Cross‑Chain Interoperability: How NEAR, Tron and LayerZero Are Rewiring Liquidity and DeFi UX

Summary

Why cross‑chain interoperability matters now

The last 12 months have seen interoperability shift from a theoretical benefit to a core product requirement for DeFi teams and liquidity providers. When a token can live and trade easily across EVM and non‑EVM environments, capital allocation decisions change: liquidity can migrate to the cheapest, deepest or fastest market, and UX expectations migrate with it. For many DeFi leads, that means building products and incentives for multiple chains from day one instead of retrofitting bridges later.

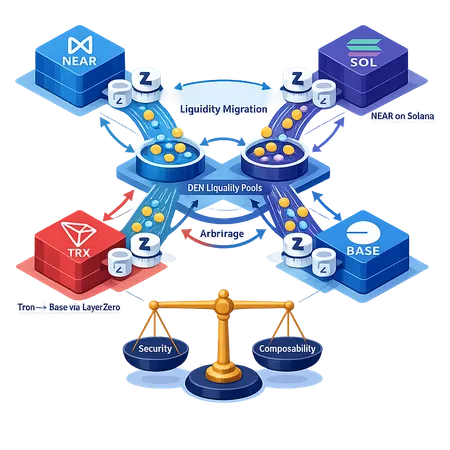

This isn’t abstract. Integrations like NEAR’s deployment on Solana and Tron’s cross‑chain access to Base show how technical plumbing directly alters liquidity flows and price action. For context on how these moves play out in the market, consider how cross‑chain narratives influence momentum: in some cases, increased access results in noticeably tighter spreads and higher on‑chain volumes, which can feed price momentum — as recent SOL price moves demonstrate when network demand and integrations converged Solana price coverage.

Recent integrations reshaping liquidity

NEAR launching on Solana: a test case for composability

NEAR teams launching on Solana creates a concrete example of liquidity migration and new composability paths. When NEAR liquidity lands on Solana, it becomes immediately available to Solana’s order books, AMMs, and derivative venues. That reduces execution costs for traders wanting NEAR exposure without routing through bridges every time and invites new pairings (e.g., NEAR/SOL pools), which can increase depth for both tokens. Coverage of the launch highlights how cross‑chain listings can catalyze market interest and deeper trading on the host chain NEAR on Solana launch.

TRX + Base via LayerZero: messaging protocols as on‑ramps

Tron’s integration with Coinbase’s Base network via LayerZero is a different but complementary pattern: LayerZero provides a composable messaging layer that allows TRX to be represented and used inside Base applications without bespoke bridge builds for each protocol. That lowers onboarding friction for projects and lets Base‑native DeFi pools access TRX liquidity quickly. The integration shows how a shared messaging primitive can scale cross‑chain UX across multiple apps Tron integration with Base via LayerZero.

How cross‑chain connections change liquidity sourcing and arbitrage

When the same economic asset exists on multiple chains, markets no longer price purely in one place. That creates three practical effects:

Liquidity corridors: Assets will naturally form corridors — routes where traders and LPs move capital. One corridor may be NEAR on Solana ↔ NEAR on NEAR mainnet, another may be TRX on Base ↔ TRX on Tron. Corridor depth depends on bridge cost, latency, and incentives.

Faster arbitrage, but higher operational complexity: Arbitrage opportunities widen when markets fragment, and the fastest actors will capture most returns. However, cross‑chain latency, messaging reliability and fees mean arbitrageurs need cross‑chain routing logic and capital distributed across chains to capture spreads.

Fee and UX arbitrage: Users will route trades to the venue with the best net cost (gas, slippage, bridge costs). That can cause liquidity migration toward cheaper L2s or chains with popular aggregators, reinforcing winner‑take‑most effects in UX‑friendly venues.

A recent Solana price surge illustrated this: network integrations and inbound liquidity can amplify price moves as on‑chain venues concentrate trading Solana market signal. For DeFi product leads, this means the UX you offer (low friction, fast execution) can directly capture migrating liquidity.

Technical trade‑offs: security vs composability

Building cross‑chain composability is not purely a feature toggle — it introduces new threat models. Consider these trade‑offs:

Trust assumptions: Native tokens on a host chain may be represented by wrapped tokens or via canonical vault models. Bridges and messaging protocols introduce additional trust layers; if a bridge or relayer fails, assets can be locked or double‑spent in practice.

Finality and consensus mismatch: Chains differ in finality time (e.g., Solana vs EVM chains). Cross‑chain workflows must accommodate differing confirmation semantics, which can increase the risk window for reorgs or state inconsistencies.

MEV and sandwich risk across rails: Fragmented liquidity widens MEV surfaces. Arbitrageurs and bots operating cross‑chain can extract value where latency or oracle updates lag, increasing effective trading costs for LPs and traders.

Composability vs isolation: Deep integration (native composability) gives better UX and capital efficiency, but increases blast radius: a compromise or exploit on one chain can cascade to others through composable contracts and shared liquidity.

LayerZero — used in the TRX/Base example — is powerful because it standardizes messaging, but it also centralizes new critical infrastructure. Every messaging layer should be threat‑modelled for relay/endpoint compromise, replay attacks, and denial‑of‑service vectors before being trusted with high TVL.

Strategies for projects and liquidity providers

Below are practical, prioritized strategies to capitalize on cross‑chain corridors while managing risk.

For projects (protocol and product leads)

Choose a canonical model: Decide whether you want a single canonical asset (custodial vault + minting) or multi‑representation (wrapped tokens). Canonical assets reduce fragmentation but can concentrate counterparty risk.

Limit attack surface: Start with audited, battle‑tested bridges and messaging layers. If you use a messaging protocol like LayerZero, segment high‑risk flows (e.g., governance or admin operations) away from high‑frequency liquidity flows.

Build composable‑friendly UX: Abstract away bridge complexity in the front end. Users should feel they’re interacting with a single logical market even if liquidity sits across chains. Good UX attracts order flow and LPs.

Incentive design: Use dynamic liquidity mining to seed shallow pools on the host chain and pay down to ensure natural volumes follow. Time‑limited rewards can bootstrap corridors; sustained incentives can be tapered as organic flows grow.

Observability and emergency plans: Implement cross‑chain monitoring, slashing windows, and pause mechanisms. Plan canonical redemption paths so users can reclaim value if a bridge endpoint becomes unavailable.

For liquidity providers (LPs and market makers)

Distribute capital across corridors: Place portions of capital where spreads and volumes support expected returns rather than betting on one venue. This requires active capital management and tooling to rebalance.

Use hedging primitives: Counterparty risk and basis risk increase cross‑chain. Use perpetuals, options, or synthetic hedges where available to neutralize directional exposure while harvesting spread.

Prioritize low‑latency routing and co‑located relayers: Arbitrage often comes down to latency. Implement smart order routers that consider cross‑chain message time and bridge finality.

Concentrated liquidity and fee tiers: Provide concentrated liquidity in price bands where you expect most activity and tier fees to protect against sandwich attacks. Dynamic fee models help preserve returns during volatile migration.

Monitor MEV and oracle health: Use MEV‑aware strategies and oracle redundancy to avoid being picked off by cross‑chain bots.

Tooling and partner choices

- Bridge & messaging: Prefer audited, decentralised designs with transparent sequencing rules. Consider limits on per‑tx TVL to reduce blast radius.

- Routing & aggregation: Partner with aggregators that support cross‑chain routing or build internal routers that consider bridge costs and latency.

- Analytics & observability: Instrument cross‑chain dashboards for TVL per corridor, slippage, and bridge health. Rapid detection is essential for front‑running mitigation and rebalancing.

Operational checklist before a cross‑chain launch

- Audit path: Ensure all bridge endpoints, relayers, and token wrappers are audited.

- Threat modelling: Map the failure cases (reorgs, relayer compromise, oracle lag) and build mitigations.

- Bootstrap liquidity plan: Allocate incentive budgets and partner LPs to create initial depth.

- Monitoring: Deploy chain‑agnostic alerts for stuck messages and anomalous arbitration spreads.

- User flows: Simplify UX so non‑technical users are not exposed to cross‑chain complexity.

Closing thoughts for DeFi leads and LPs

Cross‑chain interoperability is not just a backend trend — it changes where value is captured. Projects that thoughtfully design canonical models, bootstrap corridors, and instrument cross‑chain risk can access broader liquidity and better UX. LPs that adopt active capital distribution, hedging and MEV‑aware strategies can harvest spreads created by fragmentation while limiting downside.

This wave of connectivity — from NEAR on Solana to TRX reaching Base through LayerZero — is making the DeFi landscape both deeper and more complex. The winners will be teams that treat interoperability as product strategy, not just an integration task. For platforms, services and aggregators — including those like Bitlet.app that facilitate cross‑chain earn and P2P flows — the mandate is clear: build safety first, then optimize for composability.

Sources

- NEAR Protocol launches on Solana: https://thecurrencyanalytics.com/altcoins/near-protocol-launches-on-solana-sparking-market-interest-230875

- Tron integration with Base via LayerZero: https://blockonomi.com/tron-integration-with-base-network-brings-cross-chain-access-to-trx-token/

- Solana price surge coverage: https://www.newsbtc.com/news/solana/solana-price-approaches-130-whats-behind-the-recent-surge/

For further reading on cross‑chain design patterns and examples of liquidity migration, see protocol docs and bridge audits before deploying capital or incentives.