Chainlink

LINK has steadied around $14 as institutional ETP inflows approach $50M. This piece parses the mechanics behind ETP conversions, on-chain signals, cross‑chain demand drivers and what allocators should watch next.

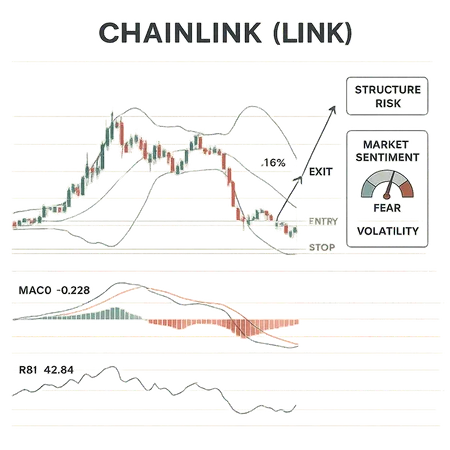

Grayscale’s move to convert its Chainlink Trust into the first U.S. spot LINK ETF is a structural event that could reshape liquidity, institutional access, and oracle economics. This feature explains the mechanics, near-term price drivers, and how allocators should evaluate LINK ahead of the listing.

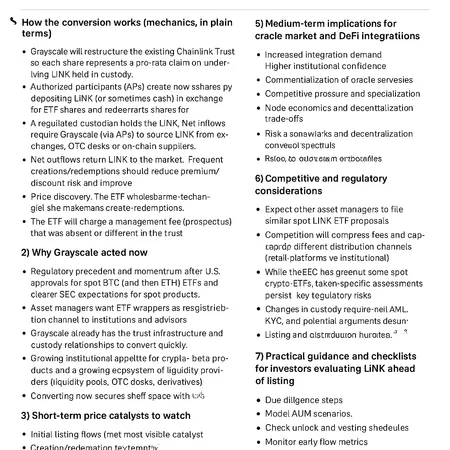

LINK has slipped for several sessions even as ETF hopes rise — a mix of technical sell signals and a curious decline in exchange reserves demands careful reading. This post blends on‑chain context and TA to outline scenarios and trade management ideas for holders.

Injective’s integration of Chainlink sub-second data streams brings professional-grade, low-latency market data to Helix, enabling tighter derivatives pricing, faster low-latency AMMs, and more credible RWA primitives. Institutional desks and builders should reassess data pipelines, risk engines, and decentralization assumptions to capture the benefits while managing trade-offs.

A trader-focused technical breakdown of LINK after the recent pullback: setup, the case for a short-term 16% rebound to $16.50, the structural risks, and a concrete trade plan with stops and targets. Includes how extreme fear readings can amplify quick rebounds or violent breakdowns.

A measured look at Chainlink's short-to-medium term outlook after a prediction that LINK could rise to ~$19 from mid-$14s — covering technical pivots, on‑chain oracle demand, macro risks, and concrete trade scenarios.

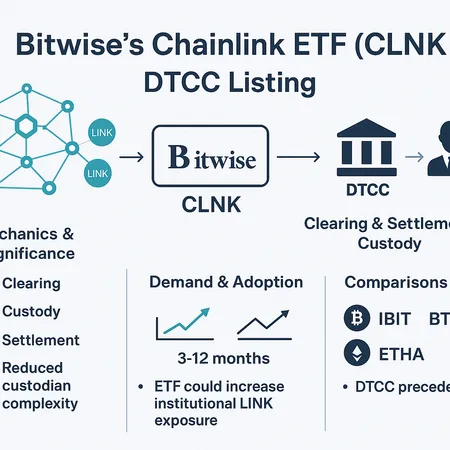

Bitwise’s Chainlink ETF listing on the DTCC platform removes a major operational barrier for institutions wanting oracle exposure via an ETF wrapper. This explainer outlines the DTCC mechanics, custody and clearing implications, how ETF demand could change LINK dynamics, and likely 3–12 month market outcomes.

Chainlink and Stellar have partnered to enhance cross-chain decentralized finance (DeFi) and improve tokenized asset flows. This collaboration aims to bridge liquidity and interoperability gaps, advancing the DeFi ecosystem. Platforms like Bitlet.app stand to benefit by integrating such technologies to offer users seamless crypto services, including flexible payment options like crypto installment plans.

The partnership between Chainlink and Stellar is set to enhance cross-chain DeFi by expanding tokenized asset flows, enabling more seamless and secure decentralized finance applications across blockchains. This collaboration paves the way for improved interoperability and greater access to DeFi services.

ChainLink (LINK) has experienced a significant price surge recently, driven largely by whale activity. This blog explores the reasons behind this surge and what it could mean for LINK's future, including opportunities to invest via platforms like Bitlet.app.