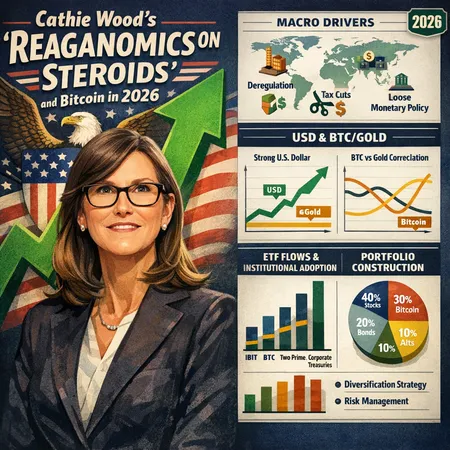

Cathie Wood's 'Reaganomics on Steroids' — What a 2026 Macro Shift Means for Bitcoin

Summary

Why Cathie Wood's 'Reaganomics on steroids' thesis matters for allocators

Cathie Wood's recent framing — a US macro regime that tilts toward deregulation, tax relief and looser real policy stances — is provocative because it reframes why investors might buy risk assets rather than simply chasing yield. In Wood's view, the policy mix could re-price risk premia and push institutional flows into non-traditional diversifiers like Bitcoin. That matters because the drivers of Bitcoin demand are shifting from purely retail/speculative buyers to allocators deciding whether BTC belongs in long-term portfolios.

This article translates that macro thesis into portfolio-level implications for 2026: how correlations may change, what current ETF flows and mandate moves tell us, and concrete allocation and risk-management frameworks for investors who think of BTC as a diversification sleeve rather than just "digital gold." Along the way we'll cite recent evidence that institutional demand is materializing now.

The macro case Wood lays out: deregulation, tax cuts and monetary policy

The core narrative

Wood argues a policy pivot toward deregulation and tax relief—paired with a political appetite for growth—would act like an accelerator on risk assets. She’s likened the shift to “Reaganomics on steroids,” suggesting a mix of fiscal and regulatory changes could increase corporate investment, compress risk premia and encourage leverage and risk-taking in capital markets. See her view summarized in coverage like NewsBTC and Crypto.News.

Transmission channels to markets

- Fiscal/tax easing: Boosts nominal growth and earnings expectations, improving equity valuations and making carry/risk-taking more attractive.

- Deregulation: Lowers compliance friction for new financial products and infrastructure, potentially easing institutional onramps for crypto custody and trading.

- Monetary policy nuance: If real rates fall (through higher nominal growth or lower real yields), risky assets often re-rate upwards even if headline rates are unchanged.

Together these channels reduce the opportunity cost of holding non-yielding assets and increase risk tolerance among allocators—conditions under which Bitcoin wins attention as an uncorrelated-ish asset or as a risk-on growth lever.

How a stronger dollar and capped gold prices could change Bitcoin's correlation profile

Two moving anchors: dollar strength and constrained gold

Wood’s scenario doesn’t preclude a stronger dollar—growth can coincide with dollar strength if the US outperforms peers. At the same time, if gold’s upside is capped (through central bank behavior or low inflation surprises), allocators seeking an alternative store-of-value may shift to Bitcoin. That interplay would reshape BTC’s correlations.

Possible correlation regimes

- Short-term risk-on regime: In an environment where equity beta is re-valued upward, BTC may behave more like an equity-like risk asset, showing positive correlation with equities and inverse correlation with the dollar. This is the regime many allocators would experience first.

- Store-of-value emergence: Over multi-year horizons, constrained gold upside and persistent institutional adoption (ETFs, corporate treasuries) could create a second-order effect: demand for BTC as a digital scarcity asset strengthens, lowering its correlation to equities and making it a genuine diversifier for long-term portfolios.

Why BTC is not simply 'digital gold' — and why that matters

Even if BTC becomes more equity-like in the short run, its non-sovereign, globally tradable nature and capped supply create a separate risk-return characteristic from fiat assets. If gold’s role is constrained by central bank behavior, Bitcoin’s asymmetric supply narrative (21 million supply cap) could attract allocators seeking asymmetric payoffs that complement traditional hedges.

Evidence from ETF flows and new institutional mandates

ETF flows: a directional signal

Institutional demand is not just theoretical. Recent ETF data show material inflows that point to allocation decisions at scale. For example, tracking reports detail net inflows across ETFs with IBIT leading some recent surges in AUM and flows. A compilation of fund flows notes net inflows totaling roughly $100 million in a recent window, with IBIT alone leading with sizable contributions—illustrating that managed, diversified Bitcoin ETFs are becoming a favored wrapper for allocators.

(See a flow summary for context: Blockonomi’s reporting on Bitcoin ETF inflows and IBIT's leadership.)

Big-ticket mandates and manager moves

Institutional infrastructure is moving beyond ETFs. Firms like Two Prime have been selected to manage large-scale allocations to Bitcoin—an example being the appointment to manage roughly $250 million for Digital Wealth Partners—highlighting how wealth managers and delegated investment platforms are operationalizing allocations to BTC.

These moves matter because they shift Bitcoin exposure from a niche trading instrument to a line item that can sit on balance sheets and fiduciary models. That institutionalization reduces execution and custody frictions, lowering the governance barrier for allocators.

Corporate treasuries and corporate behavior

Parallel to ETFs and mandates, some corporate treasuries continue to increase exposure to BTC as an active treasury management or strategic diversification choice. That corporate demand acts as a different bucket of structural demand than trading flows—more akin to long-duration strategic allocation.

Practical portfolio allocations and risk management for allocators

Sizing frameworks by risk appetite

- Conservative sleeve (1–3% of portfolio): Treat BTC as a satellite diversifier. Allocate via a regulated ETF wrapper (if available) to reduce custody and governance overhead. Expect high volatility; size to a tolerable drawdown.

- Strategic diversifier (3–7%): For investors convinced of BTC’s multi-year diversification potential but wary of short-term beta, use layering and dollar-cost averaging (DCA) to scale exposure while keeping a rebalancing discipline.

- Allocator/active (7–15%+): For sophisticated allocators comfortable with crypto infrastructure, combine spot holdings with options overlays and selective futures to manage tail risk and capture carry when appropriate.

These bands are illustrative; decide using a risk-budget approach (e.g., allocate an equity-volatility equivalent rather than a raw percent of NAV) and run downside stress tests.

Execution and risk controls

- Use regulated ETF wrappers (IBIT-style funds) when fiduciary constraints exist; they ease custody and reporting.

- Layer entries with DCA and size positions to a pre-defined maximum drawdown (e.g., no single slice >30% of the BTC sleeve).

- Implement tail hedges: long-dated put options or structured collars can blunt catastrophic drawdowns at a cost.

- Rebalancing discipline: Rebalance on volatility- or threshold-based rules (e.g., rebalance quarterly or when BTC deviates >20% from target allocation) to harvest volatility and control allocation drift.

- Liquidity planning: Accept that BTC’s liquidity profile is strong for spot and ETF flows but weaker for very large block trades; use OTC desks or programmatic execution for large mandates.

Governance and reporting

- Document the investment thesis, sizing limits, custody checks, and counterparty reviews.

- Ensure tax and accounting treatments are clear—structures (spot vs ETF vs derivatives) matter for reporting and compliance.

- Monitor correlation and contribution-to-risk metrics quarterly; if BTC’s contribution to portfolio volatility exceeds risk tolerance, reduce size or add hedges.

Short-term versus multi-year scenarios: actionable planning

Short-term (0–12 months): transition and volatility

- Likely dynamics: if a risk-on macro pivot materializes, expect BTC to rally with equities but remain highly volatile. Rapid inflows can exacerbate price moves; conversely, macro news can trigger sudden drawdowns.

- Tactical advice: use disciplined DCA and smaller tactical sleeves. Consider short-dated hedges around major macro events (elections, policy announcements). Keep liquidity buffers.

Multi-year (1–5+ years): structural adoption and diversification

- Likely dynamics: sustained institutional adoption—ETF accumulation, manager mandates like Two Prime’s engagements, and corporate allocations—can establish a deeper structural bid. Over time, BTC may decouple from short-term equity beta and act as a longer-duration diversifier.

- Strategic advice: increase allocation in line with conviction and operational readiness. Use a blended approach: core exposure via secure custody/ETF and tactical exposure via spot or managed products. Reassess correlation and stress-test portfolios to ensure BTC’s long-horizon diversification benefits persist under multiple macro outcomes.

Tail risks to plan for

- Regulatory shock: sudden restrictive regulation could temporarily impair price and flows.

- Liquidity shock: extreme market stress could widen spreads and disrupt execution for large allocators.

- Macro flip: if the policy pivot stalls or inflation surprises rise unexpectedly, correlations could flip quickly (e.g., BTC falling with equities while the dollar strengthens).

Putting it together: a practical checklist for allocators

- Define your BTC thesis: diversification, growth lever, or tactical alpha? Document it.

- Choose a wrapper aligned with governance constraints: regulated ETF (IBIT-style) vs spot custody vs derivatives.

- Set size bands tied to risk budget and worst-case drawdown tolerance.

- Implement layered entry and rebalancing rules; use options or collars for tail protection where needed.

- Monitor flows, mandates and macro policy: quick changes in ETF flows or manager mandates can presage regime shifts.

Conclusion

Cathie Wood’s “Reaganomics on steroids” thesis matters because it frames a plausible macro path that pushes allocators to reassess why they might hold Bitcoin. In a risk-on policy environment, BTC may behave more like a growth asset in the short run while simultaneously accruing structural demand as ETFs and mandates mature—potentially transforming its correlation profile over multiple years. For allocators, the practical implication is not binary. Treat Bitcoin as a differentiated risk factor: size it with discipline, operationalize via fiduciary-friendly wrappers like ETFs when appropriate, and use hedges and rebalancing to manage the inevitable volatility.

For investors seeking custodial or allocation solutions, platforms such as Bitlet.app are part of a growing ecosystem that helps bridge retail and institutional execution and custody needs.

Sources

- Cathie Wood's 'Reaganomics on steroids' analysis (NewsBTC)

- Cathie Wood: Bitcoin emerges as top diversification bet for 2026 portfolios (Crypto.News)

- Bitcoin ETFs see $100.18 million net inflow as IBIT leads with $315.79 million (Blockonomi)

- Two Prime selected to manage $250 million in Bitcoin for Digital Wealth Partners (CoinDesk)