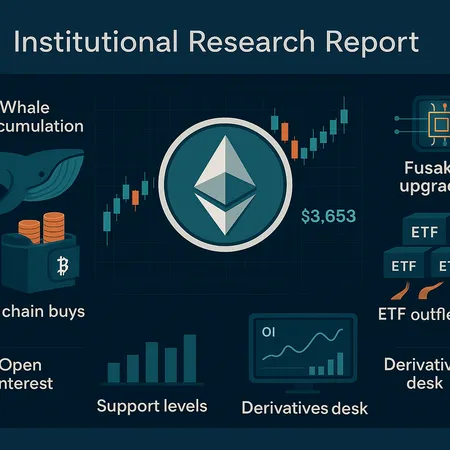

Ethereum’s November Mechanics: Whales Accumulate as ETFs Withdraw — Reconciling the Tug-of-War

Summary

Executive snapshot

November’s ETH price mechanics felt like a tug-of-war: large on-chain purchases by institutional whales coincided with meaningful ETF outflows, leaving the tape choppy and structure marginal. On one hand, blockchain analytics flagged roughly $1.37B of ETH accumulation by large wallets during the correction, a clear signal of coordinated or institutional dip-buying. This on-chain picture is confirmed in the data reported by blockchain.news: [institutional whales accumulated $1.37B] (https://blockchain.news/news/20251116-ethereum-whales-accumulate-137b-as-eth-tests-lower-bollinger-band). On the other hand, ETF products recorded notable net redemptions — about $1.4B — which pulled liquidity from the spot market and forced temporary price concessions, as covered by Coinpaper. The simultaneous presence of both flows creates the paradox institutional researchers must reconcile: accumulation is real, but the net liquidity environment can still be negative.

What the whale accumulation actually means

Large on-chain buys are not a simple “price will go up” signal. They are information. Whales accumulating into a dip indicate belief in longer-term fundamentals or event-driven upside (e.g., protocol upgrades). Institutional-sized buys—captured in the $1.37B figure—often come with execution constraints: fills across multiple venues, OTC desks absorbing inventory, and staged accumulation to avoid market impact. That said, persistent, concentrated accumulation reduces the free float available to short-term sellers and can steepen the bid under the right conditions.

Practically, whale accumulation changes the market microstructure: it tightens depth at certain price levels, increases the probability of a strong bounce from support, and signals that some capital seeks to lock exposure rather than chase momentum. For allocators, this is a signal to evaluate conviction alongside liquidity risk rather than assume it will immediately flip the tape bullish.

ETF outflows: liquidity drain and asymmetric pressure

ETF outflows act differently than a simple sell order on an exchange. When ETFs see redemptions — the $1.4B figure reported by Coinpaper is instructive (https://coinpaper.com/12385/ethereum-drops-6-6-as-1-4-b-etf-outflows-collide-with-whale-buying?utm_source=snapi) — sponsors either redeem inventory or force secondary-market sales to meet cash demands. Both pathways remove available liquidity: either spot supply held by market makers declines, or selling pressure hits order books. That effect is asymmetric — on outflows, sellers have to find buyers at current market depth; when inflows arrive, liquidity replenishment is more orderly because sponsors can route new capital into custodial wallets.

For institutional desks, this means ETF flows are a macro-level liquidity amplifier. Even if whales are buying, the timing mismatch between buy-side accumulation and ETF-driven selling can create price transients, wider spreads, and opportunities for volatility sellers — or a headache for funds forced to mark to market against thin liquidity.

Open interest, derivatives mechanics and the liquidity tug

Derivatives markets give another dimension to this tug-of-war. Open interest (OI) is the raw measure of positions outstanding; when OI rises in a falling market, it implies more leveraged short positioning or increased hedging. Conversely, if whales accumulate spot while OI climbs, derivatives books will re-hedge — sometimes aggressively — which creates additional order-flow into spot and futures markets.

The collision of ETF outflows with whale accumulation often shows as temporarily elevated funding rates, compressed basis (spot–futures spread) dislocations, and periodic liquidation cascades as desks adjust delta and gamma. Crypto derivatives desks will run the math: if significant spot buying occurs while ETF redemptions force sales, basis traders might widen hedges, increasing market-makers’ inventory costs and widening bid-ask spreads. These microstructural moves amplify short-term volatility even if the net supply-demand balance is neutral across a longer horizon.

Technical structure: why $3,653 is the structural flip

On-chain and flow analysis needs to be married to technical structure. Several technical studies argue that ETH must reclaim $3,653 to convincingly flip the short-term bearish structure into bullish, a level cited in market commentary and technical forecasts (see analysis at Cryptonews: https://cryptonews.com/news/ethereum-price-prediction-eth-must-reclaim-3653-to-flip-bearish-structure/). Reclaiming that level would restore higher lows and offer a cleaner path for momentum players and risk-on funds.

Why that number? It's a confluence level: it represents the recent swing high pivot, a cluster of liquidity, and a zone where on-chain accumulation would be validated by price action. If ETH clears and holds above $3,653, it forces short-sellers and some systematic sellers to rethink their posture; dealers reduce aggressive hedges and money managers who require constructive structure to add beta begin to scale back into risk. Conversely, failure to clear $3,653 keeps sellers in control and raises the probability that ETF outflows continue to dominate near-term price discovery.

For immediate context, ETH has been trading around the $3,200–$3,100 zone after retesting support, which aligns with the update reported by TokenPost (https://www.tokenpost.com/news/investing/17594). That retest is precisely the battleground where whalebids and ETF-supply meet.

Fusaka upgrade: catalyst or background noise?

The Fusaka upgrade is an upcoming protocol milestone that many on-chain allocators view as a medium-term positive. While upgrades alone rarely guarantee immediate price catalysts, they alter the narrative and can change marginal allocation decisions. For institutional allocators weighing custody, staking economics, or product launches, knowing a major upgrade is coming reduces idiosyncratic protocol risk and can justify accumulation ahead of adoption windows.

From a risk-management perspective, Fusaka creates two effects. First, it lengthens the investment horizon for long-term allocators who expect smoother network performance or better on-chain UX post-upgrade. Second, it provides a communication point for allocators to justify ongoing accumulation against near-term liquidity holes created by ETF flows. That said, upgrades are not panaceas; execution risk, client adoption, and macro liquidity still govern price in the weeks surrounding a protocol change.

Mentioning Fusaka should be contextualized: it’s a supportive factor for mid-to-long-term allocation but not a substitute for concrete liquidity management when ETF outflows and derivatives dynamics are active.

Tradeable scenarios — long-only funds

Below are pragmatic, rule-based scenarios tailored for long-only institutional allocators.

Scenario A — Structure flip (bullish base): ETH reclaims and holds above $3,653 and whale accumulation continues. Action: scale into exposure in tranches (e.g., 25% on confirmation, 50% on retest), set a medium-term target band based on prior resistance, and size positions relative to redemption liquidity. Use time-weighted entry to minimize market impact and consider pairing with short-dated protective puts to cap drawdown while the basis normalizes.

Scenario B — Liquidity squeeze (neutral-to-bearish): ETH fails to clear $3,653 and ETF outflows persist. Action: reduce active spot exposure, preserve dry powder, and redeploy to liquid, lower-beta allocations or short-duration derivatives hedges. Maintain a clear stop framework near the $3,100–$3,200 support band noted in recent trading (TokenPost data), and consider re-entry points if on-chain accumulation resumes without net negative ETF flow.

Position sizing guidance: emphasize liquidity-adjusted sizing rather than static allocations. With ETFs creating potential redemptions, keep a liquidity buffer (cash or stablecoin) equal to expected redemptions horizon for the fund's mandate. If custody or staking is part of the strategy, stagger lock-ups so mandatory redemptions do not force fire sales.

Tradeable scenarios — derivatives desks and market-makers

Derivatives teams should translate the dual-flow reality into hedging and relative-value plays.

Scenario A — Market structure flips bullish (OI stabilizes or drops while spot rallies): Decrease static short hedges, increase spot delta exposure, and compress option skews (sell volatility selectively). Consider selling short-dated calls against spot holdings or ratio spreads where funding rates justify carry.

Scenario B — Continued ETF outflows and structure stays bearish: Increase hedges — buy puts or put spreads against existing exposure, widen delta-neutral hedges, and use calendar spreads to benefit from front-month volatility. Basis trades (long spot / short futures or vice versa) should be sized to reflect counterparty liquidity and potential forced-liquidation events.

Tactical plays: funding-rate arbitrage if funding becomes persistently negative (borrow funding cheaply and take directional exposure), and protective dispersion trades when underlying correlation across ETH derivatives spikes.

Operationally, desks must monitor open interest, funding rates, and exchange inventories in near real-time. Large on-chain whale purchases should not be interpreted as immediate stop-loss triggers by market-makers; instead, they are inputs to adjust expected future flow.

Practical checklist for allocators and desks

- Monitor ETF flows and sponsor communications in real time — outflows are a leading liquidity signal.

- Track on-chain large transfers and accumulation clusters (whale clusters) as evidence of conviction rather than an immediate price catalyst.

- Regard $3,653 as a technical gate: reclaim and hold to de-risk bearish structural arguments.

- Use Fusaka as a medium-term conviction booster, not a proximate liquidity cure.

- Size positions based on liquidity-adjusted metrics and have mandatory redemptions stress tests built into allocation models.

These checkpoints align routine operational discipline with macro and on-chain signals and help reconcile the paradox of simultaneous buying and selling.

Conclusion — balancing conviction and liquidity

November’s ETH action was a reminder that flow matters as much as conviction. Institutional whales can and did accumulate—about $1.37B on-chain—while ETF outflows of roughly $1.4B compressed spot liquidity and left price structure precarious. The technical level of $3,653 is the practical line in the sand for flipping bearish structure; until that level holds, derivatives desks and long-only funds must respect the possibility that outflows will dominate short-term discovery. Fusaka provides a supportive narrative for mid/long-term allocators, but proper sizing, hedging, and liquidity buffers are the real operational tools.

For institutional researchers and DeFi allocators, the path forward is pragmatic: treat on-chain whale accumulation as a meaningful sentiment signal, treat ETF outflows as a tactical liquidity risk, and marry both to technical structure when sizing and hedging. For live trade execution and custody-aware allocation, platforms like Bitlet.app can help operationalize installment and custody primitives into an allocator’s toolbox while you plan entries and exits.

For further reading on the dynamics noted here, see the detailed reports cited earlier on whale accumulation, ETF outflows, technical structure, and recent price ranges: blockchain.news, Coinpaper, Cryptonews, and TokenPost.