Hyperliquid’s $40.7B Week: What Explosive Perpetual Volumes Reveal About Market Concentration

Summary

Executive snapshot

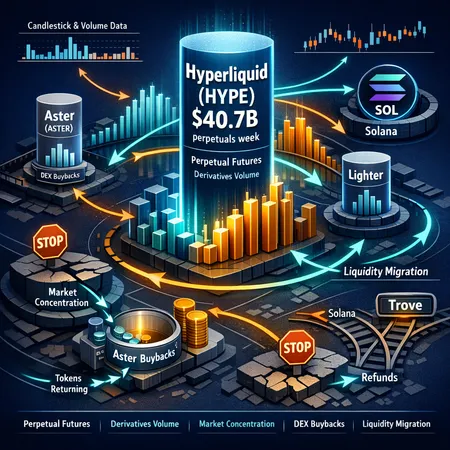

Hyperliquid recorded about $40.7 billion in perpetual futures volume in a single week — a headline number that matters because derivatives flow concentrates risk differently than spot flows. That surge helped a single venue dominate short‑term orderflow, pushing funding-rates, liquidity migration, and price discovery into a smaller number of counterparties. For experienced traders and market-structure analysts, this is less about glorifying volume and more about tracing where liquidity sits, how it moves, and what happens when protocol-level decisions ripple through the derivatives stack.

How Hyperliquid’s surge happened — short and structural

Several overlapping factors explain why Hyperliquid produced such outsized perpetual futures volume in a short period:

- Product fit: Perpetual futures are the right instrument for high-frequency, levered flow. When a venue optimizes for tight funding and low slippage, it attracts flow fast.

- Incentives and onboarding: Aggressive liquidity rebates, maker-taker economics, and promotional incentives can temporarily pull orderflow away from incumbents.

- Market conditions: A risk-on/higher‑volatility window concentrates directional trading and liquidations; venues with deep perpetual books absorb that action.

Multiple reports documented the scale of Hyperliquid’s spike; the primary data point is the $40.7B perpetuals week itself reported here. It’s key to view that figure as behavioral as much as mechanical: liquidity migrated where execution and terms were best, and it migrated fast.

Where this differs from spot-driven concentration

With spot markets, liquidity is stickier: order books and market makers tend to have longer-term capital commitments. Perpetual futures volume, especially on venues offering attractive leverage and competitive funding, can be more ephemeral. That means a few liquidity providers and a handful of institutional flows can create the appearance of deep market depth while actual counterparty concentration remains high.

Comparing Hyperliquid with Aster and Lighter

Hyperliquid’s week dwarfed many competitors in headline volume, but the downstream effects tell a fuller story. Competing venues like Aster (token: ASTER) and Lighter were materially smaller in derivatives flow and lacked the same combination of incentives and product depth. That imbalance became visible when Aster’s token failed to hold value despite aggressive treasury action.

Aster’s token printed a new all‑time low even as the protocol executed buybacks — a sign that treasury interventions can be overwhelmed by sentiment, liquidity migration, and concentrated derivatives activity https://www.coinspeaker.com/aster-prints-new-all-time-low-will-buybacks-save-the-token/. Additional reporting detailed the buyback mechanics and the limits of that response in stemming price decline Cryptopolitan coverage. The comparison is instructive: high derivatives volume on one venue can starve competing ecosystems of orderflow and make token-based defenses (buybacks, incentives) costly and often ineffective.

Concentration risks in perpetual futures venues

Concentrated derivatives activity creates several intertwined risks that matter to traders and market analysts:

- Counterparty concentration: When a large share of directional flow clears through a small set of venues, the failure or operational outage of any one of them has outsized systemic consequences.

- Liquidity migration and fragility: Liquidity is mobile. Incentives can buy flow for a time, but that same pool can leave faster than it arrived. Rapid migration raises slippage and widens effective spreads across the ecosystem.

- Price-discovery distortion: If most leveraged trading happens on a venue with thin backsweep liquidity or concentrated market makers, the venue’s prices and funding rates can deviate materially from broader market fair value.

- Oracle and settlement risk: Concentrated derivatives enable larger, faster attempts to manipulate on‑chain or off‑chain reference prices, particularly in assets with shallow spot depth.

All of these are not hypothetical. The ecosystem reaction to Hyperliquid’s surge — and to Aster’s subsequent token stress — demonstrates how protocol-level trust can erode quickly when users perceive risk.

Integration churn: the Trove pivot as a cautionary tale

Protocol integrations act like plumbing: they connect liquidity, governance, and user capital across chains and venues. When those plumbing decisions reverse rapidly, backers and counterparties can be left exposed.

A pointed example: Trove’s sudden pivot away from an integration with Hyperliquid toward Solana resulted in significant backlash from backers demanding refunds, illustrating reputational and execution risk when integrations change course midstream. The reporting on the episode highlights exactly this vulnerability: when an integration promise is reversed, users who oriented around the expectation lose confidence and seek refunds or rebalancing https://thenewscrypto.com/trove-backers-seek-refunds-after-sudden-pivot-from-hyperliquid-to-solana/?utm_source=snapi.

This kind of churn matters for two reasons: first, integrations concentrate expectations about where liquidity will sit; second, when the expectation changes, liquidity migration can be abrupt and destructive to token economics and counterparty exposure.

When DEX treasuries buy tokens: why it may not be enough

Buybacks are increasingly used by decentralized protocols to defend token price and signal protocol-backed demand. Aster’s buyback program was one such defense, but it failed to prevent an all‑time low in ASTER — a sobering result for treasuries relying on on-chain purchases to stabilize markets.

Why buybacks can fail in high-stress derivatives environments:

- Treasuries are finite and may be selling into the same algos or flow that caused the drop.

- Buybacks do not address the underlying causes of liquidity migration or concentrated derivatives activity.

- If trades and leveraged positions reside primarily off-chain or on other venues, token purchases on a DEX may have limited impact on funding-rate dynamics or liquidation cascades.

The Aster episode — covered in multiple reports — shows buybacks can buy time or signal intent but rarely fix structural mismatches caused by concentrated perpetual volumes https://www.coinspeaker.com/aster-prints-new-all-time-low-will-buybacks-save-the-token/; https://www.cryptopolitan.com/aster-token-dips-to-all-time-low-buybacks/.

Practical checklist for analysts and traders

If you trade or analyze counterparty and protocol risk in high-volume derivatives venues, here are concrete items to monitor:

- Funding-rate divergence: Persistent spreads between venue funding and broader-market implied rates can signal non-arbitrageable concentration.

- On‑chain liquidity flows: Watch where collateral and margin move; a sudden outflow from one protocol to another presages migration.

- Order-book depth vs. executed volume: High notional volume with shallow resting liquidity indicates fragility.

- Treasury health and velocity: How many tokens does the protocol hold, and is the treasury a net buyer or seller over time?

- Integration risk surface: Track announced integrations (and reversals). Trove’s pivot to Solana is a textbook case of how rapid changes can generate refund demands and reputational damage.

- Counterparty credit lines and insurance: Does the venue offer backstops, settlement guarantees, or insurance? What is the size of those commitments relative to average daily volume?

Bitlet.app users and professional desks should fold these checks into pre-trade due diligence rather than reacting after a liquidity event.

How to think about market concentration going forward

High headline derivatives volume is news, but it’s not the same as resilient market structure. Concentration compresses the error margins for both protocols and traders: an optimistic incentive program can amplify systemic fragility if the capital supporting it is short-term or if integrations reverse.

Structural fixes are not simple, but they fall into two categories: incentive design (longer-term LP commitments, staggered rewards, minimum tenure for rebates) and operational resilience (multi-provider routing, cross-margining standards, transparent treasury frameworks). Regulators and institutional counterparties are watching these dynamics as well; concentrated derivatives venues increase counterparty risk profiles and may prompt different custody or margining requirements.

Final takeaways

- Hyperliquid’s ~$40.7B perpetual week is a clear signal that derivatives volume can concentrate quickly and materially; that concentration changes where price discovery happens and who bears tail risk.

- Integration churn (Trove’s pivot), token sell pressure, and failed buyback defenses (ASTER) are practical demonstrations of how fragile protocol trust and token economics can be when liquidity moves abruptly.

- For analysts and traders, the prudent response is to monitor funding spreads, treasury actions, and on‑chain liquidity migration rather than relying on headline volume alone.

Crypto markets evolve fast. The right models now include not just orderbooks and funding, but protocol governance, treasury strategy, and the probability that a single integration reversal can shift billions in capital overnight.

Sources

- https://www.coinspeaker.com/hyperliquid-takes-lead-over-dex-exchange-aster-with-40-7-billion-trading-volume/

- https://thenewscrypto.com/trove-backers-seek-refunds-after-sudden-pivot-from-hyperliquid-to-solana/?utm_source=snapi

- https://www.coinspeaker.com/aster-prints-new-all-time-low-will-buybacks-save-the-token/

- https://www.cryptopolitan.com/aster-token-dips-to-all-time-low-buybacks/