MemeCoin

Memecoin teams are shifting from pure speculation toward product-led strategies — notably on-chain gaming and L2 builds — to rebuild durable demand. Case studies of $TRUMP’s mobile-game push and SHIB’s Shibarium plus Coinbase futures interest show how token utility and exchange products alter value capture metrics.

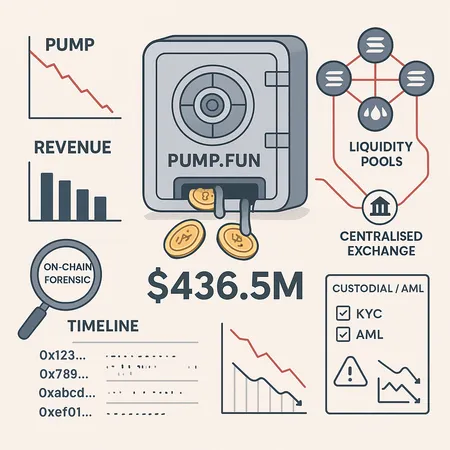

On‑chain data shows Pump.fun moved roughly $436.5M in USDC into custody while PUMP token markets collapsed — a red flag for counterparty, AML, and liquidity risks across Solana memecoins. This exposé reconstructs the timeline, market impact, contagion vectors, and practical monitoring steps for compliance and risk teams.

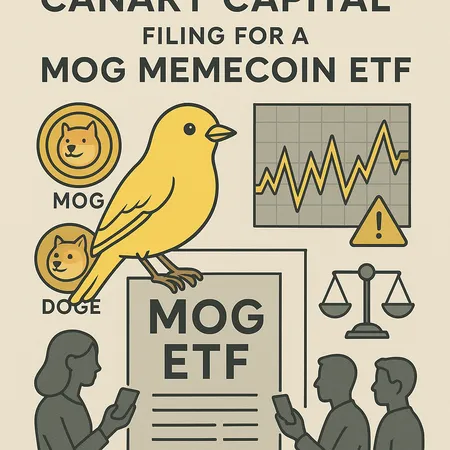

Canary Capital's filing to launch a memecoin ETF tied to MOG re-frames how retail flows can be channeled into highly speculative tokens. This explainer examines the filing, the near-term price response, the precedent it creates, and practical guardrails exchanges and issuers should adopt.

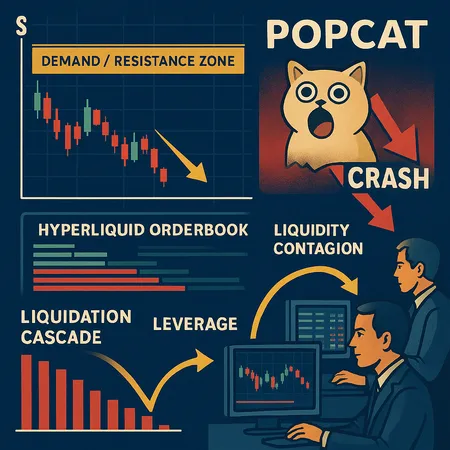

Solana sits at a pivotal technical level while the POPCAT memecoin crash and suspicious Hyperliquid order flows have amplified systemic risk. Active traders and risk managers need a clear map of demand/resistance, contagion mechanics, and tactical hedges.

The $LIBRA meme coin crash serves as a critical lesson on the importance of informed investing. Learn how Bitlet.app offers tools like Crypto Installment services to help you invest smarter and mitigate risks.

The $LIBRA meme coin crash highlights the risks of hype-driven crypto investments. Learn key lessons and discover smarter ways to invest using Bitlet.app's innovative Crypto Installment service, allowing you to buy cryptocurrencies now and pay monthly.

The $LIBRA meme coin crash in 2025 revealed critical insights about meme coin investments and the risks of hasty decisions. Learn how platforms like Bitlet.app can help you invest smarter with options like crypto installment plans, allowing a safer and more manageable approach to buying cryptocurrencies.