Endowment

Harvard’s Q3 2025 increase in Bitcoin exposure — now reported at $443M — is a watershed for endowments, testing governance, custody, and the precedent for other institutions. This feature unpacks the allocation’s scale versus gold, fiduciary risks, operational hurdles, likely copycat behavior, and market impact on BTC liquidity and volatility.

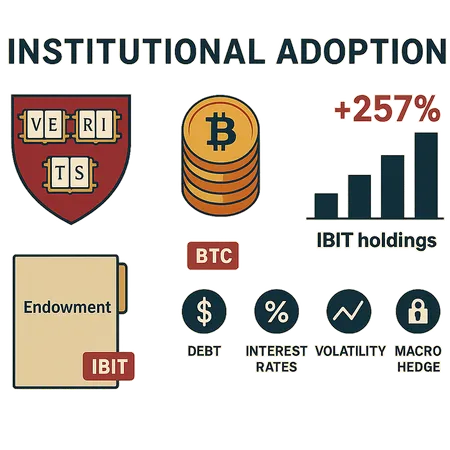

Harvard’s reported 257% jump in iShares Bitcoin Trust (IBIT) holdings to $442.8M this quarter is more than headline noise — it’s a signal about how elite endowments are approaching BTC exposure, product preference, and portfolio risk management. This piece unpacks the purchase, why ETFs win over direct custody for some allocators, and what it means for other endowments, pensions, and BTC’s macro hedge case.