Onchain

Bitcoin's on-chain liveliness is signaling renewed activity even as technical charts and corporate treasury stress flash warning signs. This piece synthesizes the bullish on-chain case with the fallout from corporate adopters to outline realistic 2026 regimes.

A data-first look at massive recent Bitcoin on-chain flows — 580k BTC withdrawn from exchanges, SpaceX’s $105M wallet moves, Coinbase custody migrations and a $100B market inflow — and how to convert those signals into practical trading rules.

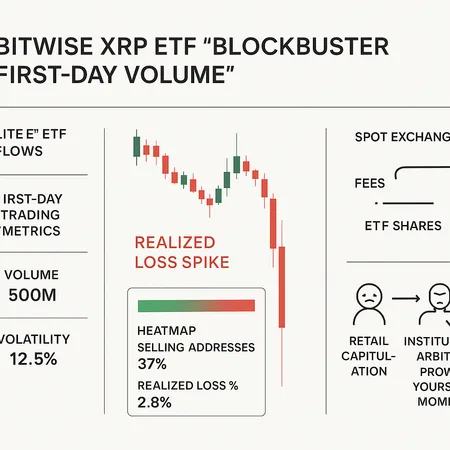

Bitwise’s XRP ETF posted a >$100M first‑day trading blaze while on‑chain metrics showed a wave of realized losses and retail capitulation. This explainer reconciles ETF flow mechanics, arbitrage paths, seller profiles, and practical risk management for active traders.

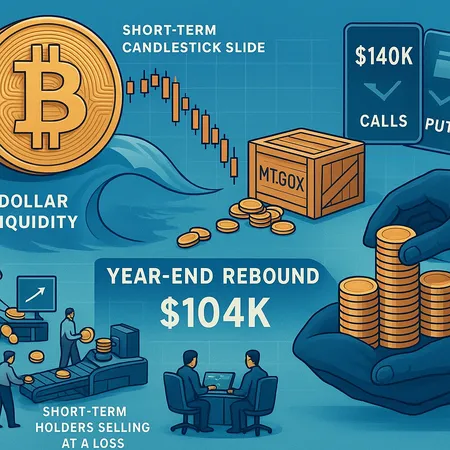

A liquidity-driven unwind, an options-market flip toward puts, and on-chain selling by short‑term holders — amplified by Mt. Gox outflows — point to a near-term slide for BTC before conditions set up a possible year‑end rebound toward $104K. Here’s how traders and institutions can position.