers, the right approach is analytical and skeptical: parse which tokens were removed, inspect the mechanism for future cash flows, and model how incentives for liquidity providers change. Only then can a burn be evaluated as a durable value driver rather than a headline stunt.

Sources

- CoinTribune — Crypto: Uniswap burns 100 million UNI, but the market does not ignite: https://www.cointribune.com/en/crypto-uniswap-burns-100-million-uni-but-the-market-does-not-ignite/?utm_source=snapi

- AmbCrypto — Uniswap price prediction: Is UNI holding the line after the fee switch vote?: https://ambcrypto.com/uniswap-price-prediction-is-uni-holding-the-line-after-the-fee-switch-vote/