What Bitwise’s Chainlink ETF Listing on DTCC Means for Institutional Access to Oracles and LINK

Summary

Executive snapshot

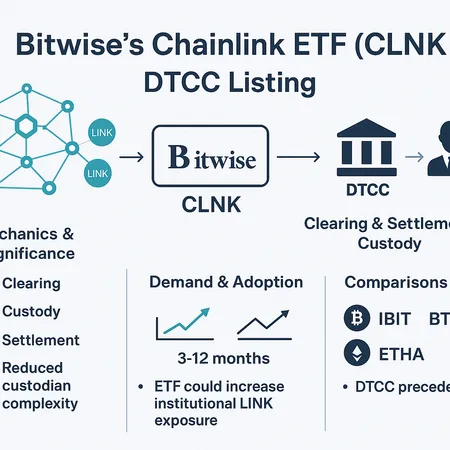

Bitwise’s Chainlink ETF appearing on the DTCC platform is more than a ticker on a screen — it changes how institutional investors access Chainlink and its native token, LINK. For asset managers and custody teams evaluating oracle exposure via an ETF (ticker: CLNK), the DTCC listing removes a key operational constraint: it lets the product live inside the standard U.S. institutional plumbing for clearing, settlement, custody and securities lending.

This explainer breaks down the mechanics, the likely demand dynamics for LINK and oracle usage, lessons from prior crypto ETF rollouts, and practical scenarios for the next 3–12 months.

What a DTCC listing actually means (mechanics + implications)

When an ETF becomes DTCC‑eligible it is integrated into the industry’s primary post‑trade ecosystem (DTC/NSCC flows). The practical implications for institutions are significant:

- Standardized clearing and settlement: Trades settle through the same book‑entry rails as equity and fixed income ETFs, simplifying back‑office workflows and margining. That eliminates bespoke bilateral settlement protocols many desks avoid.

- Custody interoperability: Custodians that require DTCC eligibility to support a product for their clients can now custody CLNK shares just like any other listed ETF — no bespoke custodian onboarding to hold “unusual” instruments.

- Prime broker and repo access: Prime brokers, broker‑dealers and lending desks prefer DTCC instruments for borrowing/lending and repo operations. DTCC listing therefore enables securities lending for CLNK and cleaner short/hedge execution.

- Operational predictability: Institutional compliance, risk, and operations teams rely on predictable T+1/T+2 processes, tax reporting formats, and reconciliation cycles that DTCC standards provide. That reduces legal and operational gating points for adoption.

Important caveat: DTCC eligibility applies to the ETF shares, not automatically to the underlying tokens. Custody and transfer of actual LINK tokens still require a regulated digital asset custodian and the audit/processes that come with on‑chain holdings.

How an ETF wrapper could change demand for LINK and oracle adoption

An ETF is a product design that converts a hard-to-hold asset into a regulated, custody‑friendly security. That conversion shifts the buyer base and the path into the underlying market:

- Lowering the bar for institutional exposure: Many asset allocators and pension consultants prohibit direct crypto custody. A DTCC‑cleared ETF lets those allocators gain LINK exposure without touching private keys, clearing a major compliance hurdle.

- Channeling new liquidity into LINK: Authorized Participants (APs) create/redemptions to keep ETF price in line with NAV. APs will source LINK from exchanges, OTC desks, or pre‑funded inventories. If APs draw from spot markets, the ETF can materially increase on‑chain/spot demand for LINK as inflows rise.

- Price formation and arbitrage: The ETF creation mechanism enforces an arbitrage corridor between CLNK share price and the spot/LINK basket. That can tighten spreads and elevate realized liquidity in underlying markets, especially on heavy inflows.

- Indirect boost to oracle adoption: Institutional exposure to LINK via ETFs may make counterparties (exchanges, DeFi treasuries, custodial staking services) more comfortable integrating Chainlink services. If institutions can hedge or buy exposure easily, they may be more inclined to contract with oracle operators in the same ecosystem.

- Securities lending and staking interplay: If CLNK participates in securities lending desks, it could increase lendable supply of ETF shares (not LINK tokens). Separately, if LINK staking or node operator economics become material, APs and custodians will have to decide how to treat staking rewards relative to ETF NAV and accounting — a nontrivial operational question.

Lessons from prior ETF rollouts (Bitcoin and others)

The Bitcoin spot ETF approvals in 2023 and subsequent listings on DTCC rails provide a playbook and warning signs:

- Rapid inflows can be front‑loaded. Bitcoin ETFs saw large early demand as institutions chased regulated access. That drove significant spot market activity and liquidity shifts.

- Creation mechanics matter. For Bitcoin, APs pulled from exchanges and OTC inventories; markets absorbed large flows but also experienced transient premiums and liquidity fragmentation across venues.

- Custody and proof mechanics were decisive. Institutions insisted on qualified custodians, strict proof‑of‑reserves, and transparent audit trails. Those requirements raised costs but also built trust.

- Not all ETFs move the underlying price equally. Some ETFs were used predominantly as trading instruments rather than buy‑and‑hold exposure; the net effect on underlying token price varied by product design and investor mix.

Apply these lessons to CLNK: demand could be meaningful if asset allocators view LINK as strategic infrastructure (oracle exposure) rather than a speculative bet. But execution details — AP sourcing, custodian design, transparency on underlying LINK holdings and any staking policy — will determine the scale and persistence of flows.

Practical due diligence checklist for asset managers and custody teams

If your firm is evaluating adding CLNK to a product shelf or client offering, prioritize these operational and governance questions:

- Authorized Participant & creation/redemption mechanics: Who are the APs? Where will they source LINK (exchange liquidity, OTC desks, custodial inventories)? Ask for AP operational playbooks and SLAs.

- Custodian and custody model for underlying LINK: Which regulated digital custodian holds the underlying tokens? Are keys segregated, are multi‑party custody solutions used, and what are the recovery procedures?

- Auditability and proof-of-reserves: Does Bitwise (or its custodian) publish regular, third‑party audited proof‑of‑reserves and reconciliation reports tying ETF NAV to actual LINK holdings?

- Staking/earnings policy: If underlying LINK is staked or used to generate protocol yields, how are rewards treated for ETF holders? Is yield credited to NAV, passed through, or retained by the manager?

- Securities lending and collateral practices: Will CLNK shares be lendable? If so, what are the collateral types, rehypothecation rules, and haircut policies?

- Operational SLAs and settlement cycles: Confirm settlement cadence, fail management, and client reporting formats that align with your custody and middle‑office needs.

- Legal & tax treatment: Ensure your tax team reviews the ETF structure, especially if the product claims to be physically backed by tokens vs. synthetic exposure.

A short operational note: platforms like Bitlet.app and other infrastructure providers expect DTCC‑cleared securities; the DTCC listing therefore smooths integration into many institutional workflows.

Market outcomes over 3–12 months — scenarios and indicators to watch

Scenario A — Active on‑ramp (probability: medium):

- Large initial inflows from funds that previously avoided direct crypto custody.

- APs source substantial LINK from spot/OTC, tightening liquidity and potentially lifting LINK price.

- Markets see compressed spreads and higher on‑chain volumes as ETF creations/redemptions interact with spot markets.

Scenario B — Steady adoption (probability: medium‑high):

- Moderate, consistent inflows as allocators slowly reweight portfolios for oracle exposure.

- AP sourcing is split between inventories and exchanges; impact on spot price is positive but measured.

- CLNK becomes a familiar instrument for hedging and allocation, with limited market disruption.

Scenario C — Limited impact (probability: low‑medium):

- ETF trades mostly as a liquidity/hedge instrument with muted net inflows.

- Creation/redemption activity is light; APs source LINK opportunistically without large market stress.

- LINK price and oracle adoption continue on existing trajectories driven by on‑chain demand, not ETF flows.

Key indicators to monitor in the first 3–12 months:

- Net asset flows into CLNK (weekly/monthly inflows/outflows).

- Creation/redemption volume and the ratio of creations sourced via exchange takedowns vs. OTC.

- Spread between CLNK market price and reported NAV — persistent premiums point to unmet demand.

- Custodian proof‑of‑reserves frequency and third‑party attestation reports.

- Securities lending availability and borrow rates for CLNK shares.

Operational risks and watch‑outs

- Concentration of AP supply: If only a small set of APs supply LINK, counterparty risk and sourcing fragility can surface during stress.

- Custody misalignments: Any ambiguity about how underlying LINK is stored, segregated, or used (e.g., staking) will create regulatory and reconciliation headaches.

- Accounting & reporting mismatches: Ensure portfolio accounting systems treat CLNK consistently with client mandates and regulatory reporting rules.

- Market microstructure stress: Large, fast inflows without corresponding creation capacity can push ETF prices away from NAV temporarily.

Actionable next steps for teams evaluating CLNK

- Request the AP and custodian operational playbooks, proof‑of‑reserves cadence, and third‑party audit documents.

- Simulate trade lifecycle in your middle office: order routing, settlement, fails handling, and tax reporting for CLNK.

- Determine whether you need to amend policies to permit ETF securities lending or to treat CLNK differently from spot holdings of LINK.

- Monitor early flow metrics and creation/redemption patterns for 8–12 weeks after listing to inform sizing and client guidance.

Bottom line

A DTCC listing for Bitwise’s Chainlink ETF materially reduces operational barriers for institutions seeking oracle exposure. By making CLNK interoperable with standard custody, clearing and prime broker systems, the ETF is likely to expand the pool of buyers that can claim LINK exposure within regulated mandates. How much that translates into meaningful on‑chain demand for LINK — and faster oracle adoption — depends on AP sourcing, custodian design, and investor behavior. For asset managers and custody teams, the smart play is to focus on the operational contract details (APs, custodian, proof‑of‑reserves, and payout/treatment of any yields) before scaling allocations.

For a technical read on Chainlink’s role in decentralized infrastructure, see the institutional perspective on Chainlink and how oracles fit into broader on‑chain finance narratives like DeFi.