XRP Valuation Under Scrutiny: Escrow, Evernorth Losses, and the Liquidity-Layer Thesis

Summary

Why this debate matters now

XRP’s narrative has shifted over time from a payments utility to, more recently, a proposed global liquidity layer that can move value between rails with minimal friction. That narrative matters because a claim of utility implies a different valuation framework than pure speculative demand. For professional allocators and traders, the difference changes the metrics you track, how you stress-test positions, and what sell-side or counterparty behavior might do to price under stress.

Institutional concentration is now part of the story: reports that Evernorth is sitting on more than $200 million in unrealized losses raise the question of how concentrated unrealized losses among large holders affect price signaling and liquidity during drawdowns. This investigation parses valuation frameworks, examines the Evernorth report and Ripple’s escrow defense, and delivers practical guidance for market participants evaluating XRP exposure.

Valuation frameworks: utility (liquidity layer) vs. speculation

The first technical choice is framing. There are two dominant lenses to value XRP.

Utility-driven valuation: XRP as a liquidity layer

If XRP truly functions as a global liquidity layer, value accrues to token holders through network utility. A utility-driven valuation typically starts with:

- addressable transaction volume (value transmitted),

- take-rate or fees captured by the token (if any),

- velocity of the asset (turnover per period),

- supply schedule and lock-ups (escrow releases), and

- competition from other rails and stablecoin/fiat corridors.

For common frameworks, think of a discounted cash-flow analogue: expected fee flows or savings delivered to users multiplied by adoption, then discounted for execution risk. That implies the token’s fair value should move in rough correlation with measurable usage metrics: settlement flows, on-chain flows that correspond to cross-border liquidity operations, and number of counterparties using XRP as corridor liquidity.

But XRP’s fee model and the mechanics of capture are not as straightforward as a transaction-fee token like ETH. That creates a challenge: where does the revenue stream come from, and who captures it? Without clear fee-capture mechanics, the utility-story requires higher adoption to justify higher valuations.

Speculative valuation and market structure

The simpler—if less flattering—lens is that XRP’s price mostly reflects speculative demand, macro liquidity, and concentration among large holders rather than realized liquidity-utility. Under this view, price depends on:

- capital flows into retail and OTC desks,

- derivatives and leverage dynamics,

- perception-driven narrative shifts (partnership headlines, legal outcomes), and

- the effective free float — which can be very different from total supply because of escrow and custodial holdings.

This framework explains why prices can decouple from measurable utility: token demand is often driven by momentum, macro, and liquidity provision from market makers rather than by predictable fee capture.

Evernorth, concentrated institutional holdings, and price signaling

A pivotal recent data point is the BeInCrypto report that Evernorth reportedly sits on over $200M in unrealized XRP losses. Concentration matters because large positions can amplify price moves and distort the marginal seller/buyer dynamics that determine market clearing prices.

Large institutional holders create three linked risks:

- Price pressure if the holder needs liquidity and floods the market. Large block sales in thin periods create outsized slippage.

- Negative signalling: public reports of sizable unrealized losses can trigger mark-to-market selling by counterparties or redemption pressure from clients.

- Counterparty fragility: if institutions use leverage, sudden margin calls can force fire-sales that cascade.

Evernorth’s unrealized loss figure, therefore, is not just a headline—it’s a potential catalyst. Even absent immediate selling, concentrated unrealized losses change the incentives for holders to reduce exposure, and they increase the probability of disorderly selling if macro or idiosyncratic shocks worsen.

Ripple’s escrow defense and responses to valuation skepticism

Ripple has repeatedly pointed to its escrow system as a structural mechanism intended to reassure markets: predictable, time-staggered releases of XRP from escrow reduce the risk of a sudden supply shock. Ripple CTO David Schwartz has publicly defended escrow as a tool to stabilize supply and market expectations.

At the same time, critics argue escrow is incomplete as a defense. An opinion piece in NewsBTC questioned whether XRP’s valuation actually makes sense relative to its proposed utility, arguing there’s a disconnect between the lofty liquidity-layer narrative and measurable fee-capture or on‑chain settlement volumes. Those critiques highlight an important point: escrow moderates supply-side fears but does not directly resolve questions about demand-side adoption or token economics.

For context, see Ripple CTO comments defending escrow in Tokenpost and the NewsBTC valuation critique for a dissenting perspective.

Contagion pathways: how concentrated losses can ripple through markets

When a dominant holder shows large unrealized losses, contagion can occur through several channels:

- Direct selling: gradual liquidation or forced selling depresses prices, prompting more mark-to-market losses for other leveraged holders.

- Liquidity evaporation: market makers widen spreads when inventory risk increases, making it costlier to execute large trades and amplifying slippage.

- Perception-driven flows: counterparties and custodians may reclassify risk exposures, raise haircuts, or close lending lines.

This is where market structure matters. If XRP’s active market depth is shallow relative to a holder’s position size, liquidation impact is non-linear. Professional traders should model impact cost (slippage = f(order size, market depth, volatility)) and run stress tests where a 10–30% price shock forces x% of holders to liquidate.

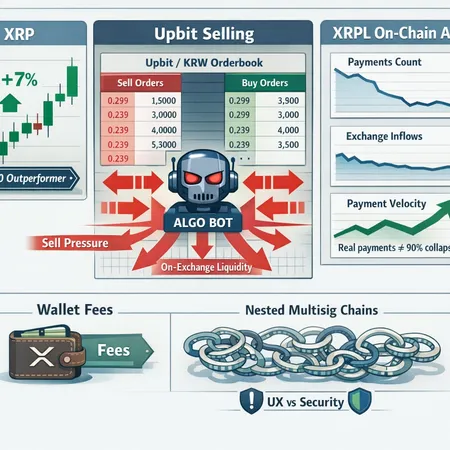

Quant metrics and on-chain signals to watch

Portfolio managers should combine off-chain and on-chain indicators to triage risk quickly. Key items include:

- Escrow release schedule and actual releases (monitor how much supply becomes tradable).

- Whale concentration: proportion of total supply in large addresses and known custodial wallets.

- Exchange inflows: sudden spikes in exchange deposits often precede selling pressure.

- Order-book depth across major venues and OTC desk willingness to fill large blocks.

- Funding rates and derivatives skew: persistent negative funding suggests bearish leverage; skew shows directional bias.

- On-chain settlement volumes that map to cross-border activity (to test liquidity-layer claims).

For macro context, watch broader flows into crypto (e.g., BTC correlation) and whether narrative headlines about payments or bank corridors actually translate into incremental transaction volume.

Practical checklist for portfolio managers and traders

Below are tactical steps and sizing rules you can incorporate into portfolio governance and active risk management:

- Position sizing: cap single-name exposure to a fraction of average daily traded value (e.g., not more than 2–5x 30-day ADV for spot positions unless hedged).

- Stress tests: simulate forced liquidation scenarios where large holders (including Evernorth) reduce positions by 10–30% over 48–72 hours. Measure slippage and P&L impact.

- Monitor escrow and Evernorth: set alerts for escrow releases and material changes in Evernorth’s filing or public statements. The BeInCrypto report is a starting data point; corroborate with custody/OTC data where possible.

- Hedging: use futures or options to hedge directional tail risk. If options liquidity is thin, consider correlated hedges (e.g., broad crypto index futures) or OTC structured hedges with trusted counterparties.

- Counterparty risk: review lending lines, margin terms, and rehypothecation clauses if you’re lending XRP or using it as collateral.

- Liquidity playbook: pre-negotiate block liquidity with OTC desks, set limit-only execution rules for large orders in thin markets, and avoid market orders that exceed safe thresholds.

Weighing the narratives: practical takeaways

- Escrow reduces headline supply-release risk, but it does not create demand. That distinction matters: predictable supply is useful only if demand exists to absorb it.

- Evernorth’s reported unrealized losses are a signal of concentration risk. They don't prove imminent selling, but they increase the probability of disorderly moves in stressed markets.

- The liquidity-layer thesis requires empirical adoption metrics to be credible. Track on-chain settlement that maps to real-world cross-border liquidity operations, not just nominal transfers.

- Valuation models that ignore market structure and holder concentration will misprice risk. For allocators, the correct price of risk includes potential impact costs and contagion pathways, not only tokenomics.

What to watch next (short- and medium-term indicators)

- Escrow activity and any deviations from the published schedule.

- Public statements or regulatory filings from large holders such as Evernorth, including any movement of coins off custody platforms.

- Exchange inflows and concentrated sell blocks; sudden rises in exchange balances are a red flag.

- Settlement volumes that would justify the liquidity-layer narrative—are real counterparties using XRP as corridor liquidity, or are transfers largely intra-exchange and speculative?

- Derivatives market signals: widening bid-ask, stressed funding rates, or concentrated open interest at one strike indicate fragility.

For comparative market context, remember how narratives around Bitcoin or DeFi adoption were tested against measurable usage—XRP’s case is no different. Also consider infrastructure players and platforms (including Bitlet.app) that report execution and liquidity metrics in their product analytics.

Final assessment for allocators

XRP’s market price is defensible only to the extent that measurable demand for a liquidity layer grows and fee capture or other economic rents accrued to holders. Escrow helps manage supply risk but is not a substitute for demonstrable adoption. Evernorth’s reported unrealized losses amplify market-structure risk and underscore why concentrated holdings should be an explicit input into valuation and stress-testing.

If you manage institutional capital in crypto, treat XRP as a higher market-structure–risk exposure than a token with transparent, recurring fee capture. Use position-size limits, hedging where available, and proactive monitoring of escrow releases and large-holder behavior.

Sources