UNI

UniswapX’s channel for Securitize‑issued BUIDL marks a major moment for institutional tokenized funds on DEXs. This article unpacks the technical path, market impacts on UNI and short‑term liquidity, and the hard limits — from allowlists to KYC friction.

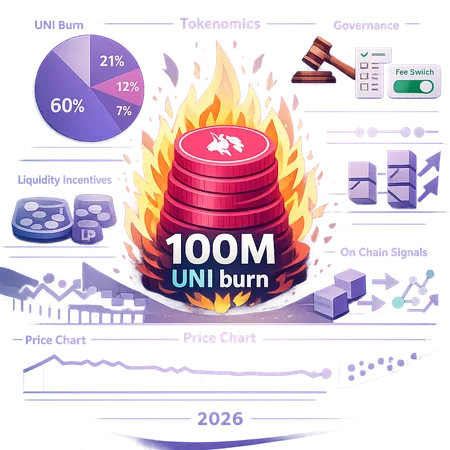

Uniswap’s decision to burn 100 million UNI was significant on paper but produced a muted market response. This explainer unpacks the burn mechanics, governance context around the fee switch, on‑chain signals, and how investors should treat similar supply‑reduction moves in 2026.

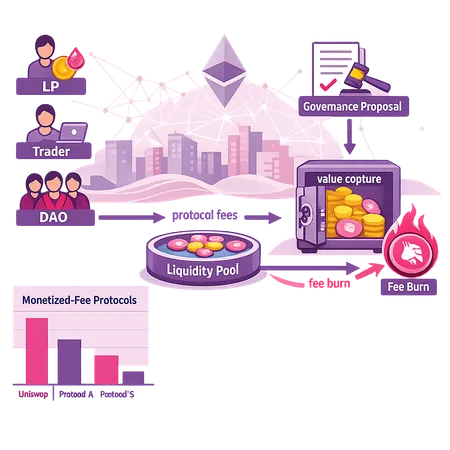

Uniswap’s governance push to enable protocol fees and use proceeds to reduce UNI supply is a pivotal tokenomics experiment. This guide breaks down the proposal specifics, how fee flows would affect LP economics and governance revenue, and plausible market outcomes.

Uniswap’s community has activated protocol fees and executed a large UNI token burn — a shift that could reshape token economics, LP incentives, and how DeFi protocols capture value. This explainer breaks down what happened, the immediate UNI price reaction, and the longer-term governance and market implications.