Reading Capitulation: Mining Difficulty, ETF Outflows and the Checklist for a Durable Bitcoin Bottom

Summary

The signal: panic, search trends and why it matters

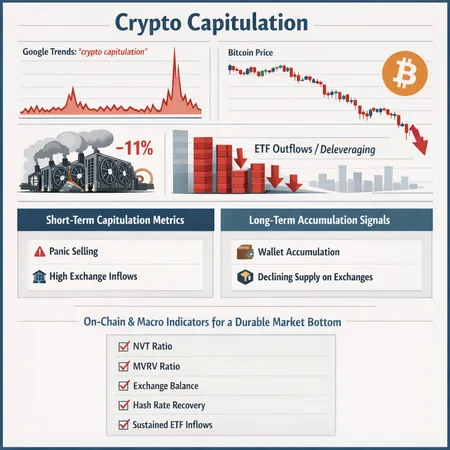

We are in a moment where sentiment indicators and on-chain plumbing are converging. Google Trends shows a sharp spike in searches for “crypto capitulation,” a behavioral sign often associated with local market bottoms as retail attention reaches a fever pitch — a datapoint highlighted in reporting at Cryptopolitan (see: crypto capitulation spike). That kind of attention isn't proof of a bottom, but it is a useful contrarian input: extreme retail fear often coincides with price troughs, or at least with short-term price exhaustion.

For macro traders and long-term allocators the question is not whether people are panicking — they are — but whether the panic is accompanied by structural changes that make this sell-off an episode of cleansing rather than a prelude to a deeper regime shift.

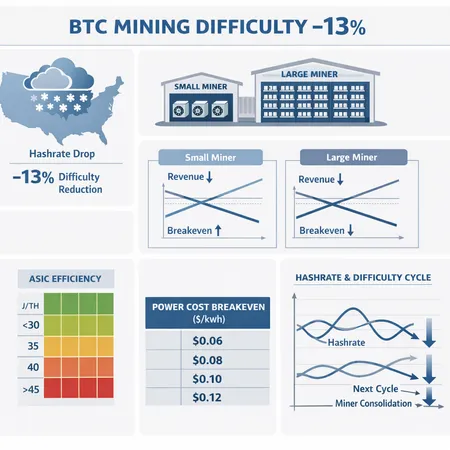

Mining difficulty plunged — why an ~11% drop is more than a footnote

Bitcoin's network difficulty just experienced an eye-catching decline of about 11%, reported by CoinTribune. A move of this size matters for several reasons: first, it reflects real economic stress among marginal miners who either turned off rigs or lost connectivity. That reduces hashrate pressure and can briefly improve miner margins, but it also signals capital depletion at the edges of the mining cohort.

Second, difficulty is a near-real-time gauge of miner behavior and infrastructure resilience. When difficulty falls, difficulty-adjusted supply pressure can subside because miners' forced selling (to cover operating costs or service debt) tends to pause. That mechanical reduction in sell-side flow is one of the reasons traders watch mining difficulty as an early bottoming indicator.

Third, an 11% plunge is large enough to suggest this was not a routine rebalancing. It's consistent with a capitulation event inside the miner cohort: operations scale back, liquidity burns off, and weaker participants are culled. That aligns with the narrative of short-term cleansing rather than a slow grind lower.

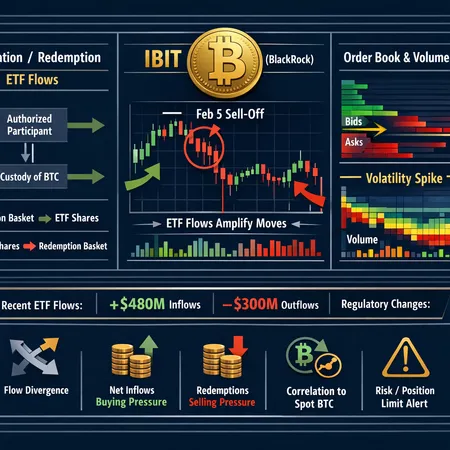

ETF outflows and deleveraging: the institutional plumbing unclenches

ETF flows and related institutional flows have become a dominant macro force for BTC. Recent coverage connects downward pressure on BTC to ETF outflows and weaker US macro data that rattled risk assets (FXEmpire analysis). When ETFs see redemptions, custody desks and market makers must rebalance, which can translate into accelerated selling into an already thin market.

But there's nuance: ETF-driven outflows also perform a deleveraging function. Many of the pro-cyclical flows that pushed BTC higher were magnified by leverage and fast institutional allocation. As that leverage is removed, price moves become cleaner — often exaggerated to the downside in the near term, but less fragile if the remaining holders are long-duration allocators.

In short, ETF outflows increase near-term volatility and produce liquidity stress, but they also purge crowded short-term leverage. For allocators, the key is to determine whether outflows are temporary technical reallocations or signals of lasting reduction in institutional demand.

Differentiating short-term capitulation from long-term accumulation

Short-term capitulation shows up in panic metrics: search spikes, liquidations, quick miner shutdowns, and fast outflows. Long-term accumulation — the signal allocators covet — looks different: steady increases in exchange withdrawals, sustained accumulation by long-term wallets, and reduced spending from historically active whales.

Blockonomi recently framed this divergence as short-term capitulation hitting even as longer-term value signals do not line up perfectly with the spike in panic (Blockonomi analysis). The takeaway: capitulation is happening in the near-term cohort, but large, patient holders may be opportunistically adding.

NewsBTC has also described the market entering a “deep conviction zone,” where smart-money accumulation is visible beneath retail panic (NewsBTC view). That pattern — where on-chain evidence of accumulation by long-term addresses coincides with retail fear — is one of the healthier ways a market forms a durable bottom.

How to read the plumbing: key mechanics that separate noise from durable reset

Three mechanics to watch simultaneously:

Flow compression: are miners, funds, and retail reducing the pace of selling (e.g., fewer exchange inflows, miner balances stabilizing)? The mining difficulty drop suggests miners are pausing, which temporarily reduces sell-side flow.

Balance-sheet repair: are leveraged instruments and spot ETFs deleveraging in an orderly way? ETF outflows are painful but, if contained, indicate deleveraging rather than systemic demand destruction.

Accumulation vs distribution: are long-term holders increasing balances while short-term addresses reduce theirs? That kind of optical divergence is the classic accumulation-under-capitulation signature.

Each by itself can be noise. Together they point to structural repair.

Practical checklist: on-chain and macro indicators to confirm a sustainable market bottom

Below is a methodological checklist macro traders and long-term allocators can use. Think of it as a filter: the more items ticked, the higher the conviction for shifting from defensive sizing to gradual long-duration allocation.

On-chain indicators

Exchange net flows stabilize and trend negative for a sustained period (7–21 days). A persistent net outflow from exchanges suggests reduced selling pressure.

Miner behavior normalizes: miner reserves stop drawing down, or miner outflows fall materially after an initial spike. The recent ~11% difficulty plunge implies a temporary miner pause; confirmation is when miner balances cease falling.

Long-term holder accumulation: growth in non-exchange, long-holder wallets and declining UTXO-age turnover. This shows patient capital stepping in.

Stable or rising realized price and declining spent output age bands for long-term cohorts. In other words, long-term coins are not being sold en masse.

Decrease in liquidation cascades and funding-rate normalization in derivatives markets. Extreme funding rates and liquidation clusters are classic short-term blowoff characteristics.

Macro and market structure indicators

ETF flows and institutional flows show signs of stabilizing: outflows transition to smaller, more sporadic redemptions instead of accelerating dumps. Context matters: a single-day outflow headline should not alone trigger a position change.

Volatility regime shifts from vertical drawdowns to range contraction and then to measured mean reversion. A durable bottom often follows a short-lived volatility spike, then consolidation.

Risk-on correlation regime returns cautiously: BTC resumes a positive — but not perfect — correlation to growth assets when macro data stabilizes. Watch US macro prints and central bank communication; FXEmpire ties weak US data and ETF flows to recent BTC pressure.

Liquidity depth improves: order-book depth at key levels (e.g., important moving averages and round-number supports) increases and larger buy-side limit orders persist over multiple sessions.

Timing and sequence: ideally, you see exchange outflows and long-term accumulation before or concurrent with miner stabilization and a tapering of ETF outflows. The opposite sequence (miners stabilizing but exchanges still bleeding with relentless ETF redemptions) suggests more downside risk.

Putting it together: a methodical trade and sizing approach

For macro traders and long-term allocators this is a multi-step process rather than an all-or-nothing bet:

Start with signal-weighted sizing. Assign weights to the checklist items (e.g., on-chain = 60%, macro/ETF = 40%), and scale in as more items confirm.

Use phased dollar-cost averaging with range-based entries, not time-only DCA. If exchange outflows and long-term accumulation appear while ETF outflows slow, begin initial tranche buys. Add more only after miner drawdowns stabilize and volatility contracts.

Use options and structured overlays to express bullish view while hedging tail risk. If you prefer cash-only exposure, keep a reserve to buy further if a false break tests lower support.

Monitor institutional flow desks and custody spreads. Wider spreads between OTC and spot can indicate stress even when on-chain indicators look healthy.

Remember: the goal for allocators is not to catch an absolute bottom but to build exposure with a favorable risk-reward profile as structural repair unfolds.

Final thoughts: capitulation as cleansing, not prophecy

Capitulation is noisy by design — it's a rapid redeployment of capital and sentiment. The recent Google Trends spike, the coin mining difficulty plunge, and ETF outflows are components of that noise, each telling part of the story. The difference between a bear-market low and a transient washout is whether the market's plumbing — miner economics, exchange flows, long-holder behavior and institutional demand — shows concerted repair.

For those building position frameworks, use a checklist mentality: require multiple confirmations (miners, exchange flows, long-term accumulation, and ETF stability) rather than acting on any single sensational datapoint. Tools like on-chain analytics, derivatives market reads, and ETF flow trackers will be indispensable. And remember to keep horizon alignment in mind: long-term allocators can tolerate interim volatility if accumulation happens beneath the surface.

Platforms that surface these metrics — from custody flow dashboards to on-chain explorers — can help, and even product ecosystems such as Bitlet.app increasingly pull several of these threads together for allocators and traders.

Sources

- Cryptopolitan — Crypto capitulation spikes as Bitcoin dips: https://www.cryptopolitan.com/crypto-capitulation-spikes-as-bitcoin-dips/

- CoinTribune — Why Bitcoin's mining difficulty just plunged ~11%: https://www.cointribune.com/en/why-bitcoins-mining-difficulty-just-plunged-11/?utm_source=snapi

- Blockonomi — Short-term capitulation hits as Bitcoin diverges from long-term value: https://blockonomi.com/short-term-capitulation-hits-as-bitcoin-diverges-from-long-term-value/

- FXEmpire — Bitcoin under $70,000 as ETF outflows and US data rattle markets: https://www.fxempire.com/forecasts/article/bitcoin-btc-under-70000-as-etf-outflows-and-us-data-rattle-markets-1578027

- NewsBTC — Bitcoin in deep conviction zone: https://www.newsbtc.com/news/bitcoin/bitcoin-in-deep-conviction-zone/

For many traders, Bitcoin remains the central macro risk asset to watch as these indicators play out.