Uniswap Fee Switch Explained: How Turning On Protocol Fees Would Reshape UNI Tokenomics

Summary

Why this proposal matters

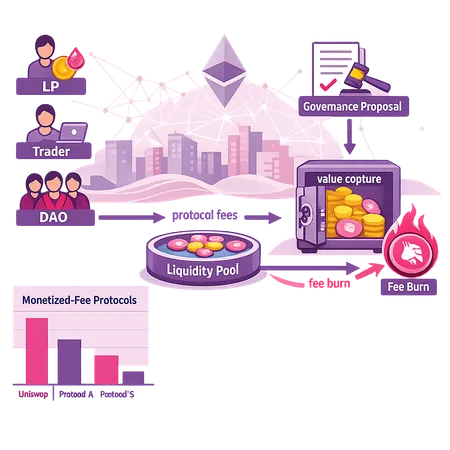

Uniswap is the market-leading automated market maker on Ethereum, and UNI is its governance token. The governance proposal to enable protocol fees — a configurable portion of swap fees routed to the protocol rather than to LPs — paired with a plan to use proceeds to reduce UNI supply would convert a purely utility/governance token into a more direct vehicle for value capture. For DAO participants and token-economics researchers, that is a big structural change in how Uniswap returns economic value to stakeholders.

The debate isn't abstract: DEX fee switches have precedent, and the movement of on-chain activity to Ethereum suggests fee revenue could grow. On-chain deployment and activity trends help underwrite the revenue case; for context on rising smart contract deployment and on-chain activity, see this analysis of Ethereum smart contract deployments and ecosystem growth.

The specifics of the proposal: what’s being asked

At a high level, the proposal requests two things: (1) enable a protocol-level fee switch that allows governance to capture a configurable fraction of swap fees (the fee switch is currently off), and (2) commit that captured fees will be used to buy back and/or burn UNI (a mechanism often described informally as a fee burn). The intent is explicit: transform recurring trading activity into ongoing buybacks that reduce circulating UNI.

Practically this means these configurable levers:

- Fee percentage charged to traders (existing swap fee tiers remain under LP control in each pool).

- The protocol cut: what fraction of the pool fee is diverted from LPs to the protocol treasury.

- The use of proceeds: direct buyback and burn, directing revenue to a treasury, or hybrid approaches.

The reporting and execution path would be executed on-chain via governance-controlled parameters. For a primary report on the Uniswap proposal and the reasoning for turning on protocol fees, see this coverage of the proposal.

How fee flows would change LP economics

Currently, liquidity providers earn the entire swap fee allocated to their pool. If the protocol takes a slice of that fee, LPs face two simultaneous shifts: lower immediate fee income and potentially higher long-term token value if buybacks increase UNI scarcity.

A simple framework to think about LP impact:

- Gross fee per trade = volume * pool fee rate (e.g., 0.3%).

- Protocol capture = gross fee * protocol_split (e.g., 10–50% under different governance settings).

- Net to LPs = gross fee * (1 - protocol_split).

So if protocol_split = 20% in a 0.3% fee pool, LPs receive 0.24% (80% of 0.3%) while the protocol receives 0.06%.

Key LP considerations:

- Short-term APY compression: LPs will see immediate yield reductions proportional to the protocol split. That directly reduces gross returns on capital for traders who provide liquidity.

- Rebalancing and migration: LPs can shift to pools with lower protocol splits or to alternative AMMs. This risk creates pressure on governance to set a split low enough to avoid capital flight.

- Fee-tier optimization: Protocols might rely on a mix of fee tiers (0.05%, 0.3%, 1%) where higher-fee pools can sustain a larger protocol split without destroying LP incentives; governance could design splits per fee-tier.

Finally, LP economics are not static. If buybacks materially raise UNI price over the medium term, LPs who hold UNI (or UNI-staked vehicles, if any) could gain from secondary price appreciation that offsets lower fee yields. But that is contingent and uncertain.

Governance revenue, buyback mechanics, and UNI tokenomics

Converting protocol fee revenue into supply reductions or treasury value creates a feedback loop: trading => fees => buybacks/burn => lower supply/increased treasury value => potential UNI price appreciation. The proposal’s specific commitment to use proceeds to reduce UNI supply implies direct deflationary pressure.

Two primary execution paths exist:

- Direct buy-and-burn (fee burn): the protocol swaps collected ETH or tokens for UNI and burns them on-chain. This is the most deflationary and straightforward path to increase scarcity.

- Treasury accumulation and active management: fees are stored in a protocol treasury and used for buybacks, ecosystem grants, or converted to stable assets. This provides optionality but dilutes the immediacy of supply reduction.

Tokenomics impacts to consider:

- Supply dynamics: A consistent buy-and-burn schedule creates a predictable deflationary mechanism; supply reduction pace depends on trading volumes and the protocol split.

- Circulating supply vs. vesting: Burns shrink circulating supply but do not affect locked/vested tokens unless governance enacts additional changes.

- Market expectations: The signaling effect can be as important as actual burns. Announcing a robust fee-capture mechanism can shift forward-looking valuations even before significant burns occur.

External integrations and ecosystem effects

If Uniswap captures fees, external integrations reassess how they route volume and partner economics. Examples of downstream effects:

- Aggregators and routers: Fee-aware routing algorithms may prefer pools with lower protocol splits when optimizing for trader cost, changing internal routing logic.

- Custodians and index products: Products that index AMM fees or that market themselves as ‘yield on liquidity’ will need to adjust APY estimates and messaging.

- Derivatives and revenue tokens: Monetization enables structured products (e.g., revenue-backed tokens or derivatives that pay out a share of protocol fees), expanding the ecosystem.

Importantly, many of these integrations are built on the assumption that Uniswap is the low-friction venue on DeFi; any structural change to fee allocation will ripple through relayers, aggregators, wallets and DEX-tiling strategies.

Comparative analysis: lessons from other fee-monetizing protocols

Other protocols have experimented with fee monetization or revenue capture. Comparing outcomes highlights trade-offs.

Balancer: Balancer implemented a protocol fee switch that allows a portion of fees to flow to the protocol. The community has been cautious with the parameter settings because excessive protocol capture risks liquidity migration. Balancer’s experience shows governance tends to prefer conservative initial splits and incrementalism.

SushiSwap: Sushi’s tokenomics redirected a slice of trading revenue to xSUSHI holders historically, creating a direct yield for stakers. That model proved effective at rewarding token holders but required strong staking demand to lock token supply. Sushi’s experiment suggests revenue sharing with token holders can substitute for buy-and-burn in delivering token-holder value.

Curve: Curve’s value capture has been multi-faceted — fees, CRV emissions, and the veCRV locking model. Curve highlights that aligning fee policy with emissions and voting power creates powerful, albeit complex, incentives. Curve’s edge came from designing long-term lockups that convert revenue and governance power into sustained value capture.

The common lessons:

- Gradualism wins: DAOs often start with small protocol splits and adjust after observing on-chain reaction.

- Complementary mechanisms matter: Fee monetization is most effective when paired with staking, vote locks, or buyback-and-burn mechanisms that create scarcity or yield for holders.

- Market structure influences results: Protocols on chains or segments with sticky liquidity (e.g., pools with concentrated liquidity, or on chain with fewer alternatives) can support higher protocol splits.

Modeling outcomes: plausible scenarios for value capture

Below are simplified scenarios using parametric assumptions to illustrate how fee monetization could translate into UNI buybacks.

Assumptions (illustrative):

- Daily trading volume across Uniswap: V = $1,000,000,000 (1B)

- Average pool fee: f = 0.3%

- Protocol split: s = 20%

- UNI market price: P = $5

Daily protocol revenue = V * f * s = 1,000,000,000 * 0.003 * 0.20 = $600,000

Annualized (x365) = $219M. At P = $5, that buys back ~43.8M UNI/year.

Interpretation: with these numbers, if UNI had a circulating supply of 1B tokens, this represents a ~4.38% annual reduction in circulating supply (ignoring new issuance and vesting). The arithmetic is instructive but depends heavily on real volumes, fee tiers, and split.

Scenario variants to consider:

- Low-volume conservative case: If volume is half or the split is 10%, annual buys drop proportionally.

- High-volume aggressive case: If protocol split moves to 50% or network volumes increase significantly, buybacks become a material supply sink and could be a meaningful driver of price—assuming demand remains.

Caveats:

- Market reaction to buybacks is not guaranteed: If market participants anticipate the buybacks and sell into them, the net effect on price could be muted.

- Liquidity migration: If LPs withdraw because of lower net fees, trade execution quality may deteriorate, reducing volume and thus fees—creating a negative feedback loop.

Potential market reactions: short, medium, and long term

Short-term (announcement to weeks):

- Volatility spike: Announcements can trigger speculative flows—UNI could see a quick price bump on the expectation of future buybacks.

- LP rebalancing: Some LPs may reduce exposure until parameter details crystallize.

Medium-term (months):

- Pricing in of expected revenue: Markets will reprice UNI based on modeled fee capture and tokenomics changes.

- Capital flows: If buybacks are meaningful, capital could flow back into UNI and into LP positions that benefit indirectly.

Long-term (years):

- Structural value capture: If protocol fees meaningfully grow with adoption and burns are sustained, UNI’s value proposition shifts toward revenue-backed governance token.

- Network effects and competitive response: Competing AMMs could respond by lowering fees, innovating fee tiers, or offering alternative incentives to LPs. The net long-term outcome depends on Uniswap’s market share and its ability to tune parameters without destabilizing liquidity.

Governance trade-offs and the DAO checklist

For DAO voters, the decision is not purely mechanical. Consider these questions:

- What split level minimizes capital flight while still generating meaningful revenue?

- Will fees be burned immediately or routed through a treasury for adaptive use?

- Are there complementary mechanisms (staking, vesting changes, vote-lock models) to align LPs and token holders?

- How will parameter changes be tested and monitored? Do we need temporary trials and on-chain metrics?

- What reporting/oversight will the community require to ensure transparent execution of buybacks and burns?

A pragmatic approach many DAOs adopt: launch the switch at a conservatively low split, instrument robust analytics, and iterate based on observed liquidity and volume responses.

Final takeaways for DAO participants, investors, and researchers

Turning on Uniswap’s protocol fees and using proceeds to reduce UNI supply is a structural pivot toward revenue capture. It offers a clear mechanism to translate trading activity into token-holder value, but it also introduces trade-offs around LP yields, capital allocation, and network dynamics.

Practical points to hold in mind:

- Small protocol splits can test the waters without alarming LPs;

- Pairing fee monetization with complementary tokenomic mechanisms (lockups, staking rewards, or partial treasury accumulation) can smooth incentives;

- Transparent, incremental governance and strong on-chain metrics are essential to detect liquidity migration early.

For active DAO participants and DeFi investors, a disciplined modeling approach — using real volume data, realistic fee splits, and sensitivity analyses — is the most reliable path to evaluating whether fee monetization meaningfully improves long-term value capture. Platforms like Bitlet.app that aggregate DEX metrics and yield models can be helpful in running those scenarios in practice.