Ethereum's Mixed Signals: $95.5M ETF Outflows vs. Whale Accumulation — How Traders Should Respond

Summary

Executive snapshot

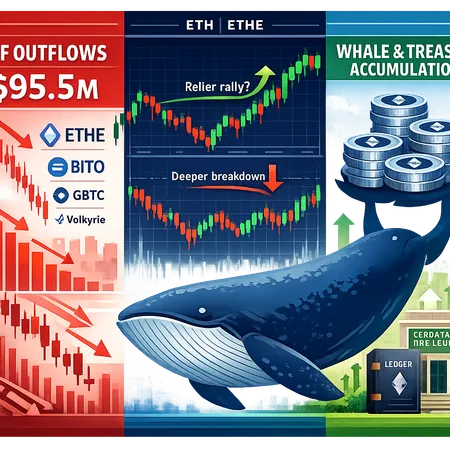

Ethereum is flashing mixed signals. In the past days ETFs tracking ETH recorded roughly $95.5M in net outflows, with ETHE and ETHA posting the largest withdrawals — a near-term liquidity drain that can translate into selling pressure. At the same time, on-chain activity and press reporting show selective accumulation from large private buyers and apparent treasury-level interest. For allocators and traders, the core question is: is this weakness a buying opportunity or an early warning sign?

For many market observers, Ethereum remains the bellwether of smart-contract activity and DeFi liquidity, so understanding both capital flow and on-chain behavior is essential before making a call.

The ETF story: $95.5M outflows and which funds led the withdrawals

The clearest headline is the recent net outflow sum — about $95.53M — from funds that provide exposure to ETH. According to reporting, withdrawals were concentrated in certain tickers, with ETHE and ETHA identified as posting the largest redemptions. That kind of concentrated flow matters because ETF redemptions convert passive demand into direct spot or secondary-market supply, pressuring price near-term.

Why ETF outflows matter:

- ETFs (and trusts) aggregate institutional and retail demand; large redemptions remove a steady bid.

- Redemptions frequently require managers or authorized participants to sell or deliver the underlying asset, creating immediate market liquidity needs.

- ETF flows are observable and often move faster than on-chain accumulation, so they can dominate short-term price action even if whales buy elsewhere.

Blockonomi’s coverage of the recent moves highlights that ETHE/ETHA led the withdrawals, which helps explain the magnitude of the net outflow and why traders felt the impact that day: Ethereum ETFs bleed $95.53M as ETHE and ETHA post the largest withdrawals.

On-chain and whale behavior: selective accumulation amid noise

Paradoxically, while ETFs were bleeding, multiple on-chain and press signals pointed to targeted accumulation.

- Large private purchase: Trend Research reportedly acquired 46,379 ETH in a private transaction — a material, concentrated buy that signals conviction from a sizable player Trend Research's purchase reported by Cointelegraph.

- Smart-investor buys: coverage noted opportunistic buying beneath key levels and suggested a relief-rally scenario if sentiment stabilizes Coinspeaker coverage on smart-investor buys.

- Insider flow: not all big transfers are bullish. For example, reporting that Arthur Hayes moved ETH to exchanges — a typical precursor to selling — is a reminder that notable insiders sometimes add supply to the market, increasing short-term downside risk BeInCrypto on Hayes moving ETH.

On-chain nuance to watch:

- Whale concentration vs. distribution: large buys concentrated into a small number of wallets can reduce circulating spot supply if those wallets are cold-storage or treasury addresses; conversely, transfers to exchange addresses often signal imminent selling.

- Exchange reserve trends: a sustained decline in exchange reserves while large wallets accumulate is a bullish divergence.

- Timing and execution: private placements (like Trend Research’s) are often off-exchange and don’t immediately press price; they remove supply from the market over the long term, whereas ETFs converting to spot can create near-term liquidity stress.

These on-chain patterns explain how significant accumulation and apparent selling pressure can coexist. One party sells into liquidity created by ETF redemptions while another picks up bargains over a longer horizon.

Reconciling ETF outflows with private and treasury accumulation

The apparent contradiction dissolves when you separate participants by time horizon, motive and execution channel.

- Time horizon: ETFs and some active traders react to short-term liquidity and flows; treasuries and strategic whales often think in multiyear horizons and buy opportunistically.

- Execution channel: ETF redemptions typically convert to spot or OTC selling. Private buys can be OTC or direct treasury purchases that circumvent exchange order books.

- Motivations: redemptions may represent portfolio rebalancing, short-term liquidity needs or capital flight; whale/treasury buys may represent strategic allocation, treasury diversification, or longer-term hedging.

Net effect: ETF outflows can create a short-term price shock, while whales and treasuries can reduce free float over months, slowly tightening supply. Both forces are true at the same time — their impact just plays out on different cadences.

A pragmatic, data-driven framework for traders and allocators

Below are practical frameworks you can apply depending on your objectives and risk tolerance. These are templates, not prescriptions — adapt position sizing and risk controls to your portfolio.

1) Institutional allocator / long-term treasury framework

- Objective: add to strategic ETH exposure while preserving capital.

- Signals to monitor: sustained decline in exchange reserves, continued private buys or treasury additions, long-term on-chain metrics (active addresses, staking inflows).

- Tactical approach: staggered accumulation (e.g., dollar-cost averaging across multiple price bands), prioritize OTC/private channels where possible to avoid slippage, and maintain an allocation cap (e.g., target % of treasury or endowment).

- Risk rules: maintain liquidity buffers; if price breaks critical structural levels (your internal rule), pause buys.

Platforms like Bitlet.app are useful for systematic recurring buys, but corporates often prefer OTC for large lot sizes to minimise market impact.

2) Tactical trader — riding a relief rally

- Objective: capture a short-to-medium-term bounce while protecting downside.

- Entry triggers: clear technical confirmation such as a daily close above the 21–50 EMA with a meaningful uptick in volume, a falling-wedge or double-bottom breakout, or a confluence with on-chain support (e.g., reduced exchange inflows).

- Positioning: enter partial size on first confirmation, add on pullback to the breakout, and take partial profits at pre-defined resistance zones (e.g., recent high-volume nodes or moving averages).

- Risk controls: hard stop below the breakout invalidation point (example: 8–12% from entry depending on volatility), and limit overall exposure to an acceptable fraction of portfolio.

3) Defensive / preserve-capital framework (avoid a deeper breakdown)

- Objective: avoid large drawdowns if ETF-driven selling morphs into a broader capitulation.

- Signals to monitor: large-day exchange inflows, sustained increase in selling from known insider wallets, spike in short-bias metrics (derivatives open interest skew), and daily closes below major structural supports.

- Tactical approach: move to cash or stablecoin, hedge existing ETH exposure with short futures or puts, or reduce positions size progressively as bearish signals confirm.

- Risk rules: understand liquidity of hedges; costs of protective puts can rise rapidly in a sell-off.

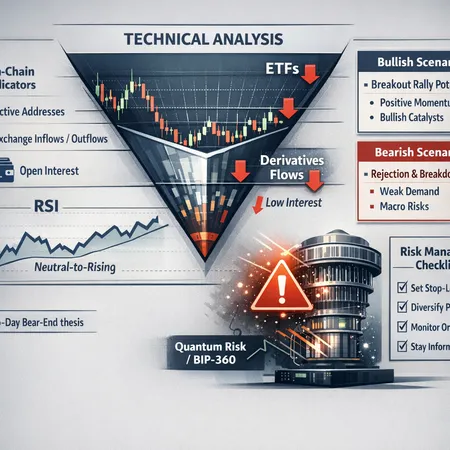

4) Quant / on-chain signal checklist (operational)

Track these metrics in near real-time to reconcile conflicting headlines:

- ETF flow ledger: daily net inflows/outflows and which funds are leading.

- Exchange reserves: 7-day and 30-day percent change.

- Whale transfer activity: count and volume of transfers >1k ETH in the last 24–72 hours, and whether they flow to exchanges.

- Option open interest and skew: rising put demand and skew can signal fear; falling skew suggests complacency.

- Funding rates and perpetual basis: persistently negative funding can amplify downside; a flip to positive funding supports rallies.

A simple conditional rule: if ETF outflows >X and exchange inflows >Y while whale-buy signals are absent, treat the market as short-biased until readings normalize. Replace X/Y with institutionally relevant thresholds derived from historical volatility and average flows.

Practical example: a two-tier approach for a medium-risk trader

- Allocate a small base position (25% of intended max) at current levels if on-chain whale accumulation is visible and exchange reserves are stable/declining.

- Add another tranche (50%) on a confirmed relief-rally trigger (daily close above the 50 EMA with volume), and retain last tranche as cash to buy deeper on a confirmed breakdown.

- Place stop under the invalidation level (for example, below the recent low or key support area), and size so the maximum loss is within acceptable limits.

This approach lets you participate in a relief rally while keeping powder dry if ETF outflows re-accelerate into broader selling.

What to watch this week (actionable checklist)

- ETF flow report updates: is the $95.5M a one-off or the start of a trend?

- Trend Research-style buys or other off-exchange deals: more private BUY ink = structural support.

- Exchange reserve movements and large deposit/withdraw patterns.

- Insider transfers to exchange addresses (e.g., high-profile wallets).

- Technical confirmation levels: the market’s behavior around the 21/50/200 EMAs and key volume nodes.

If ETF outflows persist while exchange reserves rise sharply, bias to risk-off. If outflows moderate and on-chain accumulation deepens, a relief rally becomes a higher-probability trade.

Final thoughts — balance conviction with liquidity awareness

The headline $95.5M ETF outflow is significant — it creates short-term selling pressure and can exacerbate volatility. But it sits beside credible, selective accumulation from large private buyers and treasury-minded participants. Neither signal cancels the other; they coexist. The decision to buy, sell or hedge should hinge on your horizon, access to OTC vs exchange execution, and the on-chain/lite technical confirmations outlined above.

For traders and allocators, the path forward is pragmatic: monitor flows and on-chain signals in tandem, use staged sizing to manage execution risk, and deploy hedges when uncertainty spikes. The market often rewards patience and process — and in this environment, process means being data-driven about both capital flows and on-chain behavior.