Is Bitcoin’s Bull Cycle Over or Just Pausing? A 3–12 Month Playbook for Traders

Summary

Executive takeaway

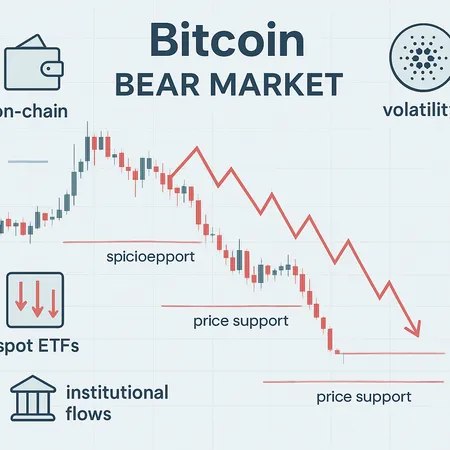

The headlines are mixed: several respected data providers and analysts are flagging bearish territory for BTC as institutional buying slows and technical/on-chain indicators deteriorate. At the same time, spot ETF flows have not disappeared — they briefly flipped back to net inflows — and the market continues to produce transient rebounds. For intermediate traders and crypto-focused investors, the prudent approach is not binary (sell everything or HODL forever) but conditional: tighten risk controls, trim and hedge exposures where appropriate, and look for disciplined re-entry cues over the next 3–12 months.

What’s driving the bearish talk: on-chain and macro signals

Multiple lines of evidence are being cited to justify the claim that Bitcoin is moving into a more bearish phase. Cointelegraph summarized that institutional buying has waned and several indicators that previously supported the bull case are turning negative, creating the narrative that the cycle could be cooling rather than accelerating (see the Cointelegraph piece for specifics). On-chain flows onto and off exchanges, realized volatility metrics, and the behavior of long-term holders are all part of that picture.

Macro factors amplify the risk backdrop. Rising real yields, tighter central-bank rhetoric in some regions, and the potential re-pricing of risk assets have historically pressured BTC. When institutional buying — a major bid in the post-ETF era — dials back, the market loses a structural buyer, which can leave price vulnerable to capitulation if retail and shorter-term traders step back.

The counterargument: ETFs, short rebounds, and liquidity dynamics

The narrative isn’t one-sided. Spot Bitcoin ETFs remain a meaningful structural tailwind even if flows are choppy. Recent data shows spot Bitcoin ETFs broke a five-day outflow streak and returned to net inflows, suggesting demand hasn’t vanished entirely and that flows can stabilize quickly when sentiment shifts (see the Invezz report). Those episodic inflows are important: they create recurring bid liquidity that can prop up price during drawdowns.

Short-term rebounds and technical support levels matter, too. Markets that have experienced heavy selling often see snapback rallies as leverage is reduced and opportunistic buyers jump in. That’s not necessarily the reassertion of a bull market — more a symptom of a two-sided market finding temporary balance.

The psychology effect: influential voices dial back forecasts

When high-profile figures publicly trim bullish price targets, it changes perception. The Cardano founder’s lowered Bitcoin forecast is an example of how influential commentary can feed into a negative narrative and induce caution among followers and some institutional desks (see NewsBTC). That sort of commentary contributes to an environment where confirmation bias can amplify sell pressure.

Add broader media headlines warning of large-scale exits and dramatic market contractions (Coinpaper’s coverage on sweeping losses across crypto markets), and you get a feedback loop: negative headlines spook marginal holders and reduce liquidity, which makes price moves sharper and more volatile.

Reading the most useful indicators over the next 3–12 months

For traders and institutions, monitor a prioritized set of signals rather than chasing every headline:

- Exchange flows and reserve change: net outflows historically support price; a sustained rebuild of exchange balances can be bearish.

- ETF net flows and product AUM trends: watch 3–7 day flow persistence, not day-to-day noise — the Invezz note shows flows can reverse quickly.

- Futures basis, open interest, and funding rates: compressed basis and falling OI often precede risk-off experiments; flaring funding can signal crowded long positions ripe for a squeeze.

- Long-term holder activity and realized cap metrics: long-term selling after multi-year accumulation is important evidence that the regime has changed.

- Macro variables: real yields, dollar strength, and systemic risk events will continue to dictate cross-asset appetite for risky, uncorrelated assets.

Combine these with classic technical levels: previous multi-week support zones, volume-by-price clusters, and moving average confluence.

What this mix means for price action and volatility

Expect a market regime of higher episodic volatility with directionally biased risk. Practically that means:

- Short-term: quick rallies that fail to sustain are likely, especially if ETF inflows are transitory. These punts can trap momentum chasers.

- Medium-term (3–6 months): consolidation or further drawdown is plausible if institutional flows remain muted and on-chain selling from bigger holders continues. Funding/liquidation events can exacerbate moves.

- Longer window (6–12 months): if ETFs maintain net inflows and macro conditions ease, the structural bull thesis can reassert; otherwise, protracted range-bound or cyclical re-pricings may occur.

Volatility will remain an inherent feature — more frequent whipsaws and flash moves are the price of transitioning from a one-sided bull market to a contested regime.

Positioning playbook: de-risk, re-enter, or hedge (practical guidance)

Below are actionable strategies tailored to different risk appetites for the 3–12 month horizon.

Conservative institutional posture:

- Trim size: reduce gross BTC exposure to targeted strategic allocations rather than full liquidation. Preserve optionality.

- Hedge with inverse products or put options to cap tail risk while retaining upside.

- Raise cash and liquidity buffers — staying able to buy on confirmed capitulation is a powerful advantage.

Intermediate trader posture (you):

- Scale out into strength, scale back in on weakness: avoid large unilateral trades in either direction.

- Use staggered DCA re-entry points across key support bands and emphasize smaller position sizes when volatility spikes.

- Consider collar strategies (long spot + sells/long puts) to limit downside without giving up all upside — options markets can be expensive, but targeted hedges are efficient around known events.

Aggressive / opportunistic posture:

- Use defined-risk products (options spreads) to express leveraged directional views.

- Short-term traders should rely on clear stop rules and monitor funding rates/open interest closely to avoid nasty squeezes.

Always match position size to volatility assumptions and the amount of time you can tolerate being wrong. Remember: risk management is the trade that pays you to stay in the market.

Watchlist: triggers that invalidate the ‘bearish continuation’ thesis

If you want a signal that the bull cycle remains intact, monitor these potential bull-validation points:

- Sustained multi-week net inflows into spot ETFs and upward trending cumulative AUM.

- Long-term holder balance stabilization or renewed accumulation instead of distribution.

- Macro tailwinds: falling real yields or a clear market repricing that restores risk appetite.

- Technical breakout above key market structure levels on high volume and rising OI.

If these align, the current pause can flip into resumed bull momentum; otherwise, expect more consolidation or extended weakness.

How sentiment and headlines influence positioning — a practical note

Headlines about market collapse or big-name forecast cuts (for example, a prominent founder trimming targets) matter because they change the market’s risk tolerance, not necessarily the underlying on-chain reality. Media narratives can precipitate forced selling, but they can also create buying opportunities if fundamentals haven’t structurally changed.

That’s why monitoring both quantitative signals (flows, OI, reserves) and qualitative signals (sentiment, influential forecasts) is essential. The two combined often tell you whether negative price action is a liquidity event or a regime shift.

Final framework: act like a risk manager, think like an investor

Short answer: the bull cycle is not obviously dead — but it’s on thinner ice. Current newsflow and on-chain signals justify caution and defensive positioning, while ETF flows and short-term demand indicate that the structural buyer isn’t fully absent.

Over the next 3–12 months, expect heightened volatility and the need to be nimble. Use disciplined risk sizing, hedges or collars when appropriate, and phased re-entry strategies around validated support levels. For ongoing market intelligence that complements this analysis, track ecosystem trends — from institutional flows and on-chain metrics to coverage of other assets like ADA that often color investor sentiment across crypto.

If you trade or invest through platforms, remember to factor execution risk and custody into your plan — whether you’re scaling into BTC on Bitlet.app or expressing a short-term hedge via derivatives, practical details matter as much as macro views.

Recommended next steps

- Set explicit stop-loss and position-size rules tied to volatility, not just price.

- Monitor ETF weekly flow persistence and exchange reserve trends as primary early-warning indicators.

- Maintain a playbook for buying tiered exposures if price hits pre-defined support zones, and prepare hedges around major macro events.

For further reading on the current debate, see Cointelegraph’s take on institutional buying trends, Invezz’s note on ETF flows, Coinpaper’s coverage of recent panic-driven drawdowns, and NewsBTC’s summary of high-profile forecast adjustments.

This article synthesizes on-chain data and market commentary to provide a balanced, actionable thesis — not financial advice. Stay disciplined, and trade your plan.