Analyzing ChainLink's Recent Whale-Driven Price Surge and LINK's Future Potential

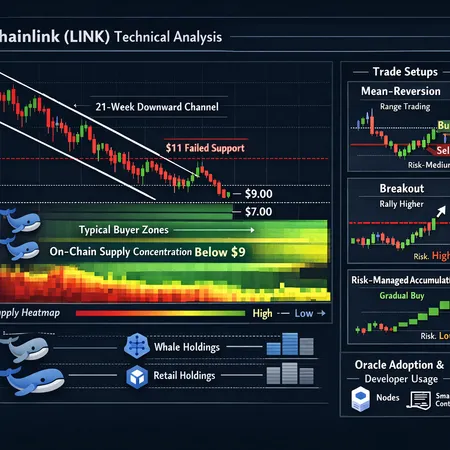

ChainLink (LINK) has caught the attention of crypto investors due to its recent price surge fueled by whale transactions. Whales, or large holders of LINK tokens, have been accumulating or moving significant amounts, indicating strong interest and confidence in the project's future. This whale-driven momentum often signals upcoming developments or positive sentiment within the market.

The surge not only boosts LINK's market price but also highlights its use case as a decentralized oracle network, which is critical for connecting smart contracts with real-world data. Given the growing adoption of decentralized finance (DeFi) and blockchain-based applications, ChainLink stands to benefit significantly.

For investors looking to enter or expand their position in LINK, platforms like Bitlet.app offer unique opportunities. Bitlet.app provides a Crypto Installment service that allows users to buy LINK now and pay monthly, making it easier to invest without the need for large upfront payments.

In summary, the whale-driven price surge in ChainLink indicates a promising future with potential growth. Utilizing services like Bitlet.app can help investors capitalize on this momentum by making LINK acquisitions more accessible and manageable financially.