When Storms Take Down Hashrate: How Winter Outages Hit Bitcoin Price and Network Resilience

Summary

Executive overview

Extreme weather can look like a temporary headline—but for Bitcoin, outages of mining capacity are both a network and market event. In recent weeks U.S. winter storms forced a subset of miners to curtail operations, producing an estimated ~12% decline in overall hashrate. That supply‑side shock briefly slowed block production, nudged fee dynamics, and arrived at the same time BTC dumped below $80,000 amid heavy liquidations, amplifying market volatility.

For an institutional audience, the key takeaway is not panic but preparedness: miner outages are a plausible shock that should be modeled alongside custodian, counterparty and funding risks. For many traders and allocators, Bitcoin remains the primary market bellwether, so supply disruptions deserve the same attention as macro or liquidity shocks.

What happened: winter storms and the 12% hashrate drop

Multiple outlets reported a meaningful hashrate decline after extreme winter weather hit U.S. mining regions. Industry coverage quantified the shock at about a 12% drop in measured hashrate as operators curtailed rigs in response to grid constraints and site conditions. See the reporting on the immediate hashrate fall and operator curtailments here and additional local reporting on network turbulence here.

This wasn’t a single data point; it was a geographically concentrated outage tied to U.S. miners. Because the U.S. hosts a large share of global hashpower, regional weather and grid events can move the needle on global metrics. Smaller operators and facilities without robust backup power or contractual grid priority were hardest hit, while larger publicly listed miners with diversified footprint and stronger grid agreements were generally better able to maintain operations.

Short‑term technical effects on block production and fees

A ~12% drop in active hashing power produces predictable short‑term technical effects. With less aggregate hashing, the expected block interval increases until the protocol adjusts difficulty (difficulty retargets every 2,016 blocks, ~two weeks). A rough estimate: removing 12% of hashpower increases average block time by about 1 / 0.88 ≈ 13.6%, lifting the nominal 10‑minute interval closer to ~11.4 minutes on average while the network rebalances.

Operationally that means:

- Longer average confirmation times for on‑chain transactions until difficulty corrects.

- Potential mempool buildup and transient fee pressure if transaction demand remains steady; users seeking timely confirmation may pay higher fees.

- Slightly reduced security headroom—while a 12% change doesn’t materially make a 51% attack feasible, it lowers the total cost of a hypothetical attack and reduces the margin before an adversary could threaten finality assumptions.

Nodes and wallets experienced variance in propagation and confirmation latency during the outage window; miners that remained online saw temporary increases in block rewards by capturing a larger share of solved blocks relative to their hash contribution. These are normal, short‑lived dynamics and the protocol’s difficulty mechanism is designed to restore target block time over subsequent retarget periods.

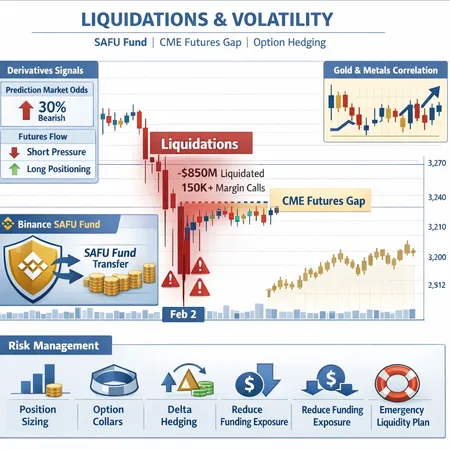

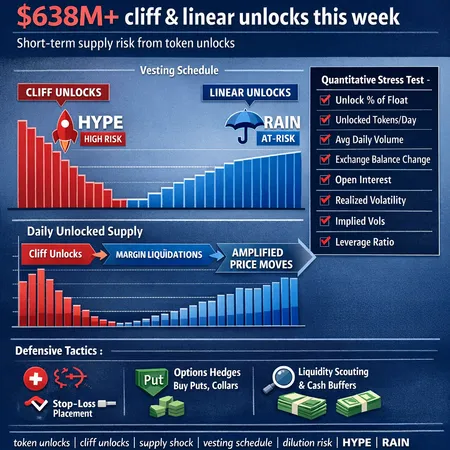

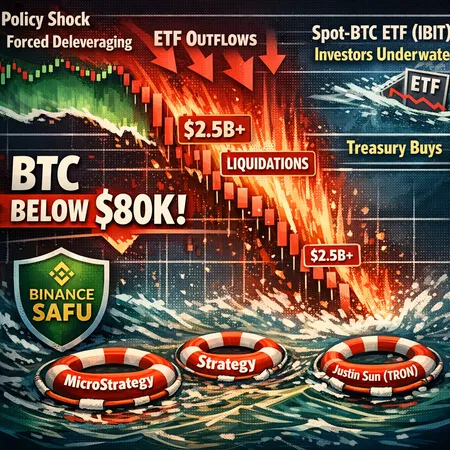

Market interplay: BTC under $80k and large liquidations

Timing magnified the effect. The hashrate shock coincided with a sharp BTC sell‑off that pushed prices below $80,000 and generated heavy liquidations across leverage pools and derivatives venues. Market coverage highlights the depth of liquidations and the price path during that window here.

How do these two phenomena interact? Causality is subtle and usually mixed:

- Narrative and signaling: sudden miner outages are negative news for market sentiment—reduced hashrate gets framed as a fragility that can amplify volatility, prompting short‑term selling.

- Liquidity and margin feedback: falling prices trigger liquidations; forced selling increases price pressure, which in turn can force more selling—an autopilot many risk managers model as cascade risk.

- Miner balance‑sheet effects: miners under outage still face fixed costs (capital leases, interest, maintenance). Short‑term production losses can accelerate reserve drawdowns or cause near‑term sales of holdings if firms rely heavily on spot sales to fund operations.

Importantly, the price drop was not solely—or even primarily—caused by the hashrate decline. Macro, flow‑based, and funding factors drove significant order flow. But the timing created a compounding story: operational outage + down market = amplified risk.

Why miner outages matter to institutional risk managers

Treat miner risk like an operational‑infrastructure risk with market consequences. Specific reasons institutional stakeholders should care:

- Counterparty exposures: OTC desks, lenders and custody providers can be exposed to miners that suddenly lose production and liquidity. That affects margin calls and funding lines.

- Market microstructure: unexpected on‑chain slowdowns change cost and timing of settlement, which can matter for derivatives settlement and liquidation timing.

- Systemic narratives: clustered outages give headlines that can undermine confidence, widening bid‑ask spreads and increasing funding costs for leveraged participants.

Risk managers should track miner health metrics (hashrate by region, miner public filings, OPEX breakeven estimates) as part of counterparty diligence.

Contingency planning: what miners and exchanges can do

Operational resilience is a mix of hardware, contracts and financial planning. Below are practical mitigations for both sides of the market.

Miners (operational / financial):

- Geographic diversification: distribute hash across multiple grid regions and countries to avoid correlated weather or grid events.

- On‑site redundancy: deploy backup generation, modular battery storage and N+1 power redundancy for critical sites.

- Grid and offtake contracts: negotiate demand‑response clauses, priority access and compensation terms with utilities.

- Insurance and parametric products: pursue business interruption and parametric weather insurance that pays on defined triggers (temperature, grid outages) rather than complex loss adjusters.

- Spare capacity & cold spares: maintain a pool of ready but idle rigs and fast‑deploy technicians to recover hash quickly.

- Hedging and liquidity buffers: use futures/options to hedge bitcoin revenue and keep liquid reserves to cover fixed costs through outage windows.

Exchanges, lenders and institutional counterparties:

- Larger insurance funds and dedicated liquidity buffers to absorb concentrated liquidation events.

- Stress testing and pre‑trade risk limits tuned to on‑chain latency and confirmation delays—simulate longer settlement times in stressed scenarios.

- Multi‑custody and geographic dispersal of cold storage to avoid correlated physical risks.

- Conservative margin frameworks and circuit breakers for products exposed to sudden drops in underlying settlement certainty.

Platforms and product teams — including those building lending or earn products like Bitlet.app — should bake miner outage scenarios into product stress tests and KYC/counterparty onboarding.

Practical checklist for risk managers (quick reference)

- Monitor global hashrate and regional breakdowns daily.

- Track miner public disclosures and OPEX / reserve metrics as counterparty health signals.

- Simulate 10–20% hash shocks in settlement and liquidation models.

- Require miners to demonstrate redundancy and insurance when onboarding as counterparties.

- Ensure exchanges maintain >X days of liquidity buffer and run liquidation drills that assume slower block times.

Conclusion: resilience is both technical and financial

The recent winter storms were a reminder that Bitcoin’s security model is built on distributed, real‑world infrastructure that is vulnerable to weather, grid constraints and human operations. A 12% fall in hashrate was technically manageable—the protocol’s difficulty mechanism restores balance—but the market consequences were real when the outage coincided with a price drawdown below $80k and heavy liquidations.

For institutional risk managers the lesson is straightforward: incorporate miner risk into counterparty assessments, require demonstrable contingency measures, and stress test financial systems against correlated operational and market shocks. Monitoring tools and clear playbooks—covering insurance, geographic diversification and liquidity buffers—turn what looks like an unpredictable “black swan” into a rehearsed scenario.

Sources

- CryptoNews: Bitcoin hashrate falls 12% after U.S. winter storms hit miners — https://cryptonews.com/news/bitcoin-hashrate-falls-12-after-us-winter-storms-hit-miners/

- CoinTribune: Harsh weather hits US miners, Bitcoin hashrate sinks — https://www.cointribune.com/en/harsh-weather-hits-us-miners-bitcoin-hashrate-sinks/?utm_source=snapi

- BeInCrypto: Bitcoin crash below $80K, market liquidation — https://beincrypto.com/bitcoin-crash-below-80k-market-liquidation/