Market

Bitcoin’s sharp Q1 drawdown and a renewed gold rally force a deeper look: is this a tactical entry for dollar-cost averaging or an early signal of structural market stress? This article breaks down the mechanics of the decline, historical context, the 66%‑below‑gold thesis, institutional flow patterns, and a pragmatic 3–12 month accumulation strategy.

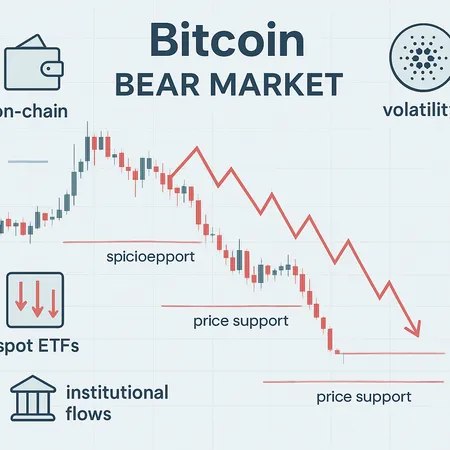

Recent headlines suggest Bitcoin has slipped into bearish territory, but ETF flows and short rebounds complicate the picture. This deep dive weighs on-chain signals, institutional flows, and vocal market forecasts to lay out practical positioning options for the next 3–12 months.

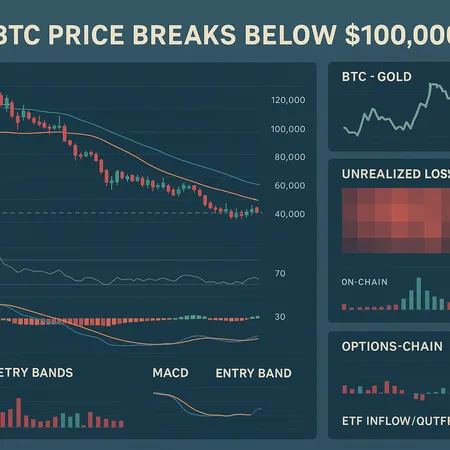

Bitcoin’s slide under $100,000 has split opinion: some see a brief capitulation flagged by a rare BTC-to-gold signal, others warn of a drawn-out correction through 2026. This analysis weighs technicals, on-chain pain, options positioning, ETF flows and offers a practical timeline and investor playbook.

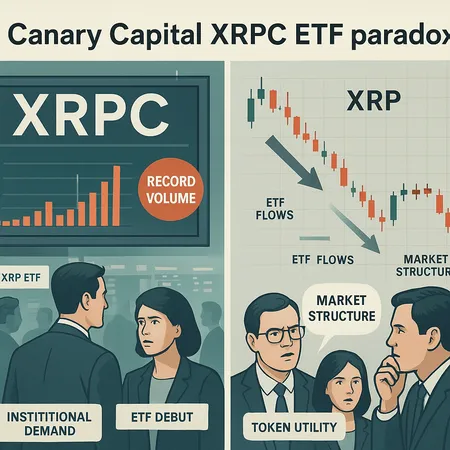

Canary Capital’s XRPC posted a record $58M first-day volume, yet XRP fell sharply—exposing gaps between ETF demand, liquidity plumbing, and the token-utility debate. This article unpacks what the debut reveals for allocators weighing single-asset altcoin ETFs.

Market sentiment has collapsed even as BTC trades above $100k, creating a paradox where price strength coexists with rising fragility. This analysis unpacks macro triggers, JPMorgan’s $94k support thesis, Fidelity’s on-chain selling signals, ETF flows and miner difficulty relief, and actionable trading ideas for a sideways-to-bearish regime.

Crypto markets can be unpredictable, especially in 2025. Bitlet.app provides a flexible solution with its crypto installment plans, allowing investors to buy cryptocurrencies now and pay monthly, easing the impact of volatility.

In 2025, presidential remarks have significantly influenced Bitcoin market sentiment, causing fluctuations in prices and investor confidence. Understanding this impact is crucial for crypto investors and enthusiasts.

Explore the latest trends in the Bitcoin options market highlighted by Deribit's unprecedented open interest levels, and learn how platforms like Bitlet.app can help you navigate these developments with innovative crypto buying options.

Explore the growing stablecoin market, discover opportunities it presents, understand regulatory challenges, and learn effective investment strategies. Bitlet.app offers unique benefits like Crypto Installment service to get started easily.

The merger between Strive and Semler Scientific highlights the growing trend of corporate Bitcoin adoption and its impact on the crypto market. This article explores the strategic benefits of the merger and how platforms like Bitlet.app can support crypto investments through flexible payment options.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility